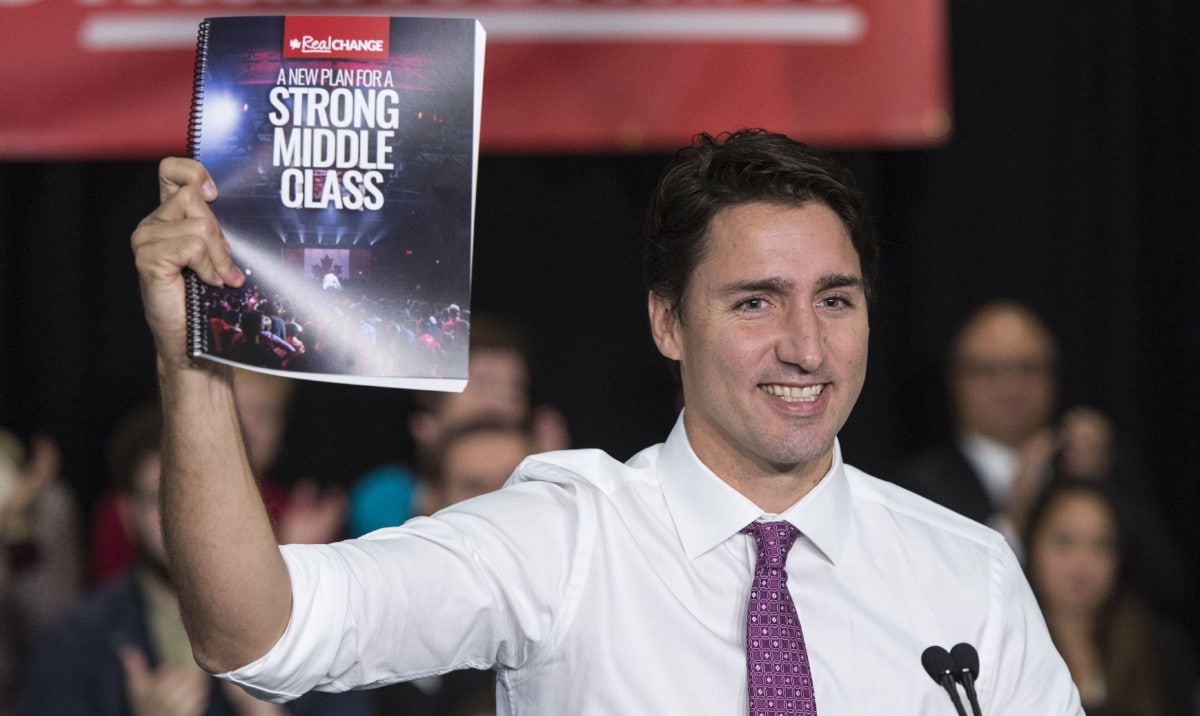

Canada’s Prime Minister Justin Trudeau, under pressure over a lack of affordable housing, and his latest solution is to tax Canadian’s even more by introducing a tax on short-term rentals.now

Many Canadian’s subsidize their already highly taxed income by renting our rooms in their homes through Airbnb and other short term rentals. Well now Canada’s Finance Minister Chrystia Freeland will put an end to that, she has unveil tax reforms aimed at reducing the use of Airbnb Inc. and other short-term rental services in areas of Canada where those platforms are prohibited.

According to reports in Montreal’s La Presse and the Toronto Star, Freeland’s fall economic statement will include the proposal. According to news outlets, the government will restrict property owners from deducting expenses for short-term rentals in places where those services are already limited by other levels of government.

According to the Star and La Presse, the tax reform, which would take effect on January 1, is intended to punish property owners who violate local restrictions. A lack of suitable rental homes is an issue in locations like British Columbia, where the provincial government recently enacted new regulations that makes it more difficult for owners to post vacant properties on sites like Airbnb, VRBO, and Expedia.

Last month, Freeland stated that the federal government was investigating what instruments it may use to combat short-term rental sites, which result in “fewer homes for Canadians to rent, particularly in urban and populated areas of our country.”

According to La Presse, the federal government’s housing agency, Canada Mortgage & Housing Corp., would be given C$15 billion ($10.9 billion) to offer low-interest loans to real estate developers for the development of rental homes as part of a new housing package.

Trudeau Raises Tax on Alcohol

Prime Minister Justin Trudeau of Canada frequently declares that he is “working to make life more affordable.” Instead of doing the one thing that would immediately make living more cheap – cutting taxes – he’s leveraging inflation to go on a drinking binge.

Trudeau intends to boost the federal excise tax on alcohol once again in 2024. This time, it was by 4.7%. Even a 4.7% tax increase, however, minimizes the amount of tax you pay every time you go to the liquor store.

In Canada, taxes already account for over half of the price of beer, two-thirds of the price of wine, and more than three-quarters of the price of spirits. That means a 24-pack of pilsner, a couple bottles of Pinot, plus a bottle of vodka will set you back around $120. Over $75 of it is tax.

In fact, Canadians pay five times the tax on a case of beer as our southern neighbors. The tax on a case of beer in Saskatchewan, Prince Edward Island, and Newfoundland and Labrador is higher than the total price of a case in half of American states.

While Canadians pay greater taxes, Americans benefit from tax cuts. Between 2017 and 2019, Canadian beer taxes increased by $34 million for large brewers, whereas American beer taxes decreased by $31 million.

Since the 2017 budget, the federal government has been on a tax rise spree. The Trudeau government implemented an automatic tax hike escalator that year. That means that on April 1 of each year, the federal excise tax automatically increases with inflation.

With inflation at a 40-year high, Canadians will face a significant tax increase in 2024.

The escalator tax was initially unpopular because inflation was low. However, even minor tax increases might add up to large costs over time. Because of the automatic annual tax raise that began in 2017, the federal government’s alcohol excise taxes will have jumped 19% after next year’s boost.

According to polls, the growing cost of living is the single most pressing economic issue confronting Canadians. Any government that cares about affordability will cancel the forthcoming tax hike and eliminate the automatic tax escalation system.

Brownie points for restoring alcohol taxes to their pre-automatic tax escalation levels. After all, the administration has boosted its tax take without MPs voting on it since Budget 2017. This is inherently anti-democratic.

Votes on tax increases are required for democracy. That is why we have a House of Commons full of MPs elected by their voters and paid $194,000 by the public. The automatic tax rises, on the other hand, make a mockery of our democratic processes.

In fact, the one time MPs had the opportunity to vote on the most recent alcohol tax rise, they decisively voted to repeal it. Trudeau just rejected the non-binding motion and Parliament’s democratic will.

Canadians require assistance. And the simplest and most straightforward way for him to demonstrate that he cares about affordability is to cease his alcohol tax spree.