News

7 Countries Offering Visa-on-Arrival for Indians

International trips are mesmerising and provide exposure to new cultures and people. However, a visa sometimes acts as a hurdle and becomes the reason for changing plans. Well, some countries offer visa-on-arrival for Indians, making your trip seamless. Let’s check out these countries and select the ones best suited to travel.

What is Visa-on-Arrival?

A visa-on-arrival is issued to a foreign visitor at a country’s entry point, a land checkpoint, a port, or an airport. Countries offer Visas on Arrival only to visitors from the country with which an agreement has been entered.

Visa-on-arrival countries differ from visa-free countries in that while the former provides a visa upon arrival, the latter doesn’t require one.

How Many Countries Offer Visa-on-Arrival to Indians?

There are 60 countries offering visa-on-arrival for Indians. This includes the following:

| 1 | Albania | 31 | Micronesia |

|---|---|---|---|

| 2 | Barbados | 32 | Montserrat |

| 3 | Bhutan | 33 | Mozambique |

| 4 | Bolivia | 34 | Myanmar |

| 5 | Botswana | 35 | Nepal |

| 6 | British Virgin Islands | 36 | Niue |

| 7 | Burundi | 37 | Oman |

| 8 | Cambodia | 38 | Palau Islands |

| 9 | Cape Verde Islands | 39 | Qatar |

| 10 | Comoro Islands | 40 | Rwanda |

| 11 | Cook Islands | 41 | Samoa |

| 12 | Dominica | 42 | Senegal |

| 13 | El Salvador | 43 | Serbia |

| 14 | Ethiopia | 44 | Seychelles |

| 15 | Fiji | 45 | Sierra Leone |

| 16 | Gabon | 46 | Somalia |

| 17 | Grenada | 47 | Sri Lanka |

| 18 | Guinea-Bissau | 48 | St. Kitts and Nevis |

| 19 | Haiti | 49 | St. Lucia |

| 20 | Indonesia | 50 | St. Vincent and the Grenadines |

| 21 | Iran | 51 | Tanzania |

| 22 | Jamaica | 52 | Thailand |

| 23 | Jordan | 53 | Timor-Leste |

| 24 | Laos | 54 | Togo |

| 25 | Macao (SAR China) | 55 | Trinidad and Tobago |

| 26 | Madagascar | 56 | Tunisia |

| 27 | Maldives | 57 | Tuvalu |

| 28 | Marshall Islands | 58 | Uganda |

| 29 | Mauritania | 59 | Vanuatu |

| 30 | Mauritius | 60 | Zimbabwe |

Top 7 Countries to Travel Amongst Visa-on-Arrival Countries

Here are the top 7 countries to travel amongst the visa-on-arrival countries:

1) British Virgin Islands

The British Virgin Islands consist of four large and 50 smaller islands. They are popular for their white sand beaches, rich flora and fauna, and aquamarine waters. The British Virgin Islands are for you if you are a beach lover.

The main island of Tortola is considered the yacht charter capital of the Caribbean. The best time to visit the British Virgin Islands is between December to April.

- Places to Visit: Tortola, Virgin Goda, Jost Van Dyke, Road Town etc.

- Things to Do: Recreation, sightseeing, water sports, etc.

- Itinerary Length: 7 days.

- Estimated Expenses (7-day trip): Approximately Rs. 1.2 lakhs to Rs. 1.5 lakhs.

2) Jamaica

Jamaica is a beautiful island full of clear water, pristine beaches, a garden of corals, and natural beauty. It offers plenty of outdoor adventures, like rafting in Martha Brae River, diving into Blue Hole, or bobsledding down Mystic Mountain.

Further, you cannot miss the Carnival celebrations and the world-famous Reggae Sumfest. The best time to visit Jamaica is between December and April.

- Places to Visit: Blue Hole, Catamaran Cruise, Seven Mile Beach, Negril Cliffs, Bob Marley Museum

- Things to Do: Scuba diving, snorkelling, Reggae Music, tour to a rum distillery, river rafting, etc.

- Itinerary Length: 7 days.

- Estimated Expenses (7-day trip): Approximately Rs. 50,000 to Rs. 70,000.

