News

Supreme Court Upholds Trump-Era Foreign Earnings TAX

On Thursday, the US Supreme Court upheld an obscure tax established as part of Trump’s big 2017 reform package that targets U.S. taxpayers who own shares in certain foreign firms.

The Supreme Court concluded 7-2 that the so-called mandatory repatriation tax, or MRT, is constitutional under Article I and the 16th Amendment, rejecting a lawsuit by a Washington couple, Charles and Kathleen Moore, who claimed the provision violated the Constitution. Justice Brett Kavanaugh authored the majority opinion. Justices Clarence Thomas and Neil Gorsuch dissented.

The Supreme Court’s decision was narrow, but by declining to overturn the tax, the justices avoided closing the door on Democrats’ proposals to levy taxes on the nation’s richest earnings. Kavanaugh emphasized that the court’s analysis ignores the difficulties created by holdings, wealth, or net worth taxes, as well as appreciation taxes.

“Those are potential issues for another day, and we do not address or resolve any of those issues here,” the Supreme Court judge’s counsel wrote. “In the Moores’ instance, Congress has long taxed an entity’s shareholders on its undistributed revenue, as it did with the MRT. This Court has long sustained such taxes, and we continue to do so with the MRT.

The high court opinion is also expected to allay fears about the impact of a sweeping decision rejecting the required repatriation tax on other elements of the tax legislation. Kavanaugh acknowledged the potential repercussions of such a finding, stating that if the Moores’ argument is adopted, “vast swaths” of the Internal Revenue Code may be declared unconstitutional.

“And those tax provisions, if suddenly eliminated, would deprive the U. S. government and the American people of trillions in lost tax revenue,” he wrote on behalf of the coalition. “The logical ramifications of the Moores’ thesis would thus oblige Congress to either dramatically slash important national programs or significantly increase taxes on the remaining sources available to it—including, of course, ordinary Americans. The Constitution does not need such a fiscal disaster.”

Dan Greenberg, general counsel of the Competitive Enterprise Institute, which represented the Moores, expressed disappointment with the verdict, which allows the government to collect income taxes on overseas stockholders who have never earned income.

“We think that is unfair, because the Constitution authorizes Congress to tax people on their income, not the income of foreign businesses that they do not control,” according to a press release.

Supreme Court Moore v. U.S.

The tax at the center of the case, known as Moore v. U.S., is imposed one time on U.S. taxpayers who hold shares of certain foreign corporations. The Moores challenged the measure after they were hit with a nearly $15,000 tax bill for 2017 as a result of the law, which required them to pay levies on their share of reinvested lifetime earnings from an India-based company called KisanKraft Tools.

The Moores had invested $40,000 in the company in 2006 in exchange for a 13% stake, and did not receive any distributions, dividends or other payments from it.

But the mandatory repatriation tax, enacted through the Tax Cut and Jobs Act that was signed into law by former President Donald Trump, taxed U.S. taxpayers who owned at least 10% of a foreign company on their proportionate share of that company’s earnings after 1986. The tax was projected to generate roughly $340 billion in revenue over 10 years.

Though KisanKraft reinvested its earnings in the years after its founding, rather than distributing dividends to shareholders, the tax still applied to the Moores.

The Moores paid, but filed a lawsuit against the federal government to obtain a refund and challenge the constitutionality of the mandatory repatriation tax.

A federal district court ruled for the government and dismissed the case, finding that the mandatory repatriation tax is permitted under the 16th Amendment, which grants Congress the authority to tax “incomes, from whatever source derived.”

The U.S. Court of Appeals for the 9th Circuit upheld the lower court’s decision, ruling that nothing in the Constitution prohibits Congress from “attributing a corporation’s income pro-rata to its shareholders.” The 9th Circuit noted that courts have consistently upheld other similar taxes, and warned that finding the measure unconstitutional would call into question many other long-standing tax provisions.

The Supreme Court affirmed the 9th Circuit’s ruling and found that by 1938, its precedents had established a rule that contradicted the Moores’ argument in their case. That line of prior decisions, Kavanaugh wrote for the court, “remains good law to this day.”

