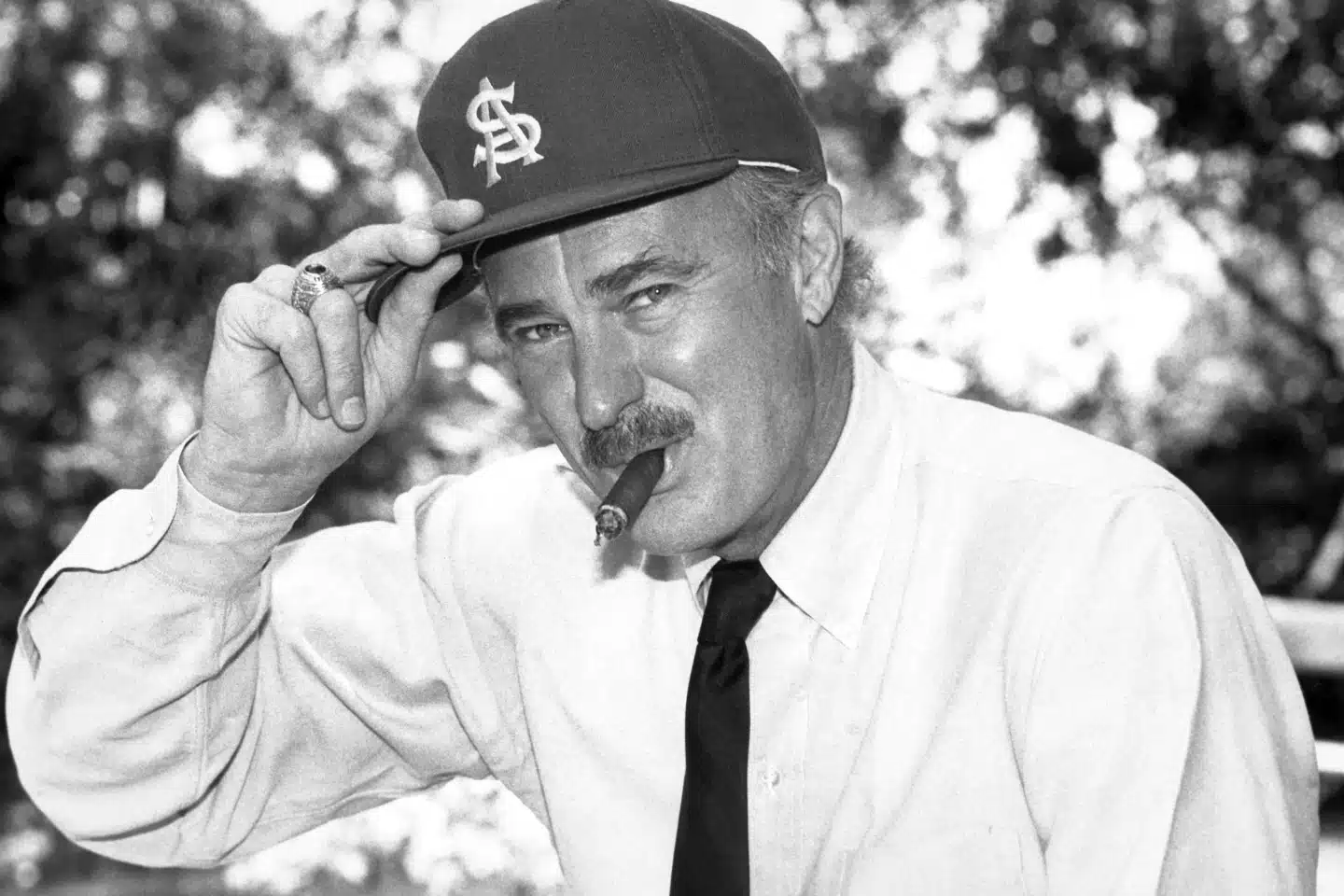

NEW YORK — Dabney Coleman, the mustachioed character actor who played smarmy villains like the chauvinist boss in “9 to 5” and the cruel TV director in “Tootsie,” has died. He was 92.

Coleman died Thursday at his Santa Monica home, according to his daughter, Quincy Coleman, who spoke with The Associated Press. She stated that he “took his last earthly breath peacefully and exquisitely.”

“The great Dabney Coleman developed, or defined, in a unique way, an archetype as a character actor. “He was so good at what he did that it’s difficult to imagine movies and television in the last 40 years without him,” Ben Stiller wrote on X.

Dabney Coleman, Actor Who Specialized In Curmudgeons, Dies At 92

Coleman worked as a talented but underappreciated actor in films and television shows for two decades. That changed dramatically in 1976 when he was cast as the incorrigibly corrupt mayor of Fernwood’s Hamlet in “Mary Hartman, Mary Hartman,” a satire soap opera so outrageous that no network would air it.