3) Oman

Oman is a country of delight, with 16th-century forts, golden desert dunes, and grand canyons among the jewels worth visiting. You can spend time on road trips or go wild camping, which is quite popular nationwide. The best time to visit Oman is from October to April.

- Places to Visit: Muscat, Wadi Darbat, Khasab, Wahiba Sands etc.

- Things to Do: Visit historical heritage sites, visit the desert, explore aquamarine waters, etc.

- Itinerary Length: 7 days.

- Estimated Expenses (7-day trip): Approximately Rs. 70,000 to Rs. 90,000.

4) Maldives

The Maldives is a tiny island nation in the Indian Ocean with immaculate beaches and crystal-clear waters. The location is quite popular among Indians. It is quite popular for water sports like flyboarding, banana boat riding, parasailing, etc. The Maldives offers a range of accommodations, including private island resorts. The best time to visit is December to April.

- Places to Visit: Alimatha Islands, Atoll Transfer, Banana Reef, National Museum

- Things to Do: Scuba diving, snorkelling, jet skiing, parasailing, kitesurfing, etc.

- Itinerary Length: 7 days.

- Estimated Expenses (7-day trip): Approximately Rs. 70,000 to Rs. 80,000.

5) Cook Islands

The Cook Islands are a group of 15 islands in the South Pacific region. They are famous for their blue lagoons, lush green mountains, and white sand beaches. The locals are very friendly, and the place is ideal for beach lovers, especially snorkelling enthusiasts. With its loving and romantic atmosphere and beach resorts, it is also ideal for a honeymoon. The best time to visit the Cook Islands is between April and November.

- Places to Visit: Aitutaki Lagoon, Muri Lagoon, Aroa Marine Reserve, Muri Night Market, etc.

- Things to Do: Lagoon cruises, off-roading, hiking, cycling, etc.

- Itinerary Length: 7 days.

- Estimated Expenses (7-day trip): Approximately Rs. 2.50 lakhs to Rs. 3 lakhs.

6) Seychelles

The Seychelles Islands are 1100 miles off the coast of Main Africa and are home to UNESCO-designated sites, making them a popular tourist destination. Seychelles has a warm tropical climate and is an all-round holiday destination.

Again, a destination for beach enthusiasts, you can enjoy splendid beaches in Seychelles, including white sand beaches. The best time to visit Seychelles is all year round, especially between April-May and October-November.

- Places to Visit: Victoria, Beau Vallon, Grand Anse, etc.

- Things to Do: Visit the mountain rainforest, see prehistoric palms, hike, island hop, etc.

- Itinerary Length: 7 days.

- Estimated Expenses (7-day trip): Approximately Rs. 1.50 lakhs.

7) Marshall Islands

The Marshall Islands is a small country in the Pacific Ocean, comprising approximately 70,000 people. It is popular for its pristine beaches, tropical islands, water sports, windsurfing, and scuba diving. The locals offer warm hospitality and are friendly. The best time to visit the Marshall Islands is between May and October.

- Places to Visit: Arno Atoll, Kalalin Pass, Bokolap Island, etc.

- Things to Do: Scuba diving, snorkelling, exploring aquatic life, etc.

- Itinerary Length: 7 days.

- Estimated Expenses (7-day trip): Approximately Rs. 40,000.

Other Things to Keep in Mind

Following are some of the important things you should keep in mind while undertaking an international trip to any of the above countries:

- Medicine and first aid kit in case any emergency arises.

- Get overseas travel insurance to ensure that you are financially protected in case things go south.

- Indian Embassy details in case of any emergency.

- Travel credit card so you can spend seamlessly without worrying about the forex issues.

- Adequate cash, especially in the currency of the country you are visiting. Always research how to conveniently get cash in foreign currency and the popular modes of spending in that country.

- All your KYC documents and ID proofs are a must-have when undertaking foreign journeys.

- Any other document or thing that you feel is important for international travel

Booking and undertaking an international trip can become easier if the visa requirements are relaxed. India has negotiated with multiple countries to ensure a seamless travel experience for Indian tourists.

However, it is important to prepare beforehand when planning travel. Undermining the importance of travel insurance can be a big mistake. Pack your bags and get going now!

