Business

Tax Season Is Under Way. Here Are Some Tips To Navigate It.

NEW YORK — Tax season began Monday, and for many filing US tax returns — particularly those doing so for the first time — it may be a difficult chore that is sometimes pushed until the last minute. But, if you want to escape the stress of the approaching deadline, get organised as soon as possible.

Whether you do your taxes, go to a tax clinic, or hire a professional, navigating the tax system may take time and effort. Courtney Alev, Credit Karma’s consumer financial advocate, suggests you take it easy on yourself.

“Take a breath. Take some time, set out an hour, or work through it over the weekend. “You’ll hopefully realise that it’s much simpler than you think,” Alev added.

If you need more clarity on the process, there are numerous free tools available to assist you navigate it.

Here’s what you should know:

When is the deadline for filing taxes?

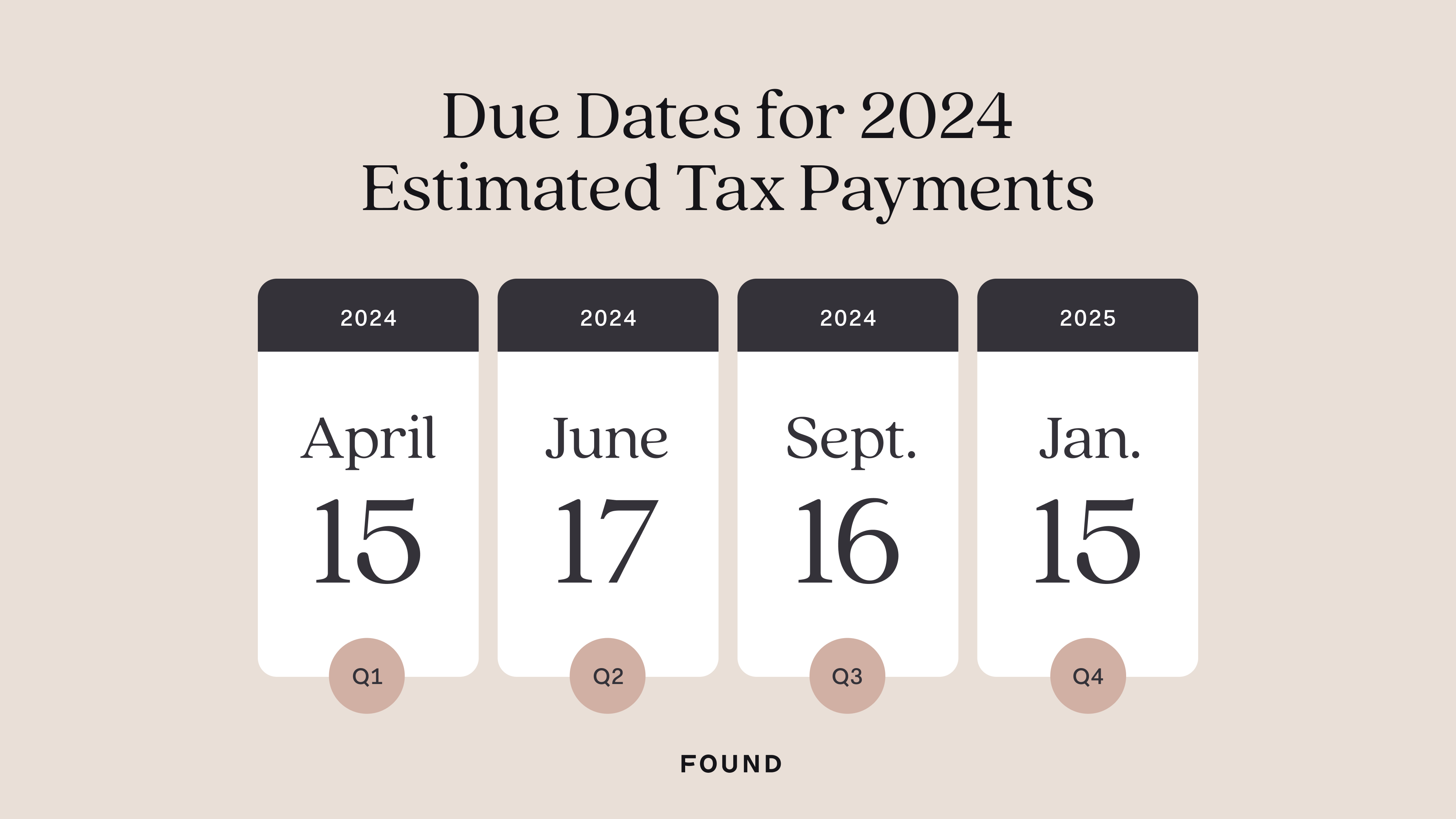

Taxpayers have until April 15 to file forms for 2023.

What do I need to do to file my tax return?

While the required documents may vary by situation, here is a broad outline of what everyone needs:

—Social Security Number

– W-2 documents, if you are employed.

– 1099-G if you are unemployed.

— 1099 paperwork if you are self-employed.

—Investment and savings records

—Any allowable deduction, such as educational costs, medical bills, charitable contributions, etc.

—Tax credits, such as the child tax credit and the retirement savings contribution credit.

The IRS website provides a more detailed document list.

Tom O’Saben, director of tax content and government relations at the National Association of Tax Professionals, recommends gathering all of your paperwork in one location before beginning your tax return and having your records from the previous year if your financial status has significantly altered.

To protect themselves from identity theft, O’Saben recommends taxpayers create an identity protection PIN with the IRS. Once you’ve created a number, the IRS will require it when you file your tax return.

How Do I File My Taxes?

You can file your taxes online or on paper. However, there is a significant time gap between the two methods. The IRS can process paper filings for up to six months, whereas electronic filings take only three weeks.

WHAT RESOURCES ARE THERE?

For those earning $79,000 or less yearly, the IRS provides free guided tax preparation that handles your arithmetic. If you have any issues while completing your tax forms, the IRS has an interactive tax aid tool that can provide answers depending on your information.