Producer Norman Lear was ultimately able to syndicate the show, which starred Louise Lasser in the titular character. It rapidly became a cult favorite. Coleman’s role, Mayor Merle Jeeter, was particularly popular, and film and television executives noted his brilliant, humorous deadpan delivery.

Coleman, a six-footer with an enormous black mustache, went on to make his mark in other blockbuster films, including roles as a stressed-out computer scientist in “War Games,” Tom Hanks’ father in “You’ve Got Mail,” and a firefighting official in “The Towering Inferno.

He received a Golden Globe for “The Slap Maxwell Story” and an Emmy Award for best supporting actor in Peter Levin’s 1987 small-screen legal thriller “Sworn to Silence.” Some of his most recent credits include “Ray Donovan” and a regular part in “Boardwalk Empire,” for which he received two Screen Actors Guild Awards

In the revolutionary 1980 smash “9 to 5,” he played the “sexist, egotistical, lying, hypocritical bigot” employer who harassed his underappreciated female subordinates — Jane Fonda, Lily Tomlin, and Dolly Parton — until they turned the tables on him.

In 1981, he played Fonda’s kind, well-mannered lover, who asked her father (played by her real-life father, Henry Fonda) whether he could sleep with her during a visit to her parents’ holiday house in “On Golden Pond.”

In Tootsie, opposite Dustin Hoffman, Coleman played the unpleasant director of a daytime soap opera that Hoffman’s character joins by pretending to be female. Coleman’s other films included North Dallas Forty, Cloak and Dagger, Dragnet, Meet the Applegates, Inspector Gadget, and Stuart Little. He reconnected with Hoffman as a land developer in Brad Silberling’s Moonlight Mile, starring Jake Gyllenhaal.

Coleman’s arrogant roles didn’t transition so well to television, where he appeared in a few network comedies. Although some became cult favorites, just one lasted more than two seasons, and some critics questioned if a show with a lead character with no redeeming characteristics could appeal to a large audience.

“Buffalo Bill” (1983-84) was an excellent example. Coleman played “Buffalo Bill” Bittinger, the smarmy, arrogant, dimwitted daytime talk show presenter who, dissatisfied with his relegation to the small-time market of Buffalo, New York, takes it out on everyone else. Despite being cleverly written and containing a strong ensemble cast, it only lasted two seasons.

Another was 1987’s “The Slap Maxwell Story,” in which Coleman played an unsuccessful small-town columnist attempting to repair his marriage while also wooing a gorgeous young reporter.

Dabney Coleman, Actor Who Specialized In Curmudgeons, Dies At 92

Other failed attempts to get a large TV audience were “Apple Pie,” “Drexell’s Class” (in which he portrayed an inside trader), and “Madman of the People,” a newspaper show in which he clashed with his younger employer, who was also his daughter.

He performed better in a co-starring role in The Guardian (2001-2004), when he played the father of a corrupt lawyer. He also liked his part as Principal Prickly in the Disney cartoon series Recess from 1997 to 2003.

Underneath all the bravado was a quiet individual. Coleman stated he was quite shy. “I’ve been shy my whole life. Perhaps it derives from being the last of four gorgeous children, including a sibling who resembled Tyrone Power. “Maybe it’s because my father died when I was four,” he told the Associated Press in 1984. “I was incredibly little, a little man there, the youngster who never caused trouble. I was drawn to fantasy; therefore, I made games for myself.”

As he grew older, he began to leave his stamp on pompous authority figures, most notably in 1998’s “My Date With the President’s Daughter,” in which he played not only an egotistical, self-absorbed president of the United States but also a dumb father to a teenage girl.

Dabney Coleman—his real name—was born in 1932 in Austin, Texas. After two years at the Virginia Military Academy, two at the University of Texas, and two in the Army, he was a 26-year-old law student when he met Zachry Scott, an Austin resident who appeared in “Mildred Pierce” and other films.

Dabney Coleman, Actor Who Specialized In Curmudgeons, Dies At 92

“He was the most vibrant guy I had ever met. He convinced me to become an actress, and I went to study in New York the next day. “He didn’t think that was very wise, but I made my decision,” Coleman told The Associated Press in 1984

Early credits include television shows like Ben Casey, Dr Kildare, The Outer Limits, Bonanza, The Mod Squad, and The Towering Inferno. He made his Broadway debut in 1961 with the play A Call on Kuprin. He played Kevin Costner’s father in the film Yellowstone.

The four children Coleman had—Meghan, Kelly, Randy, and Quincy—as well as his grandchildren Hale and Gabe Torrance, Luie Freundl, and Kai and Coleman Biancaniello—survived him. Coleman had two divorces.

“My father crafted his time here on earth with a curious mind, a generous heart, and a soul on fire with passion, desire and humor that tickled the funny bone of humanity,” Quincy Coleman wrote in his memory.

SOURCE – (AP)