SEE ALSO: Thriving in Thailand: A Traveler’s Playbook for the Best Activities

News

Trump Slams UK’s Starmer Over ‘Too Late’ Aircraft Carrier Offer

WASHINGTON, D.C. – US President Donald Trump took fresh aim at UK Prime Minister Keir Starmer on Saturday, brushing off reports that Britain may send two Royal Navy aircraft carriers to the Middle East. Trump said any move would come “too late” as the conflict with Iran continues.

Trump delivered the jab on Truth Social, where he framed the UK offer as an attempt to show up after the United States and its allies had already secured the outcome.

Trump’s Harsh Truth Social Message

Trump wrote: “The United Kingdom, our once Great Ally, maybe the Greatest of them all, is finally giving serious thought to sending two aircraft carriers to the Middle East. That’s OK, Prime Minister Starmer, we don’t need them any longer, But we will remember. We don’t need people that join Wars after we’ve already won!”

His post followed reports that the UK Ministry of Defence had put HMS Prince of Wales on higher readiness for a possible deployment. Those preparations could reportedly cut the normal sailing notice time. HMS Queen Elizabeth, Britain’s other Queen Elizabeth-class carrier, also came up in talks about boosting naval presence during the crisis.

At the same time, Trump’s comments highlighted a widening gap between Washington and London since the US-Israel campaign against Iran began on February 28. The operation has targeted Tehran’s nuclear and missile capabilities, while also tying the effort to regime change goals.

What’s Driving the Iran Conflict

Tensions climbed after Iranian actions that included missile strikes on targets in the region, followed by Iranian responses to US-Israeli attacks on key sites in Tehran and other locations. During the campaign, the United States has used British facilities, including RAF Fairford in Gloucestershire and Diego Garcia in the Indian Ocean. London described that access as for “specific and limited defensive purposes.”

However, Britain did not fully back offensive action at the start, and that stance repeatedly drew Trump’s criticism. In recent days, he has mocked Starmer and questioned the strength of the special relationship, while also contrasting him with historic leaders such as Winston Churchill.

Starmer’s Mixed Signals on the US and Israel

Opponents of Starmer have pointed to what they describe as shifting messages on the Middle East. Early in the crisis, Starmer stressed restraint and called for a “negotiated settlement” aimed at getting Iran to abandon its nuclear ambitions. He also declined to join the first wave of US-Israeli strikes.

Later, Starmer approved access to UK bases, but he framed it as defensive support rather than direct involvement in bombing runs. Throughout, he has leaned on international law, saying any action should meet global standards and avoid widening the conflict.

Critics say that the approach has looked inconsistent:

- Early resistance: Starmer held back immediate use of British bases for strikes, raising concerns about escalation and legality.

- Limited approval later: After pressure, the UK allowed restricted defensive operations from its facilities.

- Carrier readiness reports: New talk of aircraft carrier preparations suggests a step toward deeper involvement, although no final deployment has been confirmed.

Starmer has argued that the pace and limits were intentional. He has said the UK backs Israel’s right to self-defense, but still prefers diplomacy over open-ended military action.

International Law Focus, and Iran’s Record

Starmer has repeatedly urged all sides to follow international law. He has also called on Iran to respect global rules and avoid actions that could expand the conflict.

Still, his critics say the legal messaging sounds one-sided, given Iran’s long record of defying international norms. Iran has faced UN Security Council resolutions and sanctions tied to its nuclear program. It has also faced scrutiny over support for proxy militias, ballistic missile development, and attacks on shipping and regional neighbors. Many countries view those actions as clear violations of international law.

Because of that history, detractors say Starmer’s tougher legal expectations for allies, while Iran has ignored similar rules for years, have fed claims of uneven standards. Trump and his supporters have used that argument to paint Starmer as hesitant, saying the legal focus slowed meaningful help when it mattered most.

What This Means for US-UK Ties

The public clash adds pressure to the US-UK relationship at a tense moment. Trump’s warning that “we will remember” suggests he could weigh the dispute in future decisions on alliances, trade, or security cooperation.

Meanwhile, UK officials have played down the exchange. They have repeated the UK’s commitment to NATO and transatlantic ties, while also stressing an independent foreign policy. As of publication, Starmer’s office had not issued a direct reply to the Truth Social post.