Aside from famous corporations like TurboTax and H&R Block, taxpayers can use licenced professionals such as certified public accountants. The IRS provides a directory of tax preparers around the United States.

The IRS also finances two programs providing free tax assistance: VITA and Tax Counselling for the Elderly (TCE). People who earn $64,000 or less per year, have disabilities, or speak little English are eligible for the VITA programme. People over the age of 60 are eligible for the TCE programme. The IRS has a website where you may find organisations that host VITA and TCE clinics.

If you have a tax problem, clinics nationwide can help you handle it. These tax clinics typically provide services in multiple languages, including Spanish, Chinese, and Vietnamese.

HOW CAN I AVOID MISTAKES ON MY TAX RETURN?

Many people are concerned about getting in trouble with the IRS if they make errors. Here’s how to avoid some of the more popular ones:

—Confirm your name on your Social Security card.

When working with customers, O’Saben always requests that they bring their Social Security cards to double-check their number and legal name, which can change when people marry.

“You may have changed your name, but you didn’t change it with Social Security,” he remarked. “If the Social Security number doesn’t match the first four letters of the last name, the return will be rejected, and that will delay processing.”

—Look for tax statements if you’ve opted out of paper mail.

Many people prefer to avoid receiving snail mail; however, doing so may result in your tax paperwork being included.

“If you didn’t get anything in the mail doesn’t mean that there isn’t an information document out there that you need to be aware of and report accordingly,” he said.

—Be sure to record all of your income.

If you worked more than one job in 2023, you’ll need the W-2 forms for each.

What about the Child Income Credit?

Last month, Congress announced a bipartisan deal to expand the child tax credit. The tax credit is $2,000 per kid, with just $1,600 refundable. The plan would gradually boost the maximum refundable child tax credit to $1,800 for 2023 tax returns, $1,900 the following year, and $2,000 for 2025 tax returns.

According to the Centre for Budget and Policy Priorities, if this deal is implemented, around 16 million low-income children will benefit from expanding the child tax credit. Lawmakers hope to move this bill as quickly as feasible.

What if I make a mistake?

