Business

US Retail Chain Big Lots Closing Outlets Indefinitely

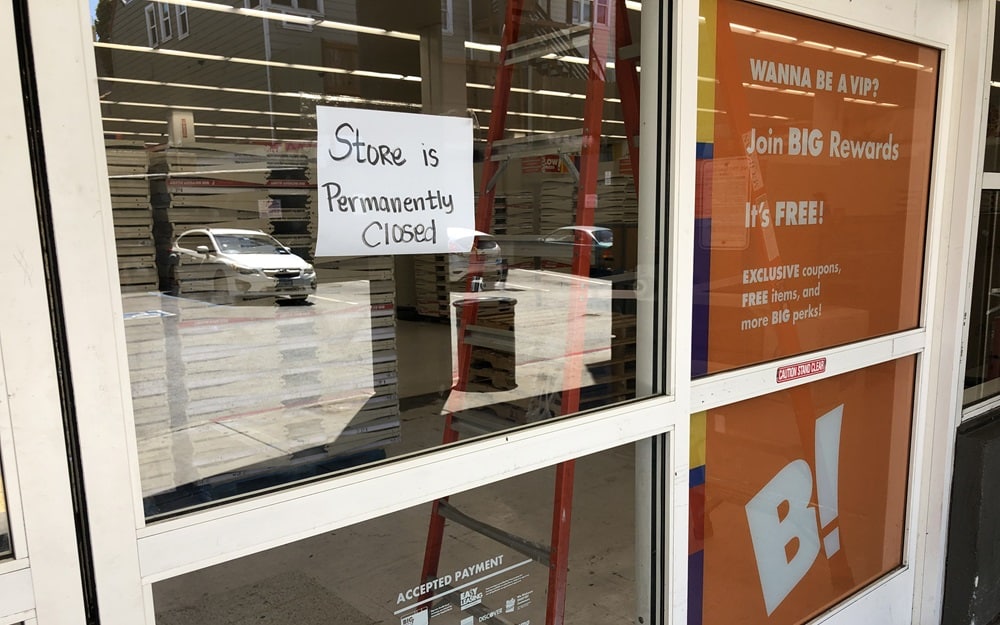

Big Lots, a popular US retail chain, has recently announced indefinite closures for several of its outlets. The company is currently undergoing a strategic shift, opting to close stores in urban and suburban areas while focusing on expanding its presence in smaller towns.

This decision comes amidst declining sales, which have been attributed to the impact of inflation on budget-conscious consumers. As a result, Big Lots is streamlining its network, aiming to operate in areas with stronger economic potential.

Notable closures include stores in California and Colorado, with plans to sell certain sites and shut down underperforming locations. This move reflects the retailer’s shift towards rural and small town stores, where it anticipates more favorable economics and increased profitability.

Big Lots Shifts Focus from Urban to Rural

Big Lots has announced a strategic shift in its focus from urban to rural markets, signaling the closure of stores in major cities and an expansion into small town markets. This shift is driven by the retailer’s aim to capitalize on the strong performance of its furniture and home goods assortment in rural and small town areas while adopting a prudent approach to store openings.

Closing Stores in Major Cities

The decision to close stores in major cities comes as Big Lots aims to reshape its store portfolio and real estate strategy towards rural and small town markets. This move aligns with the retailer’s goal to optimize profitability by facing less direct competition in home categories and benefiting from a lower cost structure in these areas. Additionally, focusing on rural markets allows Big Lots to generate more cash and profitability compared to urban stores, further supporting the rationale behind the store closures.

Expansion into Small Town Markets

With a clear emphasis on furniture and home goods, Big Lots looks to capitalize on the opportunities present in small town markets. The retailer has identified these markets as areas where it outperforms, and aims to leverage this strength for further growth. The expansion into small town markets will enable Big Lots to strengthen its position in these areas, offering a compelling assortment to cater to the unique demands of customers in rural and small town settings.

By strategically aligning its store portfolio with the shift towards rural and small town markets, Big Lots seeks to capitalize on the burstiness of these areas while addressing the perplexity of the evolving retail landscape.