As the Iran conflict continues, with reports of Iranian apologies for some regional attacks and US promises to keep up pressure, the dispute shows how Western allies remain split on timing, scope, and legal framing. Trump’s sharp tone may energize his base at home, while also pushing European partners to line up more closely with US goals in the Middle East.

Trending News:

Trump Outmaneuvers the British Empire in the Strait of Hormuz

News

Trump Outmaneuvers the “British Empire” in the Strait of Hormuz

WASHINGTON, D.C. – President Donald Trump has ordered the U.S. government to offer political risk insurance and naval escorts for commercial ships moving through the Strait of Hormuz. The directive follows a pullback by major marine insurers, led by Lloyd’s of London, after threats to Persian Gulf shipping drove war-risk costs higher or pushed coverage off the market.

Supporters say the plan keeps oil and LNG moving and strengthens energy security. Critics say it also challenges a long-standing center of global marine insurance power in London.

The Strait of Hormuz is a narrow 21-mile passage between Iran and Oman. It carries about 20 to 30% of the global seaborne oil trade and a large share of LNG exports from Gulf producers.

After U.S. and Israeli strikes against Iran in late February 2026 (called “Operation Epic Fury” in some reports), threats and attacks around the waterway drove risk levels up fast.

- By early March, traffic through the strait fell by more than 80%. On some days, tankers did not move at all.

- Major Protection and Indemnity (P&I) clubs, including Gard (Norway), Skuld, NorthStandard (UK), the London P&I Club, and the American Club, sent 72-hour cancellation notices for war-risk add-ons that took effect March 5.

- Lloyd’s Joint War Committee widened the “high-risk” area to include the full Persian Gulf. As a result, many underwriters canceled coverage or raised premiums sharply, sometimes two to five times normal levels.

In practice, shipping slowed because money, not missiles, set the limit. Without workable war-risk insurance, shipowners and charterers would not send high-value tankers into danger. That left hundreds of vessels waiting and raised fears of a global energy squeeze.

Lloyd’s holds a major share of marine cargo and war-risk business, and it has long handled complex, high-loss exposures. Its marine roots go back centuries to Britain’s early merchant trade.

Trump’s Response: The U.S. Steps Into Maritime Insurance

On March 3, Trump posted on Truth Social that he had instructed the U.S. International Development Finance Corporation (DFC) to provide “political risk insurance and guarantees” for Gulf maritime trade at a very reasonable price.”

The plan includes:

- Political risk insurance covering losses tied to war, terrorism, or government actions.

- Financial guarantees aimed at backing shipowners, charterers, and private insurers.

- U.S. Navy escorts for tankers when needed, echoing past U.S. protection missions in the region.

- A later announcement of a $20 billion reinsurance facility meant to steady prices and help restore traffic.

Trump framed the goal in simple terms: “No matter what, the United States will ensure the free flow of energy to the world.”

Using the DFC this way stands out because the agency usually supports development-related financing in emerging markets. Still, there is a recent parallel. In 2023, an insurance effort helped support Ukraine grain exports with participation from Lloyd’s and other firms.

What This Could Mean for Lloyd’s of London and the UK

Lloyd’s remains a global hub for specialty insurance and brings billions into the UK economy each year through premiums, jobs, and related services. Around 50,000 people work in insurance and connected roles in the City of London. Marine and energy coverage sit at the center of that system, and war-risk insurance, while niche, can carry real geopolitical weight.

Some analysts think Trump’s move could pull business away from London over time:

- If U.S.-backed coverage stays dependable and priced well, some shippers may favor it after the crisis.

- British headlines have floated the idea that Trump could weaken a roughly £50bn insurance giant.

- Lloyd’s has taken a cooperative tone with the DFC and says it still leads on war-risk expertise. It also argues coverage is still available, even at higher rates, and that some traffic has started to return.

Even so, the message is hard to miss. A private insurance market in London has long been able to slow trade with pricing and capacity. Now, a state backstop is trying to remove that pressure point.

Bigger Ripple Effects for Energy, Alliances, and Markets

This standoff shows how finance, military power, and energy supply connect in real time.

- Energy security and prices: By pushing shipments to resume, the U.S. reduces the risk of price spikes at home and helps allies that depend on Gulf oil and LNG.