Mistakes happen, and the IRS takes a different response in each case. In general, if you make a mistake or leave something out of your tax returns, the IRS will audit you, according to Alev. An audit indicates that the IRS will ask for additional documentation.

“Generally, they are quite understanding and willing to collaborate with others. “You won’t be arrested if you type in the wrong field,” Alev stated.

What if it has been years since I filed?

You can file taxes late; if you were expecting a refund, you may still receive it. If you last filed years ago and owe money to the IRS, you may face penalties, but the agency can work with you to set up payment plans.

How Can I Avoid Scams?

Tax season is a perfect time for tax scams, according to O’Saben. These frauds can be delivered via phone, text, email, or social media. The IRS does not use any of these methods to reach taxpayers.

Tax preparers can sometimes be fraud perpetrators, so ask many questions. According to O’Saben, this could be a warning sign if a tax preparer tells you you will receive a greater refund than in past years.

If you need help seeing what your tax preparer is doing, request a copy of the tax return and ask questions about each entry.

How long should I keep copies of my tax returns?

It’s usually a good idea to preserve a record of your tax returns in case the IRS audits you on something you reported years ago. O’Saben recommends retaining copies of your tax returns for up to seven years.

How Do I File a Tax Extension?

You can request an extension if you run out of time to file your tax return. However, remember that the extension only allows you to file your taxes, not pay them. Pay an estimated amount before the deadline to avoid penalties and interest if you owe taxes. If you expect a refund, you will still get it when you file your taxes.

Filing an extension gives you till October 15 to file your taxes. You can file for an extension using your preferred tax software or preparer, the IRS Free File tool, or by mail.

What happens if you file your taxes late?

You may face several fines if you miss the tax deadline and do not file for an extension. If you miss the deadline, you may face a failure-to-file penalty. According to the IRS, the penalty will be 5% of the unpaid taxes for each month the tax return is late.

You will face a failure-to-pay penalty if you owe taxes and fail by the deadline. Interest will be levied on both outstanding taxes and penalties. If you are eligible for a refund, you will not be penalised and will get your tax return payment. If you had unusual circumstances that prevented you from filing or paying your taxes on time, you may be entitled to waive or decrease your penalty.

You can apply for a payment plan if you owe too much in taxes. Payment options will allow you to repay over time

SOURCE – (AP)

Business

Walmart Charged With Unlawfully Establishing Bank Accounts for 1 Million Drivers

(VOR News) – The Consumer Financial Protection Bureau (CFPB) filed a lawsuit against Walmart and a fintech company called Branch Messenger, alleging that the two companies forced more than a million delivery workers to use costly bank accounts to receive their paychecks. Both of these companies were the targets of the lawsuit.

According to the action filed by the Consumer Financial Protection Bureau (CFPB), Walmart and Branch are accused of opening deposit accounts for Walmart’s Spark Drivers, who are considered independent contractors, without first getting their consent.

These bank accounts contained drivers’ personal data, including their Social Security numbers.

The lawsuit specifically claims that Walmart’s drivers, who are in charge of delivering goods from the company’s warehouses to consumers, are only allowed to have their earnings transferred into these branch accounts.

This goes against the company’s rules, which permit them to move their earnings to different accounts.

Walmart reportedly told employees in 2021 that using these accounts may lead to firing.

Additionally, the lawsuit claimed that accessing profits through the accounts was a “complex process,” typically causing weeks-long delays. Among the other accusations that were made was this one.

This was the predicament they ultimately found themselves in, even though the business had assured them that they would have prompt access to funds.

To make matters worse, according to the Consumer Financial Protection Bureau (CFPB), drivers allegedly paid ten million dollars in “junk fees” to move their earnings to different bank accounts.

Director of the Consumer Financial Protection Bureau (CFPB), Rohit Chopra, said, “Companies cannot force workers into getting paid through accounts that drain their earnings with junk fees,” in his criticism of the practice. “Junk fees are a waste of money.”

This case’s next section outlined the traits of the average Spark Driver: “in addition to being a woman, having children, not having a college degree, and having a low income.”