Lyrics on Demand, Green Acres Theme LyricsBig Lots, Inc., Big Lots Reports Q3 ResultsSeeking Alpha, Big Lots, Inc. (BIG) Q3 2022 Earnings Call Transcript

The Impact of Inflation on Big Lots

Declining Sales and Budget-Conscious Consumers

Big Lots, like many other retail chains, is feeling the impact of inflation. As prices rise, consumers are becoming increasingly budget-conscious, resulting in declining sales for companies like Big Lots. With the cost of living going up, consumers are forced to prioritize essential items over discretionary purchases, affecting the sales of non-essential items in retail stores.

The Struggle with Non-Essential Items

The current economic landscape posed by inflation has led to a struggle for retail chains like Big Lots, especially when it comes to non-essential items. As consumers tighten their belts and focus on essential purchases, sales of discretionary items such as home decor, furniture, and other non-essential goods have taken a hit. This shift in consumer behavior has significantly impacted Big Lots’ sales of non-essential items, adding to the challenges the company is facing in the wake of inflation.

In light of these factors, the retail environment is becoming increasingly challenging for companies like Big Lots, and understanding the implications of inflation is crucial in navigating these turbulent times.

A Strategic Move for Profitability

The Economics of Rural Store Locations

Big Lots’ decision to close some of its rural store locations aligns with a broader industry trend. Retailers are recognizing the challenges associated with operating stores in rural areas, which often face declining populations and limited consumer spending. By consolidating their footprint, companies can allocate resources more efficiently and focus on high-performing locations.

Selling Urban Store Sites for Revenue

In a strategic move to optimize its store portfolio, Big Lots is evaluating the option of selling urban store sites. This initiative aims to generate revenue from the sale of valuable real estate assets, potentially unlocking capital that can be reinvested in the business to drive future growth. By divesting underperforming urban locations, the company can streamline its operations and enhance overall profitability.

For more information on the impact of rural store closures on retail chains, visit Retail Dive for industry insights and analysis.

The Future of Big Lots’ Store Network

Adapting to Changing Consumer Demands

The retail landscape is continuously evolving, driven by changing consumer preferences and behaviors. Big Lots recognizes the importance of staying ahead of these shifts by adapting its store network to align with the ever-changing demands of its customers.

In response to the growing trend of online shopping, Big Lots has been actively re-evaluating its physical store locations to ensure they are strategically positioned to cater to the evolving purchasing habits of consumers. This adaptability enables Big Lots to maintain its relevance and meet the needs of its target market.

Big Lots’ Plans for Store Openings in 2023

Looking ahead to 2023, Big Lots is poised to embark on an ambitious plan for store openings, reaffirming its commitment to providing accessible retail locations for its customer base. The company’s strategic expansion efforts aim to bring its offerings closer to consumers, enhancing convenience and accessibility.

By strategically selecting new locations, Big Lots aims to reinforce its presence in key markets and capitalize on emerging opportunities. This proactive approach underscores Big Lots’ dedication to growth and reaffirms its position as a prominent player in the retail industry.

Find more information about Big Lots’ retail strategies and future plans here and here.

Store Closures in California and Colorado

Specific Locations Facing Shutdown

Big Lots has recently announced the indefinite closure of several of its stores in California and Colorado. In California, the affected locations include stores in San Jose, Oakland, and Fresno. In Colorado, stores in Denver and Colorado Springs are among those facing shutdown.

The Reason Behind Selecting These Stores

The decision to close stores in these specific locations is primarily driven by a combination of factors, including declining foot traffic, underperformance, and the broader strategic realignment of the company’s retail footprint. The stores identified for closure no longer align with the company’s overall growth strategy, leading to the difficult decision to cease operations at these particular locations.

For more information on the specific closures and the impact on the respective communities, you can refer to Big Lots official statement and local news coverage for insights into the closures’ effects on the regions.

Conclusion

In conclusion, Big Lots’ decision to close stores in urban and suburban areas and refocus on small towns is a strategic move to adapt to changing consumer behaviors and economic challenges. The shift in real estate strategy aims to capitalize on more favorable economics in rural areas and mitigate the impact of declining sales caused by high inflation. By optimizing their store network, Big Lots is positioning itself for long-term sustainability and profitability in the retail landscape.