- Tension with close partners: In London, some see the policy as a direct hit to a key national industry.

- Oil market reaction: Prices jumped at first, then eased after Trump’s announcement. Still, war-risk costs remain high, and sentiment is shaky.

- Limits of insurance alone: Shipping leaders warn that guarantees only help up to a point. If attacks continue, fear can outrun price. At the same time, more naval activity can raise the sense that the route is a live conflict zone.

The administration’s approach blends money, security promises, and military readiness. In effect, the U.S. is presenting itself as the backstop for key sea lanes.

What Comes Next for Hormuz Shipping and War-Risk Coverage

Results will hinge on execution. That includes the fine print of DFC coverage, how it coordinates with private insurers, and whether Navy escorts become routine. Lloyd’s has signaled it can work with the U.S. effort, so a shared model may emerge instead of a clean replacement.

Still, the larger shift is clear. Where private underwriters once had near veto power over a critical chokepoint, direct government support is moving in to keep tankers sailing.

For now, the U.S. has acted to prevent a supply shock, and it has turned an insurance freeze into a test of who guarantees global energy flows.

Related News:

Trump Says He’s Very Disappointed in Starmer Over Iran

News

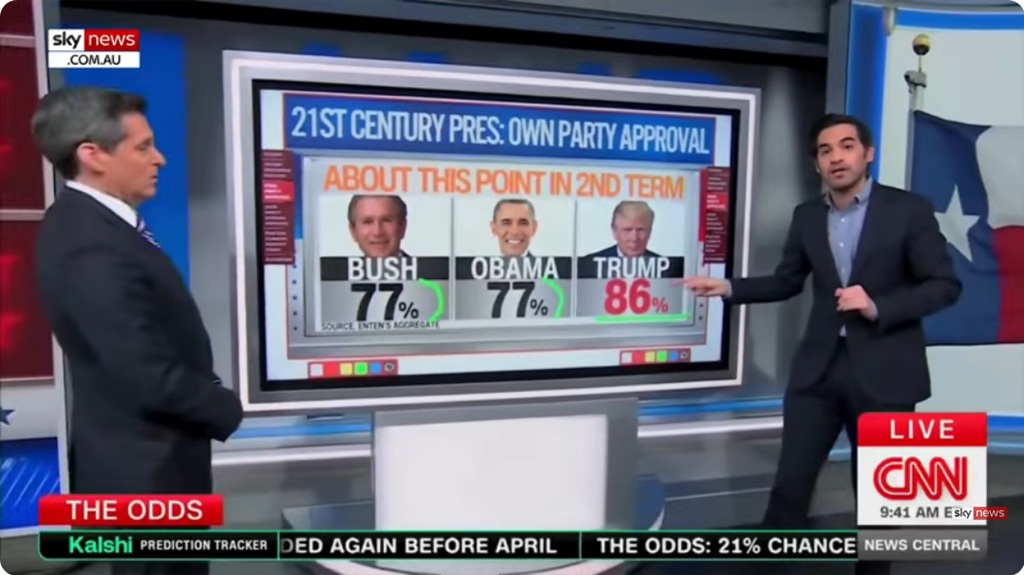

CNN Reveals Trump’s GOP Approval Tops Obama and Bush at the Same Point

ATLANTA – CNNsenior writer and chief data analyst Harry Enten walked through polling that shows President Donald Trump holding unusually strong support inside the Republican Party. Using CNN survey averages and side-by-side comparisons, Enten said Trump’s current approval among Republicans sits well above where Barack Obama and George W. Bush stood with their own parties at a similar stage of their presidencies.

The discussion came up while the panel talked about Trump’s influence in GOP primaries and the impact of his endorsements. According to Enten, the numbers suggest Trump’s pull with Republican voters remains firm. As he put it, Trump’s “magic touch has not seemed to wear off yet when it comes to the Republican base.”

Main Takeaways From Enten’s Breakdown

- Very high Republican approval: CNN polling averages show Trump at 86% approval among Republicans at this point in his second term.

- Higher than recent presidents at the same stage: At a comparable moment, George W. Bush was at 77% with Republicans, and Barack Obama was at 77% with Democrats.

- More intense support, too: 53% of Republicans strongly approve of Trump’s performance. By comparison, Obama measured 48% and Bush 47% on strong approval at the same point.