Citing those earlier rulings and the similarities between the mandatory repatriation tax and other tax provisions, the court concluded that the measure “falls squarely within Congress’s constitutional authority to tax.”

Justice Amy Coney Barrett issued a concurring opinion, joined by Justice Samuel Alito, in which she agreed with the outcome of the case, but split with the majority’s reasoning. Addressing the question that was before the court, Barrett said that the 16th Amendment does not authorize Congress to tax unrealized sums without apportionment to the states.

In a dissenting opinion joined by Gorsuch, Thomas said the Moores were correct in challenging the mandatory repatriation tax as unconstitutional. Because the couple never actually received gains from their investment, those unrealized gains couldn’t be taxed as income under the 16th Amendment, he wrote.

“The fact that the MRT has novel features does not mean that it is unconstitutional. But, the MRT is undeniably novel when compared to older income taxes, and many of those differences are constitutionally relevant,” he wrote. “Because the MRT is imposed merely based on ownership of shares in a corporation, it does not operate as a tax on income.”

Thomas criticized the majority over its concerns about the impact a broad decision would have on other longstanding taxes, writing that “if Congress invites calamity by building the tax base on constitutional quicksand, ‘the judicial power’ afforded to this court does not include the power to fashion an emergency escape.”

He also rebuffed the majority’s contention that its ruling does not speak to the constitutionality of other taxes that may be passed by Congress, such as a wealth tax.

“Sensing that upholding the MRT cedes additional ground to Congress, the majority arms itself with dicta to tell Congress ‘no’ in the future,” Thomas wrote. “But, if the court is not willing to uphold limitations on the taxing power in expensive cases, cheap dicta will make no difference.”

During oral arguments in December, the justices seemed sympathetic to concerns about how a sweeping ruling would reverberate across the U.S. tax system and threaten existing tax laws.

But some of the justices sought clarity on the limits of Congress’ taxing power. Lawyers for the Moores had warned the court that allowing a tax on income that has not yet been realized, or received, would pave the way for lawmakers to levy taxes on all manner of things, such as retirement accounts or gains in the value of real estate.

Justice Samuel Alito had faced pressure from some congressional Democrats to recuse himself from the case because of interviews he participated in with an editor at the Wall Street Journal and David Rivkin, a lawyer who represented the Moores.

The justice declined to step aside from the case, arguing there was “no valid reason” for him to do so.

Source: CBS News

News

Trudeau Rocks to Taylor Swift While Montreal Burns

Prime Minister Justin Trudeau has come under fire yet again after a video surfaced on X, showing him dancing at a Taylor Swift performance while anti-Nato protestors ransacked downtown Montreal.

Trudeau attended Taylor Swift’s concert in Toronto on Friday night. Before Taylor Swift approached the stage, X shared a viral video of him dancing and singing along to the song “You Don’t Own Me.”

The image of Trudeau dancing amid violent protests in Montreal generated widespread indignation online. Some social media users even compared Trudeau to the ancient Roman dictator Nero, known for “fiddling while Rome burned.”

Don Stewart, a Member of Parliament (MP) representing part of Toronto, called out the prime minister in a post on X.

Lawless protestors run roughshod over Montreal in violent protest.

The Prime Minister dances.

This is the Canada built by the Liberal government.

Bring back law and order, safe streets and communities in the Canada we once knew and loved. pic.twitter.com/PVJvR6gtmf

— Don Stewart (@donstewartmp) November 23, 2024

“Lawless protesters run roughshod over Montreal in violent protest. The Prime Minister dances,” Stewart wrote. “This is the Canada built by the Liberal government.”

“Bring back law and order, safe streets and communities in the Canada we once knew and loved,” the MP added.

On Saturday, the day after Taylor Swift’s concert, Trudeau condemned the anti-NATO protests, calling them “appalling.”

Anti-NATO activists set off smoke bombs and marched through Montreal’s streets waving Palestinian flags. According to the Montreal Gazette, rioters set fire to automobiles and battled with police.

Pro-Palestinian protests

Protesters also tossed tiny explosives and metal objects at officers. At one point, the mob torched an effigy of Israeli Prime Minister Benjamin Netanyahu. Police used tear gas and batons to disperse the gathering, and three persons were arrested for attacking officers and impeding police operations.