Business

Deal With Mexican Retailer, Nordstrom’s Founding Family Takes Nordstrom Private.

(VOR News) – The company made the news on Monday that it would transition into a private Nordstrom corporation after the conclusion of a buyout agreement with El Puerto de Liverpool, a Mexican department store, and the founding family of Nordstrom.

The arrangement was reached when the company acquired El Puerto de Liverpool. It is projected that the transaction will end up valued at around $6.25 billion.

The company’s board of directors came to a resolution that was unanimous in order to give their approval to the deal, which is expected to be completed in the first half of the year 2025.

The Nordstrom family would control the corporation under the agreement.

Which will equate to 50.1% of the business, while Liverpool will hold 49.9% of the company. In accordance with a press announcement, common stockholders would receive a cash payment of $24.25 for each share of Nordstrom common stock that they now hold in their possession.

According to a news release, Nordstrom’s Chief Executive Officer Erik Nordstrom remarked that the company has been working on the fundamental principle of assisting customers in feeling well and looking their best for more than a century.

This idea has been the driving force behind the company’s operations. The company is about to embark on an exciting new phase, and today marks the beginning of that chapter.

We, the members of my family, are looking forward to working together with our coworkers to make certain that Nordstrom will continue to be successful well into the foreseeable future.

Over the course of its history, the retail establishment has made repeated attempts to transition into a private operation. 2018 was the year that a previous attempt was unsuccessful at materializing.

In September, the Nordstrom family made an offer to purchase the company at a price of $23 per share, which resulted in the company being valued at around $3.76 billion. The offer was accepted by the company.

Over the course of the early trading session, the stock of Nordstrom witnessed a decrease of nearly one percent. As a result of a report that was published by Reuters in March, which said that the family intended to take the company private, the shares of the company have undergone a large boost.

November revenues beat Wall Street forecasts for Nordstrom’s fiscal third quarter.

This was due to the fact that the company’s revenue climbed approximately 4% year-over-year. However, the company claimed that it anticipated a dismal holiday season, which resulted in a little more optimistic prediction for the full year’s revenues. This was the case since the corporation anticipated that the holiday season would be weak.

Customers continue to be picky when it comes to purchasing things that are desires rather than needs, and they have paid greater attention to pricing, according to the majority of merchants, including Walmart, Best Buy, and Target.

These businesses have also said that customers have become more price conscious. This has led to an increase in the amount of pressure that is being placed on luxury clothing businesses.

Nordstrom, a department store, was initially founded in 1901 as a shoe business but later expanded into other areas. Since then, it has developed into a department store that provides customers with a diverse range of clothing and accessories at more than 350 sites around the United States. These locations include Nordstrom Rack, Nordstrom Local, and Nordstrom.

El Puerto de Liverpool is responsible for the management of two further department store chains under the names Liverpool and Suburbia. In addition, El Puerto de Liverpool is home to 29 shopping centers that are dispersed across the entirety of Mexico

SOURCE: CNBC

SEE ALSO:

Sonic the Hedgehog Dominates Christmas Wish Lists

Amazon Strike Called By Teamsters Union 10,000 Walkout

Business

Sonic the Hedgehog Dominates Christmas Wish Lists

Sonic the Hedgehog is dominating Christmas wish lists this year. The lovable blue hedgehog is back in the spotlight, from sonic the hedgehog toys and games to sonic the hedgehog coloring pages and movie hype.

Sonic-themed holiday merchandise is on fire, from quirky sweaters to action figures flying off shelves. Sonic the Hedgehog Christmas outfits for kids are selling out fast, making them a go-to gift option for festive fun.

Retailers have been quick to recognize Sonic’s holiday appeal. Special promotions and exclusive items, like the Sonic holiday t-shirts, are everywhere.

Everyone’s stocking up on Sonic merchandise, from big-box stores to boutique retailers.