- Endorsement power tied to base loyalty: Enten compared Trump’s primary influence to famous athletes like Tom Brady and Babe Ruth. He also said Trump-backed candidates have posted 95% to 99% win rates in recent cycles, helped by tight party loyalty.

- Standout own-party support in the modern era: Enten summed it up plainly, saying Republicans support Trump more than any 21st-century president’s party supporters at this point.

Even as Trump’s overall national approval moves up and down, the Republican core stays steady. That gap between base support and broader approval is a major part of the story.

Own-Party Approval, Side-by-Side

Here’s the same comparison Enten shared, focused on approval within each president’s own party at roughly the same point in their second terms:

| President | Party Approval Rating (%) | Strong Approval (%) | Time Period Context |

|---|---|---|---|

| Donald Trump | 86 | 53 | Current (second term, early 2026) |

| Barack Obama | 77 | 48 | Similar point in the second term |

| George W. Bush | 77 | 47 | Similar point in the second term |

Source: CNN polling averages and historical figures as cited by Harry Enten. Timelines reflect approximate equivalents across presidencies.

Enten stressed that this level of party unity stands out. In many presidencies, overall approval sits in the 40% to 50% range because the country splits along party lines. In contrast, Trump’s near-unified backing from Republican voters gives him a strong base even when national debates heat up.

Why These Numbers Matter for Trump’s Influence

High own-party approval usually turns into real power inside a party, and Enten argued that’s exactly what’s happening here. Because Republicans approve of Trump at such a high rate, his endorsement often carries major weight in primary elections. Since 2020, Trump-supported candidates have won GOP primaries at a pace that goes far beyond what most endorsements can deliver.

As a result, challenges to Trump-aligned candidates often struggle to gain traction. Even when Trump’s broader public numbers soften, Republican enthusiasm hasn’t dropped in the same way.

Enten’s tone stayed data-focused, but he made clear the size of the gap surprised him. “Look at this: 86% of Republicans approve,” he said, while pointing back to the 77% figures for Obama and Bush.

A Quick Look at Party Loyalty Over Time

Presidents often begin terms with strong support from their party, then see it slip when controversies build or conditions change. In that context:

- Bush held about 77% party approval at a similar second-term point, before later drops tied to the Iraq War and economic concerns.

- Obama also measured 77% among Democrats at the same stage, showing solid support but less intensity than Trump’s current numbers.

Trump’s 86% approval, paired with higher strong approval, signals a more locked-in base. That kind of support can cushion a president from pressures that hit other administrations harder.

What to Watch Next

With the 2026 midterms on the horizon, the data suggests Trump still holds major influence within the Republican Party. It’s still unclear how long that strength will last or how it will shape policy fights and candidate choices, but the polling shows little sign of fatigue among GOP voters.

Enten’s segment also highlights something many headline polls miss. National approval matters, but internal party support can say even more about a president’s staying power. After the clip aired, the comments spread quickly on social media and conservative outlets, mainly because the contrast between Trump’s GOP numbers and his broader national approval remains so sharp.

Related News:

Karoline Leavitt Slams CNN’s Kaitlan Collins Over Killed U.S. Soldiers

-

Crime2 months ago

Crime2 months agoYouTuber Nick Shirley Exposes BILLIONS of Somali Fraud, Video Goes VIRAL

-

China1 month ago

China1 month agoChina-Based Billionaire Singham Allegedly Funding America’s Radical Left

-

Politics2 months ago

Politics2 months agoIlhan Omar Faces Renewed Firestorm Over Resurfaced Video

-

Crime3 months ago

Crime3 months agoSomali’s Accused of Bilking Millions From Maine’s Medicaid Program

-

Business2 months ago

Business2 months agoTech Giant Oracle Abandons California After 43 Years

-

Politics1 month ago

Politics1 month agoCNN Delivers Stark Reality Check to Democrats Over Voter ID

-

Crime3 months ago

Crime3 months agoMinnesota Fraud Scandal EXPANDS, $10 Billion in Fraudulent Payments

-

Midterm Elections2 months ago

Midterm Elections2 months ago2026 Midterms Guide: Candidates, Key Issues, and Battleground States