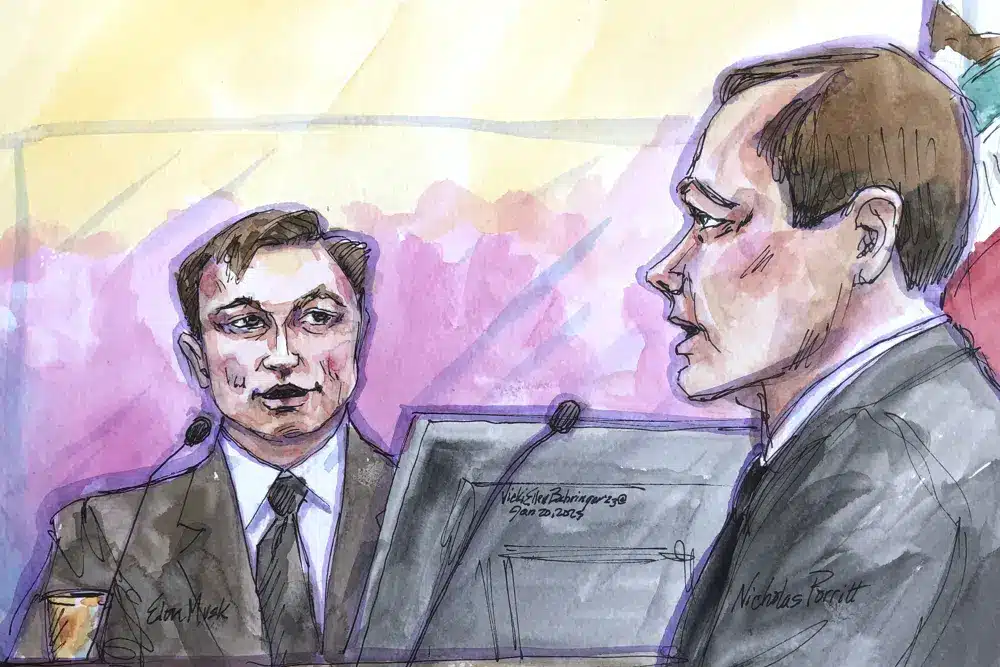

SAN FRANCISCO – Elon Musk returned to federal court in San Francisco on Monday, testifying that during 2018 meetings with representatives from Saudi Arabia’s Public Investment Fund, he believed he had secured financial backing to take Tesla private — though no specific funding amount or price was discussed.

Tesla CEO Elon Musk is facing a class action lawsuit filed by Tesla investors who claim he misled them with a tweet claiming funding was secured to take his electric car company private — for $420 per share.

The tweet resulted in a $40 million settlement with securities regulators after the deal fell through.

The trial hinges on whether Musk’s Aug. 7, 2018, tweets harmed Tesla shareholders during the 10 days preceding Musk’s admission that the buyout he had envisioned would not take place.

Musk Not At His Peak For Trial

In a soft, halting tone, Musk said Monday that he “had trouble sleeping last night, and unfortunately, I am not at my best.” He said jurors should know that he “felt that funding was secured” because of his ownership of “SpaceX stock alone.”

“I didn’t want to sell Tesla stock to buy Twitter, but I did sell Tesla stock,” he said of the stock sale to compensate for the lack of funding from other sources for his $44 billion deal to take Twitter private. Musk sold nearly $23 billion in shares of his car company between April when he began building a position on Twitter and December.

“My SpaceX shares alone would have ensured funding,” Musk said of the 2018 tweets.

Even before Musk took the stand on Friday, U.S. District Judge declared that jurors could consider those two tweets false, leaving them to decide whether Musk purposefully misled investors and whether his statements caused them to lose money.

Musk previously claimed that he entered into the SEC settlement under duress and thought he had secured financial backing for a Tesla buyout during meetings with representatives from Saudi Arabia’s Public Investment Fund.

Musk Stepped Down As Tesla’s Chairman

Musk stated in the first of the 2018 tweets that “funding secured” for a $72 billion — or $420 per share — buyout of Tesla was still dealing with production issues and was worth far less than it is now. Musk responded a few hours later with another tweet implying that a deal was imminent.

A lawyer for Tesla shareholders, Nicholas Porritt, asked Musk if he “went with 420 because it was a joke your girlfriend enjoys.” Musk responded that he believes there is “some karma” surrounding the number 420, a slang reference to marijuana, but he doesn’t know “whether it’s good karma or bad karma at this point.”

He later stated that the figure was a “coincidence” and represented a 20% premium over Tesla’s share price at the time.

As part of the Securities and Exchange Commission settlement, Musk stepped down as Tesla’s chairman while remaining CEO after it became clear that the funds to take Tesla private were unavailable.

SOURCE – (AP)