Election News

Harris Is Making A ‘Capitalist’ Pitch To Boost The Economy As Trump Pushes Deeper Into Populism

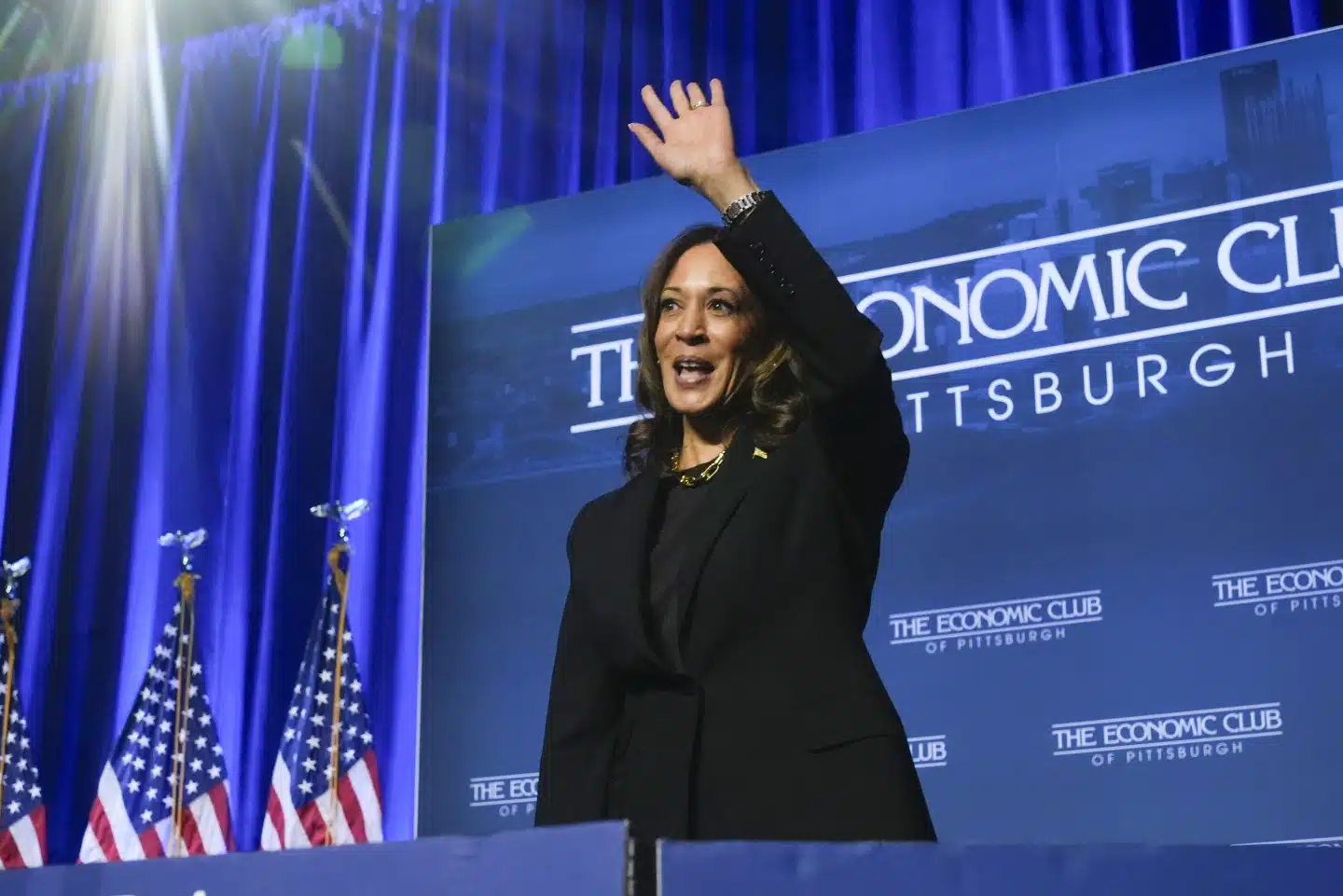

PITTSBURGH — As she pushed back against Republican contender Donald Trump’s charges that she’s advocating “communist” ideals, Vice President Kamala Harris committed on Wednesday to develop an economy that is both pro-business and aids the middle class.

The Democratic nominee stated in remarks at the Economic Club of Pittsburgh in battleground Pennsylvania that she “would take good ideas from wherever they come” as she promised to double the number of people taught in registered apprenticeships and underlined her support for increased home ownership.

“As president, I will be grounded in my fundamental values of fairness, dignity and opportunity,” Harris told the crowd. “And I promise you, I will be pragmatic in my approach.”