Walmart denied the accusations made by the Consumer Financial Protection Bureau (CFPB) and stated in a statement that it will firmly defend itself in court.

Walmart released a statement claiming that the Consumer Financial Protection Bureau’s (CFPB) hurried lawsuit is full of factual errors, exaggerations, and blatant misrepresentations of basic legal principles.

The Consumer Financial Protection Bureau (CFPB) never gave Walmart a chance to make its case in an unbiased way throughout its rushed probe. In contrast to the Consumer Financial Protection Bureau, we are ready to fiercely defend the Company before a court that respects the due process of law principle.

Additionally, Branch was charged by the Consumer Financial Protection Bureau (CFPB) with engaging in deceptive advertising and neglecting to look into and address issues pertaining to the accounts. In addition to earlier accusations, these were also made.

In contrast, Branch denied the accusations and defended its services, saying, “The Consumer Financial Protection Bureau rushed to file a lawsuit despite the company’s extensive cooperation with its investigation, refusing to engage with Branch in any meaningful way about this matter.”

Branch responded to the Walmart accusations with a statement.

Furthermore, Branch claimed that the case was motivated more by a desire for “media attention” than by concerns for the welfare of the employees. This is what he stated in his statement.

This case, which is part of a larger campaign to give these gig workers more rights, targets these individuals who work for firms like Uber, Lyft, and DoorDash who are supposed to be independent contractors. It is considered that gig workers are independent contractors.

Earlier this month, the Consumer Financial Protection Bureau (CFPB) made claims against large financial firms, including Wells Fargo, Bank of America, and JPMorgan Chase.

According to the CFPB, these organizations did not stop fraud on the money-sending app Zelle, which is a platform that lets people send and receive money.

The choice of a new director may have an impact on the outcome of this lawsuit because President-elect Donald Trump is expected to choose a replacement for the present director of the Consumer Financial Protection Bureau (CFPB).

When Jaret Seiberg was employed as a financial services policy analyst at TD Cowen Washington Research Group, she noted that the new director’s strategy for handling such matters would be the deciding element in the case’s future course.

SOURCE: TN

SEE ALSO:

Deal With Mexican Retailer, Nordstrom’s Founding Family Takes Nordstrom Private.

Sonic the Hedgehog Dominates Christmas Wish Lists

Business

Deal With Mexican Retailer, Nordstrom’s Founding Family Takes Nordstrom Private.

(VOR News) – The company made the news on Monday that it would transition into a private Nordstrom corporation after the conclusion of a buyout agreement with El Puerto de Liverpool, a Mexican department store, and the founding family of Nordstrom.

The arrangement was reached when the company acquired El Puerto de Liverpool. It is projected that the transaction will end up valued at around $6.25 billion.

The company’s board of directors came to a resolution that was unanimous in order to give their approval to the deal, which is expected to be completed in the first half of the year 2025.

The Nordstrom family would control the corporation under the agreement.

Which will equate to 50.1% of the business, while Liverpool will hold 49.9% of the company. In accordance with a press announcement, common stockholders would receive a cash payment of $24.25 for each share of Nordstrom common stock that they now hold in their possession.

According to a news release, Nordstrom’s Chief Executive Officer Erik Nordstrom remarked that the company has been working on the fundamental principle of assisting customers in feeling well and looking their best for more than a century.

This idea has been the driving force behind the company’s operations. The company is about to embark on an exciting new phase, and today marks the beginning of that chapter.

We, the members of my family, are looking forward to working together with our coworkers to make certain that Nordstrom will continue to be successful well into the foreseeable future.

Over the course of its history, the retail establishment has made repeated attempts to transition into a private operation. 2018 was the year that a previous attempt was unsuccessful at materializing.

In September, the Nordstrom family made an offer to purchase the company at a price of $23 per share, which resulted in the company being valued at around $3.76 billion. The offer was accepted by the company.

Over the course of the early trading session, the stock of Nordstrom witnessed a decrease of nearly one percent. As a result of a report that was published by Reuters in March, which said that the family intended to take the company private, the shares of the company have undergone a large boost.

