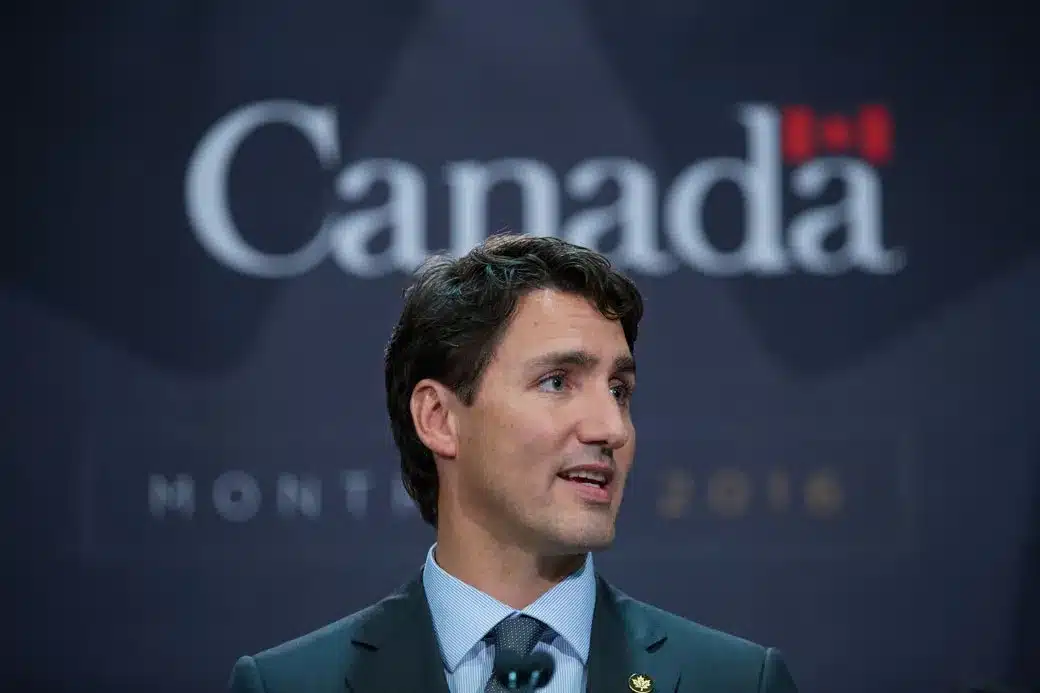

Only three years ago, Justin Trudeau was being challenged about the expense of carrying all that extra debt when the Prime Minister interrupted the reporter, CTV’s Glen McGregor, to reprimand him about how low interest rates were.

“Interest rates are at historic lows, Glen,” Trudeau added, a smug smile on his face.

Since then the Trudeau Liberals have boosted expenditure by 55% since gaining office, from $317 billion in 2016 to $490 billion presently. The government deficit increased from $29 billion to $40 billion, and the national debt increased from $648 billion to $1.2 trillion.

And the cost of debt service has risen from $25.7 billion in 2016 to $43.9 billion presently, and it is only going to rise further.

Cash-strapped Canadians who recently purchased homes with long-term variable rate mortgages may be paying up to $1,700 extra each month as a result of this year’s rate hikes.

Now, heavily indebted Canadians seeking for relief from a sharp spike in mortgage rates are in for some disappointment, as recent bond market moves indicate that interest rates will remain elevated for longer than originally thought due to tenacious inflation.

In comparison to the 30-year duration that is prevalent in the United States, nearly all Canadian mortgages have a period of five years or less. According to the Canada Mortgage and Housing Corporation (CMHC), home mortgage debt stood at C$2.08 trillion ($1.53 trillion) as of January 2023.

It implies that when around 20% of Canadian mortgages come up for renewal in the next year, many borrowers will be in a worse financial situation than they could have anticipated just a few months ago. Mortgage rates tend to lag after bond market movements.

“With each passing month, as rates rise, we discuss with consumers how much mortgage they can qualify for, and that’s been decreasing as rates rise,” said James Laird, co-CEO of Ratehub.ca.

Thanks to Trudeau the 5-year mortgage rate offered by major Canadian banks has risen to its highest level since November 2008, according to Bank of Canada data.

When it comes time to renew, homeowners who want to search for lower interest rates may have fewer options because they will have to re-qualify for the stress test at the newest interest rates with their new lender.

Read: Trudeau Now Blames Canada’s International Students for Housing Shortage

In 2021, Canada modified its stress test laws, forcing borrowers to demonstrate their ability to handle mortgage repayment 200 basis points above their contracted rate, and consumers will have to re-qualify if switching to a different lender at the time of renewal.

“That is a flaw in a stress test that hopefully will be fixed at some point.” “You’ll see more consumers than usual sticking with their lenders,” Laird said.

The likelihood of another interest rate hike in September has only increased as inflation has returned to above the Bank of Canada’s target range, while robust economic growth, particularly in the United States, has fueled concerns that rates will remain higher for longer.

With no promise of a rate drop in the near future, worried homeowners are increasingly struggling to make their monthly mortgage payments and, in some circumstances, being forced to sell their homes.

Daniel Foch, director of economic analysis at Toronto-based RARE Real Estate, cited Toronto Regional Real Estate Board statistics showing that power of sale – a clause that permits lenders to sell a borrower’s house if they default on mortgage payments – had increased in recent months.

According to the data, power of sale was used for 48 to 80 properties in the Greater Toronto Area in the last three months, up from 14 to 32 a year ago. According to Foch, that number is on course to reach 75 by the end of August.

With interest rates at a 22-year high, mortgage growth in Canada has fallen to its worst pace in about four years, according to KBW analysts, which is expected to weigh on banks’ quarterly earnings beginning this week.

“Whereas consumers may have had some strong income growth in the last 12 months to offset higher debt payments, that is not going to be the case in the next 12 to 24 months,” said Stephen Brown, deputy chief North America economist at Capital Economics.

“It will undoubtedly be problematic for the Canadian economy if interest rates remain at this level.”