Business

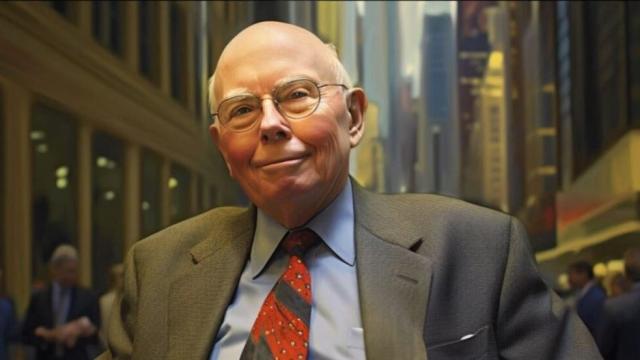

Charlie Munger, Who Helped Warren Buffett Build Investment Powerhouse Berkshire Hathaway, Dies At 99

OMAHA, Nebraska – Charlie Munger, who assisted Warren Buffett in transforming Berkshire Hathaway into an investment juggernaut, died in a California hospital. He was 99.

Berkshire Hathaway confirmed in a statement that Munger died Tuesday morning at the hospital, just over a month before his 100th birthday.

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett said. The legendary investor also paid respect to Munger in his annual letter to Berkshire shareholders earlier this year.

Munger acted as Buffett’s sounding board for investment and business choices and helped run Berkshire Hathaway for more than five decades as its vice chairman.

Charlie Munger, Who Helped Warren Buffett Build Investment Powerhouse Berkshire Hathaway, Dies At 99

Munger had needed a wheelchair for years to move around, but he had stayed mentally alert. That was evident as he handled hours of questions at the annual meetings of Berkshire Hathaway and the Daily Journal Corp. earlier this year and in recent interviews with an investing podcast, The Wall Street Journal, and CNBC.

Munger liked to remain in the shadows and let Buffett be the face of Berkshire Hathaway, and he frequently downplayed his contributions to the company’s extraordinary success.

On the other hand, Buffett has always credited Munger for pushing him beyond his early value investing tactics to acquire wonderful businesses at low prices, such as See’s Candy.

“Charlie has taught me a lot about valuing businesses and human nature,” Buffett stated in 2008.

Buffett’s early success was founded on lessons learned from former Columbia University professor Ben Graham. He would buy stock in companies selling for less than their assets were worth and then sell the shares when the market price rose.

Munger and Buffett began purchasing Berkshire Hathaway stock in 1962 for $7 and $8 per share, respectively, and bought ownership of the New England textile factory in 1965. Over time, the two brothers molded Berkshire into its current conglomerate by reinvesting profits from its businesses in companies such as Geico Insurance and BNSF Railroad. They also kept a high-profile stock portfolio, including big Apple and Coca-Cola stakes. The stock reached $546,869 on Tuesday, and many investors became wealthy by holding on to it.

Munger gave a lengthy interview to CNBC earlier this month in anticipation of his 100th birthday, and the business network aired parts from that discussion on Tuesday. In his characteristically self-deprecating tone, Munger summarized Berkshire’s achievement as avoiding mistakes and working well into his and Buffett’s 90s.

“We got a little less crazy than most people and a little less stupid than most people and that really helped us,” remarked Munger. In a special letter he published in 2014 to commemorate 50 years of helping manage the company, he went into greater depth on the reasons for Berkshire’s success.

Charlie Munger, Who Helped Warren Buffett Build Investment Powerhouse Berkshire Hathaway, Dies At 99

Buffett and Charlie resided more than 1,500 miles (2,400 kilometers) apart for their collaboration, but Buffett stated he would phone Munger in Los Angeles or Pasadena to confer on every major decision he made.

“Many will miss him, perhaps none more than Mr. Buffett, who relied heavily on his wisdom and counsel.” I envied their friendship. “They challenged each other while also seeming to enjoy each other’s company,” Edward Jones analyst Jim Shanahan said.

Berkshire would probably do fine without Charlie, according to CFRA Research analyst Cathy Seifert, but there is no way to replace the role he served. After all, Munger was one of the few people ready to tell Buffett he was incorrect about something.

“The most pronounced impact, I think, is going to be over the next several years as we see Buffett navigate without him,” he said.

Charlie grew raised in Omaha, Nebraska, only five blocks from Buffett’s current home, but because Munger is seven years older, the two men never met as youngsters, even though both worked at the grocery shop owned by Buffett’s grandfather and uncle.

