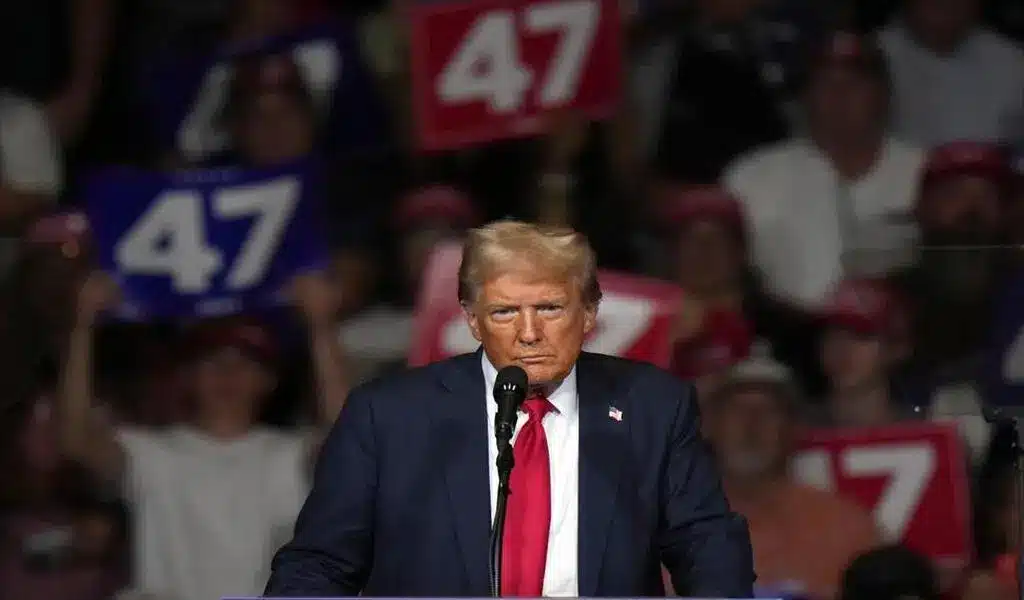

Washington — With customary bluster, Donald Trump has promised that if voters send him to the White House, “inflation will vanish completely.”

It’s a message aimed at Americans who are still frustrated by the increase in consumer costs that began three and a half years ago.

However, most conventional economists believe Trump’s economic proposals would not eliminate inflation. They’d make things worse. They warn that his proposals to slap massive taxes on imported goods deport millions of migrant workers, and demand a say in the Federal Reserve’s interest rate policy will undoubtedly cause prices to skyrocket.

Sixteen Nobel Prize-winning economists wrote a statement in June expressing concern that Trump’s measures might “reignite” inflation, which has fallen since peaking at 9.1% in 2022 and is virtually back to the Fed’s objective of 2%.

The Nobel economists emphasized that they are not alone in ringing the alarm.

“Nonpartisan researchers,” they explained, “predict that if Donald Trump successfully enacts his agenda, it will increase inflation.”

Last month, the Peterson Institute for International Economics forecasted that Trump’s actions, including deportations, import tariffs, and measures to undermine the Fed’s independence, would drive consumer prices considerably up two years into his second term. According to Peterson’s analysis, if Trump’s economic ideas are implemented, inflation will rise to between 6% and 9.3% in 2026, up from 1.9% currently.

Many experts are dissatisfied with Vice President Kamala Harris’ economic program. They dismiss, for example, her idea to tackle price gouging as ineffectual in combating high supermarket prices. However, they do not see her measures as particularly inflationary.

Trump’s Economic Plans Would Worsen Inflation, Experts Say

Mark Zandi, chief economist at Moody’s Analytics, and two colleagues estimate that Harris’ plans would leave the inflation prognosis mostly intact, even if she had a Democratic majority in both chambers of Congress. In comparison, an unrestrained Trump would raise costs by 1.1 percentage points in 2025 and 0.8 percentage points in 2026, according to their findings.

Trump’s preferred economic policy is import taxes, sometimes known as tariffs. He claims that tariffs safeguard American factory jobs from foreign competition and provide a variety of additional benefits.

While in office, Trump launched a trade war with China, placing steep tariffs on most Chinese goods. He also increased import duties on imported steel, aluminum, washing machines, and solar panels. Trump has even more ambitious intentions for a second term: he wants to slap a 60% tariff on all Chinese imports and a “universal” charge of 10% or 20% on everything else that enters the US.

Trump contends that the burden of taxing imported goods is borne by the foreign countries that produce them. The truth, however, is that tariffs are paid by U.S. importers, who then often pass on the cost to consumers in the form of increased prices, which is how Americans end up absorbing the expense.

Furthermore, when tariffs boost the cost of imports, diminished competition from foreign products allows US firms to raise their own prices.

