Finance

Canada’s Household Debt Nears $3 Trillion Under Trudeau

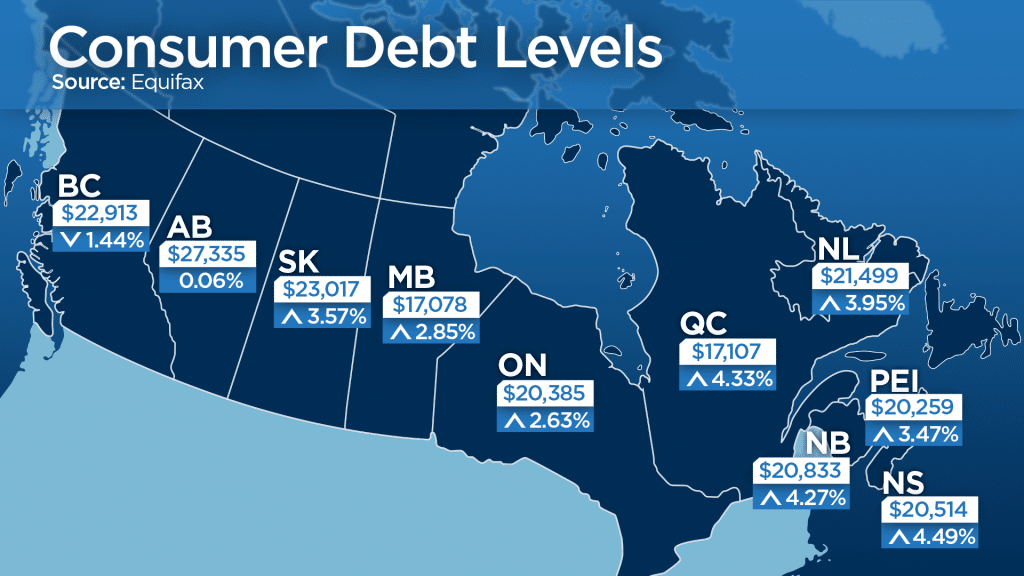

With the cost of living consistently on the rise, more Canadians are continually turning to credit. Canadian’s owe more debt relative to their income than they did before Justin Trudeau and his liberals came to power in 2015.

Many Canadians are on the verge of going bankrupt due to increased debt carrying costs, living expenses, and concerns about the possibility of further interest rate and price increases.

Higher interest rates may have deterred Canadians from borrowing, but they remain optimistic. I’m hoping that interest rates will be reduced and the debt they’re collecting will become more affordable.

According to Bank of Canada data, household credit increased in February and has accelerated slightly since then. This raises some concerns for the country, which is already experiencing slowing economic growth as a result of its enormous debt levels.

Canadian households have recently reduced their borrowing, yet they have nonetheless accrued a significant amount of debt. Household debt increased by 0.3% (+$10.1 billion) to $2.94 trillion in February.

This boosted yearly growth to 3.4% (+$96.1 billion), marking the fourth consecutive month of acceleration.

Canadians Under Mountains of Household Debt

The roughly $3 trillion in debt sounds monstrous, and it is. Between March 2020 and the most recent figures, consumers added $541 billion to their debt load. After just under four years, accumulation was 50% faster than in the years prior rate reduction.

According to the most recent data, Canada’s household debt-to-GDP ratio was around 132% in February. Statistics Canada announced Wednesday that Canada has the highest household debt-to-disposable income ratio of any G7 countries.

According to Canada’s 2023 Financial Stress Index, money is the top stressor for Canadians, with 40% citing it as their primary source of stress, surpassing personal health, relationships, and job for the sixth year in a row.

And financial problems are affecting people’s quality of life and sleep.

Leger’s poll of more than 2,000 Canadians discovered that 48% of adults had lost sleep and 36% have experienced mental health issues as a result of financial stress. Nearly half of poll respondents (48%) reported having less disposable income than a year ago.