November revenues beat Wall Street forecasts for Nordstrom’s fiscal third quarter.

This was due to the fact that the company’s revenue climbed approximately 4% year-over-year. However, the company claimed that it anticipated a dismal holiday season, which resulted in a little more optimistic prediction for the full year’s revenues. This was the case since the corporation anticipated that the holiday season would be weak.

Customers continue to be picky when it comes to purchasing things that are desires rather than needs, and they have paid greater attention to pricing, according to the majority of merchants, including Walmart, Best Buy, and Target.

These businesses have also said that customers have become more price conscious. This has led to an increase in the amount of pressure that is being placed on luxury clothing businesses.

Nordstrom, a department store, was initially founded in 1901 as a shoe business but later expanded into other areas. Since then, it has developed into a department store that provides customers with a diverse range of clothing and accessories at more than 350 sites around the United States. These locations include Nordstrom Rack, Nordstrom Local, and Nordstrom.

El Puerto de Liverpool is responsible for the management of two further department store chains under the names Liverpool and Suburbia. In addition, El Puerto de Liverpool is home to 29 shopping centers that are dispersed across the entirety of Mexico

SOURCE: CNBC

SEE ALSO:

Sonic the Hedgehog Dominates Christmas Wish Lists

Amazon Strike Called By Teamsters Union 10,000 Walkout

Business

Sonic the Hedgehog Dominates Christmas Wish Lists

Sonic the Hedgehog is dominating Christmas wish lists this year. The lovable blue hedgehog is back in the spotlight, from sonic the hedgehog toys and games to sonic the hedgehog coloring pages and movie hype.

Sonic-themed holiday merchandise is on fire, from quirky sweaters to action figures flying off shelves. Sonic the Hedgehog Christmas outfits for kids are selling out fast, making them a go-to gift option for festive fun.

Retailers have been quick to recognize Sonic’s holiday appeal. Special promotions and exclusive items, like the Sonic holiday t-shirts, are everywhere.

Everyone’s stocking up on Sonic merchandise, from big-box stores to boutique retailers.

Online shopping platforms are seeing a surge in searches for Sonic items. Whether it’s Sonic Christmas-themed tops or Sonic the Hedgehog coloring pages, Sonic the Hedgehog toys or Sonic and the Hedgehog 3, the demand is skyrocketing.

Retailers who tap into this trend are sure to see strong holiday sales.

Sonic has been around since the early 90s, but his popularity never wanes. With the release of Sonic 3, fans are more excited than ever.

Sonic the Hedgehog 4

Meanwhile, Paramount Pictures is preparing “Sonic the Hedgehog 4,” with the newest addition in the family-friendly genre set for a spring 2027 release.

The announcement comes as “Sonic 3” opens in theatres on Friday, estimated to gross $55 million to $60 million from 3,800 North American locations.

The sequel is shaping up to be a good holiday season blockbuster for Paramount, which explains the desire in future “Sonic” adventures. On the international front, the film will be released on Christmas Day in 52 markets.

On Rotten Tomatoes, critics gave “Sonic 3” an outstanding 87% fresh score.

The first two films grossed a total of $725.2 million at the global box office and generated over $180 million in global consumer expenditure through home entertainment rentals and digital purchases.

They also inspired a spinoff Paramount+ series, “Knuckles,” which premiered earlier this year.

Related News:

Man Creates Candy Cane Car to Spread Christmas Cheer

-

Politics4 weeks ago

Miller Expects 4.9 Million Foreigners to Leave Canada Voluntarily

-

News3 weeks ago

Nolinor Boeing 737 Crash Lands in Montreal

-

News3 weeks ago

“Shocking Video” Vancouver Police Shoot Armed Suspect 10 Times

-

Tech4 weeks ago

Increasing its Stake in OpenAI by $1.5 Billion is a Possibility for SoftBank.

-

Tech4 weeks ago

Canadian Media Firms Are Suing OpenAI in a Potential Billion-Dollar Dispute.

-

Finance2 weeks ago

Chrystia Freeland Promises Mini-Budget By Dec 16th