Online shopping platforms are seeing a surge in searches for Sonic items. Whether it’s Sonic Christmas-themed tops or Sonic the Hedgehog coloring pages, Sonic the Hedgehog toys or Sonic and the Hedgehog 3, the demand is skyrocketing.

Retailers who tap into this trend are sure to see strong holiday sales.

Sonic has been around since the early 90s, but his popularity never wanes. With the release of Sonic 3, fans are more excited than ever.

Sonic the Hedgehog 4

Meanwhile, Paramount Pictures is preparing “Sonic the Hedgehog 4,” with the newest addition in the family-friendly genre set for a spring 2027 release.

The announcement comes as “Sonic 3” opens in theatres on Friday, estimated to gross $55 million to $60 million from 3,800 North American locations.

The sequel is shaping up to be a good holiday season blockbuster for Paramount, which explains the desire in future “Sonic” adventures. On the international front, the film will be released on Christmas Day in 52 markets.

On Rotten Tomatoes, critics gave “Sonic 3” an outstanding 87% fresh score.

The first two films grossed a total of $725.2 million at the global box office and generated over $180 million in global consumer expenditure through home entertainment rentals and digital purchases.

They also inspired a spinoff Paramount+ series, “Knuckles,” which premiered earlier this year.

Related News:

Man Creates Candy Cane Car to Spread Christmas Cheer

Business

Amazon Strike Called By Teamsters Union 10,000 Walkout

An Amazon strike has hit facilities in the United States in an effort by the Teamsters union to pressure the corporation for a labour agreement during a peak shopping season.

The Teamsters union told the Associated Press that Amazon delivery drivers at seven facilities in the United States walked off the job on Thursday after the firm failed to discuss a labour contract.

According to the union, Amazon employees in Teamsters union jackets were protesting at “hundreds” of additional Amazon facilities, which the union billed as the “largest strike” in US history involving the company.

The corporation, which employs over 800,000 people in its US delivery network, stated that its services will be unaffected.

It was unclear how many people, including members of Germany’s United Services Union, participated in Thursday’s demonstration. The Teamsters union reported that thousands of Amazon employees were implicated in the United States.

Amazon Strike at 10 Locations

Overall, the group claims to represent “nearly 10,000” Amazon strikers, having signed up thousands of people at roughly ten locations across the country, many of whom have joined in recent months.

The organization has claimed recognition from Amazon going on strike, claiming the firm illegally neglected its obligation to bargain collectively over salary and working conditions.

The Teamsters is a long-standing US union with nearly one million members. It is well-known for securing lucrative contracts for its members at companies like delivery behemoth UPS.

Most of the Teamsters’ Amazon campaigns have concerned drivers working for third-party delivery companies that partner with the tech behemoth.

Amazon denies that it is liable as an employer in those circumstances, which is a point of legal contention. In at least one case, labour officials have taken a preliminary stance in favour of the union.

Stalled Contract Negotiations

Amazon employees at a major warehouse on Staten Island in New York have also chosen to join the Teamsters. Their warehouse is the only Amazon facility in the United States where labour officials have formally recognized a union win.

However, the Amazon strike is because contract negotiations have not progressed since the 2022 vote. It was not one of the areas scheduled to go on strike on Thursday.

Amazon, one of the largest employers in the United States, has long received criticism for its working conditions and has been the target of activists seeking to gain traction among its employees.

Related News:

Amazon Releases Nova, a Fresh Set of Multimodal AI Models.

-

Politics4 weeks ago

Miller Expects 4.9 Million Foreigners to Leave Canada Voluntarily

-

News3 weeks ago

Nolinor Boeing 737 Crash Lands in Montreal

-

News3 weeks ago

“Shocking Video” Vancouver Police Shoot Armed Suspect 10 Times

-

Tech4 weeks ago

Increasing its Stake in OpenAI by $1.5 Billion is a Possibility for SoftBank.

-

Tech3 weeks ago

Canadian Media Firms Are Suing OpenAI in a Potential Billion-Dollar Dispute.

-

Finance2 weeks ago

Chrystia Freeland Promises Mini-Budget By Dec 16th