Harris Is Making A ‘Capitalist’ Pitch To Boost The Economy As Trump Pushes Deeper Into Populism

A little more than an hour before her address, Trump visited a furnituremaker in Mint Hill, North Carolina, and presented his own competing economic agenda. He defended his proposal for a special lower tax rate for American manufacturers and promised to apply tariffs high enough to result in an “exodus” of auto production employment from Japan, Germany, and South Korea.

“I’m imposing tariffs on your competition from foreign countries, all these foreign countries that have ripped us off, which stole all of your businesses and all of your jobs years ago,” Mr. Trump added.

The two candidates’ dueling remarks demonstrated how they’re polishing their economic messaging for voters in battleground states. Both are attempting to deflect criticism while presenting their best cases to a public nonetheless concerned about the economy’s health. Trump is focused on U.S. dominance over international competitors, whereas Harris emphasizes the significance of assisting the middle class and entrepreneurs.

Harris later spoke with MSNBC and responded to Trump’s request for tariffs, stating, “You don’t just throw around the idea of, just tariffs across the board.” She said of her opponent, “He’s just not serious about very many of these issues.”

In the interview, the vice president also reiterated her desire for higher corporate tax rates, stating, “I’m not mad at anyone for succeeding, but everyone should pay their fair share.”

Those statements came after Harris’ address, which focused on her overall worldview and what she hopes to achieve for the economy. That contrasted with Trump’s, which was more freestyle, including insinuations about an Iranian connection to the two assassination attempts on him.

If elected, the former president promised to reduce the corporation tax rate from 21% to 15% for domestically produced goods. The Republican nominee said that his support for wide tariffs as high as 20% had made him an international target.

“This is why people in countries want to kill me,” he told me. “They’re not happy with me.”

The candidates are each emphasizing the economy at a time when surveys show it to be one of the most important concerns for voters to consider when deciding who to vote for. According to a recent AP-NORC poll, neither candidate has a clear advantage in public opinion on this topic.

Both claim that their respective approaches will do more to ensure that the United States economy, not China’s, dominates the globe in this century. Both are eager to project an image of a tax cutter and accuse the other of supporting enormous tax increases on the middle class. It’s a significant shift in message, as inflation concerns have subsided after the Federal Reserve dropped its benchmark interest rate last week.

Harris rebutted Trump by stating that she is a capitalist who supports a “active partnership between government and the private sector.” It was said that Trump has “no intention to grow our middle class — he’s only interested in making life better for himself and people like himself.”

The Democratic contender intends to provide $100 billion in tax credits and other incentives to boost US manufacturing and emerging technologies, according to a source familiar with her ideas who spoke on the condition of anonymity. She plans to release a pamphlet outlining her economic vision.

In other news, billionaire Mark Cuban stated that he and other business executives support Harris because she has taken thoughtful positions that firms can understand, even if they disagree.

“I want a president who, for business, goes into detail and has a policy team that understands all of the ramifications of what’s been proposed,” Cuban said on a Harris campaign-organized press call Tuesday.

The Harris campaign’s efforts to demonstrate business support have coincided with Trump’s in proposing a slew of populist proposals. In addition to eliminating taxes on tips, Social Security, and overtime pay, Trump wants to limit credit card interest rates to 10% and create low-tax zones on federal lands to attract employers. Trump also wants to repeal the cap on state and local tax deductions, which he enacted into law while president in 2017.

Both candidates perceive an opportunity to criticize each other’s tax proposals. Trump recently called Harris the “tax queen.” She proposes raising the corporation tax rate from 21% to 28%, as well as taxing unrealized capital gains for those worth more than $100 million. She would use the proceeds from that and other programs to extend tax cuts for the middle class that are slated to expire after 2025, as well as to provide new tax benefits to parents and entrepreneurs. Many of her programs are based on concepts originally offered by President Joe Biden.

Trump says that her proposed tax increases will eventually benefit the middle class.

“She’s coming for your money,” he warned a crowd on Monday. “She’s coming for your pensions, and she’s coming for your savings.”

Harris demonstrated that two can play the game. She dubbed his tariff proposal a “national sales tax,” claiming that it would raise the cost of coffee, clothing, electronics, automobiles, and practically anything else that is imported or relies on imported parts.

Her campaign frequently cites an analysis by Brendan Duke of the Center for American Progress, which found that a 20% universal tariff would cost the average household about $4,000 per year. According to calculations based on Treasury Department data, that amount would essentially increase middle-income earners’ overall federal taxes by 50%.

Trump has long portrayed himself as someone who will reduce restrictions, but Harris stated Wednesday that she would do the same because “whether it’s a new housing development, a new factory, or a new bridge, projects take too long to go from concept to reality.”

“China is not moving slowly,” Harris explained. She also stated that she would reform permitting and reduce red tape since “patience may be a virtue, but not when it comes to job creation or America’s competitiveness.”

SOURCE | AP