“There’s no question that tariffs are inflationary,” said Kent Smetters of the University of Pennsylvania’s Penn Wharton Budget Model, which analyzes the costs of government policies. “Exactly how much – that’s where economists can debate it.”

Tariffs’ inflationary impact can be determined by how consumers react to increasing import prices: do they continue to buy more expensive foreign goods, such as a coffeemaker from China, a box of Swiss chocolates, or a Mexican-made car? Or will they switch to an American-made alternative product? Or stop purchasing such items altogether?

Kimberly Clausing and Mary Lovely of the Peterson Institute determined that Trump’s planned 60% tax on Chinese imports, combined with his high-end 20% tariff on everything else, would result in a $2,600 after-tax loss for the average American household each year.

Trump has made some questionable statements about protectionist plans. When asked how he would cut grocery prices, which are a particular pain for many Americans, Trump said the US should limit food imports since American farmers are “being decimated” by foreign competition.

“It’s sort of nonsensical to say that I’m concerned about high food prices, so I want to levy a tax on food imports,” said Clausing, a UCLA economist who specializes in tax policy. “As you tax them, the food in the grocery store absolutely gets more expensive.”

According to Department of Agriculture data, a large majority of food consumed in the United States is imported, accounting for around 60% of fresh fruit and 38% of vegetables. Domestically cultivated bananas account for less than 1% of American consumption. The vast majority is imported. The United States produces less than one percent of the coffee it consumes. It imports around 70% of its seafood.

“Trump is using tariffs as a political tool to signal his strong skepticism toward globalization in general — ‘America First,'” said Zandi of Moody’s Analytics. “Most voters find it difficult to understand that this policy stance is inflationary, especially when they are told otherwise.”

The Trump campaign emphasizes that US inflation stayed low even as Trump actively raised tariffs as president. Consumer prices increased by just 1.9% in 2018, 2.3% in 2019, and 1.4% in 2020. They further point out that, while in office, the Biden-Harris administration preserved the majority of Trump’s tariffs, despite Harris’ criticism of his plans to significantly expand their usage.

“In his first term, President Trump instituted tariffs against China that created jobs, spurred investment, and resulted in no inflation,” Anna Kelly, a Republican National Committee spokesman, stated.

Trump’s Economic Plans Would Worsen Inflation, Experts Say

However, Zandi of Moody’s Analytics observed that the sheer volume of Trump’s fresh tariff proposals has significantly altered the calculations.

“The Trump tariffs in 2018-19 didn’t have as large an impact because the tariffs were only just over $300 billion, mostly on Chinese imports,” he said. “The former president is now discussing tariffs on more than $3 trillion in imported goods from all countries.”

And the inflationary environment was very different during Trump’s first term. The Fed was primarily concerned at the time with rising inflation to its 2% objective, rather than lowering it. The economy’s surprisingly high-octane recovery from the COVID-19 recession of 2020 resulted in significant shortages of parts and labor, resuming inflationary pressures that had been dormant for decades.

Trump would reverse an immigration surge that helps lower inflation.

Trump, who has used fiery rhetoric and promoted misinformation about immigration, has promised the “largest deportation operation in the history of our country.” He claims it will target the millions of illegal immigrants living in the United States.

An increase in immigration, such as what the United States has seen in recent years, makes it easier for firms to acquire employees. As a result, it can assist in moderating inflation by reducing the incentive for companies to boost wages significantly and pass on their higher labor expenses to their customers through price increases.

Trump startled many analysts in August when he stated that he would like to have “a say” in the Fed’s interest rate choices.

The Fed is the government’s primary inflation fighter. It combats high inflation by raising interest rates to limit borrowing and spending, slow the economy, and lower the rate of price increases. In March 2022, the Fed launched an aggressive sequence of rate hikes to confront the worst outbreak of inflation in four decades. Inflation has fallen down to near the Fed’s 2% objective after peaking at 9.1%.

Economic studies have indicated that the Fed and other central banks can only properly manage inflation if they are free of political pressure. That’s because hiking interest rates to combat inflation usually slows the economy and sometimes triggers a recession. Politicians often prefer that the Fed not raise interest rates, which may jeopardize their reelection prospects.

As president, Trump repeatedly pressed Jerome Powell, the Fed chair he had appointed, to decrease interest rates in order to stimulate the economy. Many economists believe Trump’s public pressure on Powell surpassed even Presidents Lyndon Johnson and Richard Nixon’s efforts to persuade past Fed chiefs to keep interest rates low, moves generally regarded for contributing to the late 1960s and 1970s chronic inflation.

“The perception that the central bank was dancing to a president’s preferred tune… would compromise its ability to raise interest rates when it believed it was necessary to combat inflation,” said Samuel Gregg, a political economist at the free-market think tank American Institute of Economic Research.

“While Trump wants to make foreigners pay,’ ” the researchers concluded in their Peterson study, “our analysis suggests his proposals will end up making Americans pay the most.”

Source | AP