Tech

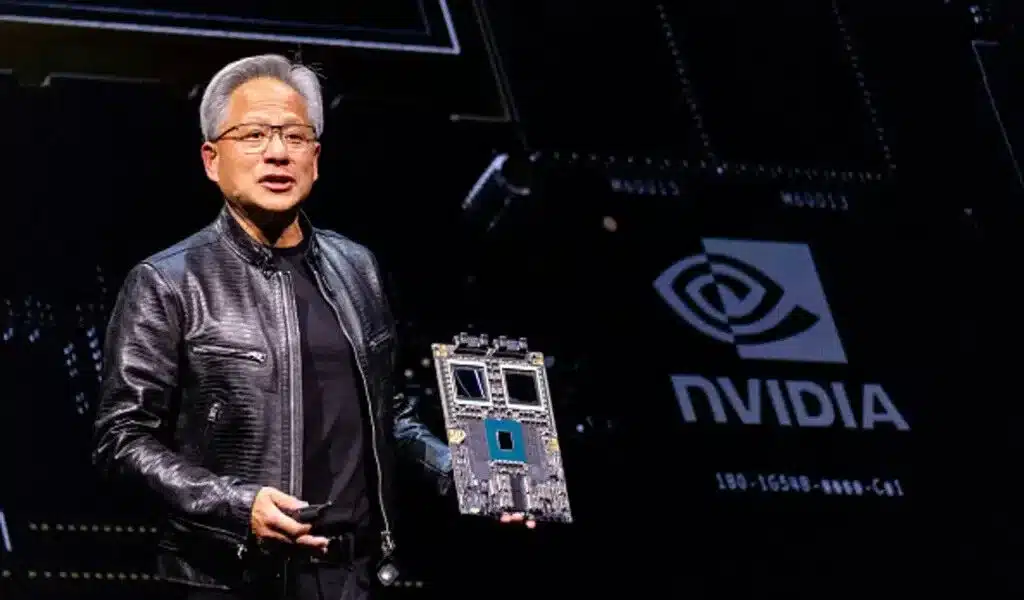

NVIDIA’s Market Capitalization Now Exceeds $3.4 Trillion, Putting It On Track For A Record Close.

(VOR News) – It is projected that Nvidia shares will establish a record close on Monday, at the same time as Wall Street is getting ready for earnings season and receiving updates from all of the chipmaker’s most important clients about their planned investments in artificial intelligence infrastructure.

In addition, it is anticipated that Nvidia shares will set a new record for the closing price.

After reaching a price of $138.31 at approximately one o’clock in the afternoon Eastern time, the stock had experienced a rise of 2.6% from its previous selling price. At the time of the 18th of June, the price that was reached at the end of trading was $135.58, which was the highest it had ever been.

Since the beginning of the year 2023, the value of the company’s shares has increased by more than nine times, and they have already gained by about 180% for the year. This is a significant increase.

OpenAI’s ChatGPT was made available to the general public in November 2022, which marked the beginning of the generative artificial intelligence boom.

NVIDIA has been the most effective beneficiary of this boom.

Despite the fact that it is often considered that Nvidia is the firm that is providing the picks and shovels for the artificial intelligence gold rush, the company has been the most successful beneficiary of the boom.

The utilization of graphics processing units (GPUs) that were invented by Nvidia is required for the creation and deployment of complex artificial intelligence models. These models are the driving force behind ChatGPT and other applications that are comparable to it.

In order to develop increasingly massive clusters of computers for their advanced artificial intelligence work, a number of companies, including Microsoft, Meta, Google, and Amazon, are purchasing graphics processing units (GPUs) from Nvidia in significant quantities. This is being done in order to enhance their capabilities.

These companies also buy GPUs from Nvidia.

When it comes to the quarterly results of each of these organizations, it is anticipated that they will be made public before the end of the month of October at the very latest.

Despite the fact that it controls more than 95% of the market for artificial intelligence (AI) training and inference chips, Nvidia is receiving a disproportionately significant amount of the billions of dollars that the largest technology companies are spending annually on their artificial intelligence (AI) buildouts.

This is because Nvidia is the market leader in both of these categories. It has been declared by the analysts at Mizuho that this is the real situation.

Nvidia’s revenue has increased by a factor that is greater than twice over the course of the past five quarters, and in three of those periods, it has increased by a factor that is at least three times higher than the previous quarter’s.

Economists are of the opinion that the rate of growth will moderately slow down during the course of the remaining months of the year, as stated by LSEG. They forecast that the industry will expand by about 82% during the quarter that will finish in October, reaching a total of $32.9 billion in revenue over the course of the period.

The demand for Nvidia’s next-generation artificial intelligence graphics processing unit (GPU), which has been given the name Blackwell, is “insane,” and the company forecasts that the new product will bring in billions of dollars in sales during the fourth quarter. Blackwell is the name of the GPU.

With a market value of $3.4 trillion, Nvidia is the second most valuable publicly traded corporation in the United States of America that is currently in operation. The market capitalization of Apple, on the other hand, is approximately $3.53 trillion, which represents the total dollar amount

SOURCE: CNBC

SEE ALSO:

Documents Show OpenAI’s Long Journey From Nonprofit To $157B Valued Company

SpaceX Landed a Starship Rocket Booster in a Spectacular Way During the Sixth Flight Test.

Documents Show OpenAI’s From Nonprofit to $157B Valued Company Long Trip