Masked protesters were seen burning flares and bashing storefront windows in videos and photographs shared on social media. Pro-Palestinian protests have been taking place across Canada since the Israel-Gaza conflict began late last year.

Critics have lambasted Trudeau for doing nothing to stop the violent pro-Palestinian marches, with some claiming he has fueled anti-Israel sentiment in Canada.

On Friday, Trudeau stated that Canada would respect the orders of the International Criminal Court (ICC), which issued an arrest warrant for Mr Netanyahu, even if it meant arresting the Israeli prime leader on Canadian soil.

Related News:

Trudeau Called the Greatest Threat to NATO

News

Calgary Zoo Admits Human Error in Death of Baby Gorilla

The Calgary Zoo has admitted in a public statement that a zookeeper’s negligence caused the death of a 2-year-old baby gorilla. Eyare, a newborn gorilla, died last week after being slammed in the head by a hydraulic door.

The accident occurred when a zoo worker attempted to separate Eyare from the rest of the gorilla tribe for a solitary training session.

The gorilla died from significant head injuries, according to the zoo’s statement.

“This tragedy has struck us all in the deepest way imaginable,” Colleen Baird, director of animal care at the Calgary Zoo, said during a news conference. “Eyare’s brief but meaningful existence gave so much joy to our community, and all will sorely miss her. We will do everything possible to prevent repeat accidents.”

According to Baird, the staff member involved was immediately removed from the workplace and will be reassigned to another area of the zoo. The Calgary Zoo stated that it would take preventive steps, such as specialist personnel training and animal behavioral training, to avoid a similar incident.

Calgary Zoo Questioned

It is not the first time an animal at the zoo has died from negligence at the Calgary Zoo. A capybara was accidentally crushed by a hydraulic door similar to the one that killed Eyare in 2019.

An otter died in 2016 after being entangled in an “unauthorized” pair of jeans that a zookeeper had dropped in its enclosure. In 2013, a penguin died in “a freak accident” after swallowing a stick.

Animal Justice, a Canadian group that promotes animal welfare, has called for an independent investigation of animal safety and oversight at the Alberta facility.

“The Calgary Zoo appears to have a higher rate of animal deaths compared to other zoos, and in light of Eyare’s death there should be a systematic review of the zoo’s operations and practices, conducted transparently by the government or another outside party,” according to Camille Labchuk, the executive director of Animal Justice.

The Calgary Zoo refuted that it has more animal deaths than other zoos, emphasizing that it adheres to operating requirements and has maintained accreditation by the Association of Zoos and Aquariums’ independent Accreditation Commission since 1978.

“We love and care for more than 4,000 animals representing over 100 species that call our zoo home,” stated a Calgary Zoo representative.

“Human error-related deaths in animals are quite infrequent. We have lost two animals in the last ten years: a North American river otter in 2016 and ‘Eyare’ this week.

While rare, even one human-caused death is too many. These unfortunate instances have served as vital learning experiences, prompting us to examine and tighten protocols to provide the greatest level of care.”

Baird said at the news conference that using hydraulic doors is “common practice with accredited zoos,” adding that the facility will consider switching to alternate doors to improve safety.

The Calgary Zoo, which established the Wilder Institute in 2021, caters to nearly 4,000 creatures, including six more western lowland gorillas.

Related News:

Beluga Whales Dies at Canada’s Marineland

Outrage Erupts After 17th Beluga Whale Dies at Canada’s Marineland

News

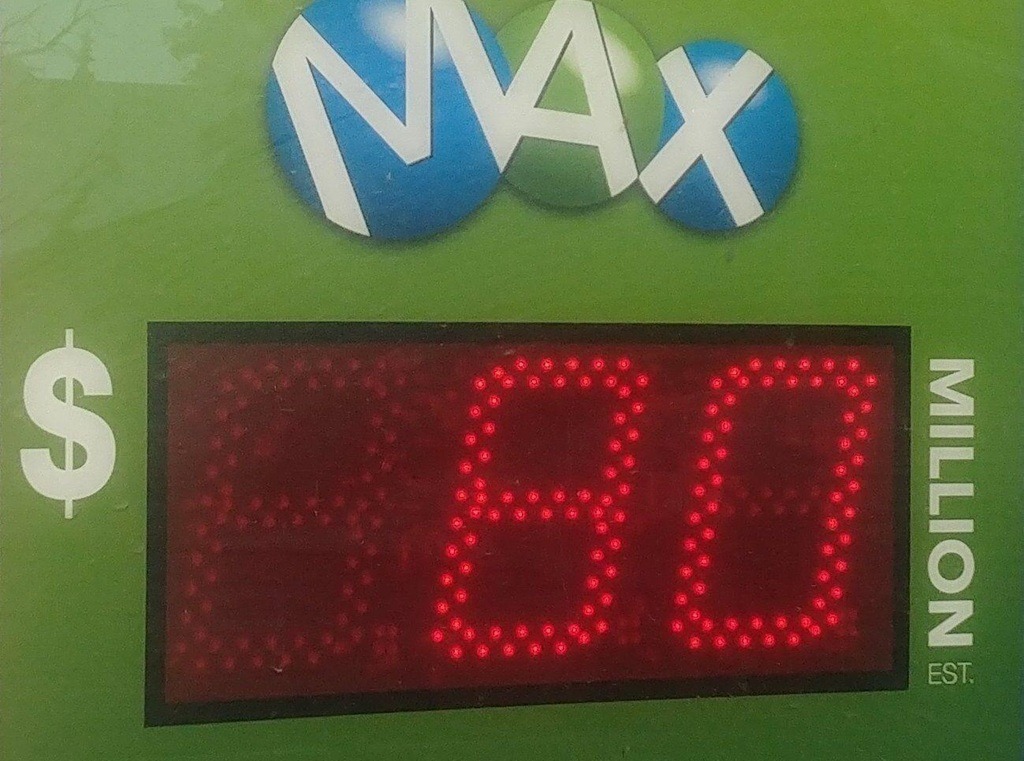

Canada’s Lotto Max jackpot Climbs to $80M

Lotto Max in Canada has reached $80 million for only the second time in Canadian lottery history. Friday’s draw sought a winner for a $75 million pool, but the top reward remained unclaimed as of Saturday, increasing the jackpot.

Only once did the jackpot reach $80 million in September, when it broke the previous record. Before that, the prize was $75 million, a record.

The Lotto Max prize maximum was boosted earlier this year, enabling for jackpots of more than $70 million. The cap is now at $80 million.

While a greater fee may encourage more people to play, the odds of winning the lottery remain extremely low.

According to the Ontario Lottery and Gaming Corporation, the odds for a $5 ticket are around one in 33,294,800.

While there was no jackpot winner in Friday’s draw, someone did match six of the seven winning numbers, plus a bonus, earning them a payout of more than $320,000.

Lotto Max History

Lotto Max is one of three national lottery games in Canada, overseen by the Interprovincial Lottery Corporation. The game was introduced on September 19, 2009, and its inaugural draw occurred on September 25, 2009. It replaced Lotto Super 7.

The odds of winning the Lotto Max are 1 in 33,294,800. This is correct to a point but misleading.

Let’s have a look at the rules:

- Players choose 7 numbers out of 50

- Numbers cannot be repeated

- Numbers are automatically sorted into ascending order

- Each play buys 3 lines

- Each play costs $5

Seeing that players choose 7 out of 50 non-repeating numbers, the equation for the total number of possible combinations (this is different from permutations where the order in which the numbers appear is significant) when playing the Lotto Max is 50! / (7! x 43!)

-

Politics2 weeks ago

Trudeau Orders Facebook to Block Australian Presser Video

-

Business4 weeks ago

Canada CBC News CEO Catherine Tait Recalled to Parliamentary Committee

-

Celebrity4 weeks ago

Shaun White’s Proposal To Nina Dobrev Was Romantic Gold

-

Tech4 weeks ago

Apple Launches The IPhone Into The AI Era With Free Software Update

-

News3 weeks ago

Pro-Khalistanis Sikhs Attack Hindu Temple in Brampton

-

Food4 weeks ago

Starbucks Is Making A Popular Add-On Free Of Charge