When the two men met at an Omaha dinner party in 1959, Munger was a Southern California lawyer, and Buffett headed an investing business in Omaha.

Buffett and Munger hit it off right away, according to the biography in the canonical book on Munger, “Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger.”

During the 1960s and 1970s, the two men traded investment ideas and occasionally invested in the same companies. They became the two largest shareholders in one of their mutual investments, trading stamp maker Blue Chip Stamp Co., and purchased See’s Candy, the Buffalo News, and Wesco. Munger was appointed vice chairman of Berkshire Hathaway in 1978 and chairman and president of Wesco Financial in 1984.

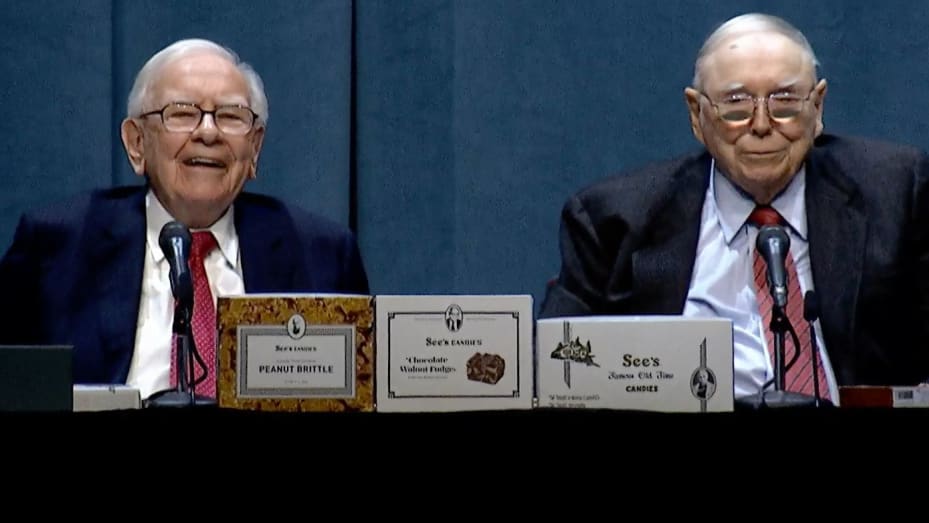

Berkshire’s legions of devoted shareholders who frequently filled an Omaha arena to hear the two men will recall Munger’s curmudgeonly comments when addressing questions alongside Buffett at the annual meetings.

Charlie was well-known for saying, “I have nothing to add” after several of Buffett’s lengthy responses at Berkshire meetings. However, Munger frequently provided crisp responses that cut to the heart of an issue, such as his advice on finding a solid investment in 2012.

“If it’s got a really high commission on it, don’t bother looking at it,” he told me.

Whitney Tilson, an investor, has attended the Berkshire Hathaway annual meetings for the past 26 years to learn from Charlie and Buffett, who shared life lessons and investing advice. Tilson stated that Charlie taught that after attaining some success, “your whole approach to life should be how not to screw it up, how not to lose what you’ve got” because reputation and integrity are the most valuable assets and can be lost in an instant.

“In the investment world, it’s the same thing is in your personal world, which is your main goal should be avoiding the catastrophic mistakes that could destroy an investment record, that can destroy a life,” he stated.

“Charlie has taught me a lot about valuing businesses and human nature,” Buffett stated in 2008.

Munger famously summarized the counsel, “All I want to know is where I’m going to die so (that) I never go there.”

Munger was well-known for being an avid reader and student of human behavior. He used several models from fields such as psychology, physics, and mathematics to evaluate potential investments.

Munger attended the University of Michigan in the 1940s but dropped out to serve as a meteorologist in the Army Air Corps during WWII.

He then acquired a law degree from Harvard University in 1948 despite having yet to complete an undergraduate degree. He co-founded a legal practice in Los Angeles that carries his name today, but he quickly realized that he preferred investing.

At one point, Charlie had a fortune of more than $2 billion and was named one of the wealthiest Americans. Munger’s fortune dwindled over time as he gave away more of it, but the ever-increasing value of Berkshire’s stock kept him affluent.

Munger has greatly contributed to Harvard-Westlake, Stanford University Law School, the University of Michigan, and the Huntington Library, among others. After his wife died in 2010, he also left much of his Berkshire stock to his eight children.

Charlie also served on the boards of Good Samaritan Hospital and the Los Angeles-based private Harvard-Westlake School. Munger also served on the board of Costco Wholesale Corp. and as chairman of the Daily Journal Corp. for many years.

SOURCE – (AP)