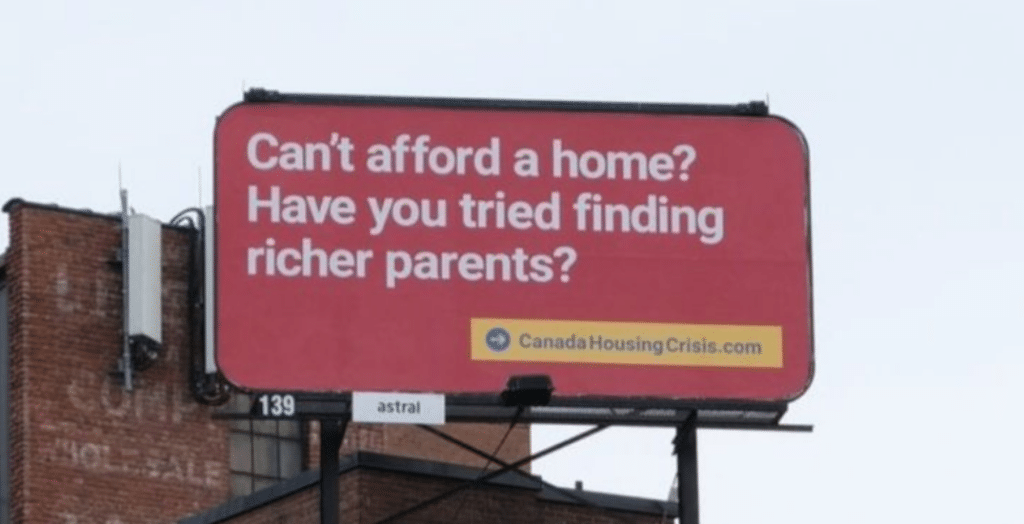

According to writer and political commentator David Moscrop, Canada’s housing problem is unprecedented, and half the country lives paycheck to paycheck.

In a classic example of disconnect, some Trudeau Liberals believe the party’s biggest problem is that people don’t realize how terrific a job they’re doing.

According to Moscrop, half of the country is living paycheck to paycheck, suffering from crippling debt, and dealing with a housing and homelessness crisis, while working families are increasingly reliant on food banks to get by.

Inflation and Interest Rates Rising

More than half of Canadians feel their personal finances are worse now than they were in 2015, when Prime Minister Justin Trudeau campaigned on a promise to support the middle class and those aspiring to it.

A jump in inflation, and the interest-rate hikes intended to combat it, have pinched deeply indebted Canadians, who have also stated that the high cost of living is the most important factor influencing how they intend to vote.

According to a Nanos Research study for Bloomberg News, 53% of people say their personal finances are worse now than they were eight years ago, while 24% say they are better off and 21% say nothing has changed.

Those aged 35 to 54 were the most likely to be experiencing financial difficulties, with 61% reporting a worsening situation.

The poll explains why Trudeau’s government is finishing the year with low ratings. “When the economy is flat and people are concerned about paying their bills, they become agitated and seek to punish the incumbent government,” said Nik Nanos, the polling firm’s chief data scientist. “If you are struggling to pay for housing or the groceries, you might think, ‘What do I have to lose with a change in government?'”

If an election were conducted today, over 45% of Canadians indicated the cost of living, including housing, groceries, and energy costs, would be the most important factor influencing their vote. The environment (14%) and health care (12%) are next on the list.

Between November 30 and December 2, Nanos conducted a telephone and online poll of 1,069 Canadians. The margin of error is 3 percentage points (19 times out of 20).

Soaring Inflation in Canada

In Canada, inflation is certainly easing. It remained constant at 3.1% annually in November, down from 8.1% in June 2022. While this is improvement, it is cold consolation for some Canadian households, which have experienced one of the most precipitous declines in purchasing power in history.

According to Bloomberg calculations, Canada’s consumer price index is 10% higher than it would have been if inflation had remained at its pre-pandemic pace. Shelter and food inflation are both roughly 14% higher.

Prices rose at an annual rate of roughly 1.8% during the time the Bank of Canada introduced inflation targeting in the early 1990s and 2020.

According to the central bank, property prices in Canada have not been this high since the early 1980s.

Though an election isn’t due until 2025, Trudeau’s biggest adversary, Conservative Leader Pierre Poilievre, has launched campaign-style advertising attacking the prime minister for rising housing, food, and energy costs. “After eight years, Justin Trudeau is not worth the cost,” Poilievre frequently states.

Majority of Canadians Can’t Afford a Home

Despite a rush of affordability announcements from Trudeau’s Liberals, including a $4-billion fund for cities to develop housing and competition-law revisions aimed at decreasing supermarket prices, most polls place the Tories roughly 10 points ahead.

“The Conservative party continues to vote against funding for housing,” Trudeau said Thursday in Toronto, where he unveiled $471 million to accelerate home building. “If it were up to them, we wouldn’t be here today.” But our Liberal strategy is to collaborate with municipalities. Our strategy is to invest in individuals. It is to invest for the future.”

Trudeau is not alone in facing an angry electorate frustrated by the loss of purchasing power. Many US voters do not appear to be buying President Joe Biden’s economic message, despite the fact that price rises have slowed since last year.

“Inflation kills governments,” said Mike Moffatt, senior policy director at the Smart Prosperity Institute and Trudeau’s former economic adviser from 2013 to 2015.

Moffatt stated in an interview that U.S. President Jimmy Carter lost his campaign for a second term by a landslide in 1980 when the Federal Reserve aggressively raised interest rates to combat inflation.

In the midst of recent price increases, voters in Australia and New Zealand ousted their incumbent administrations, and the ruling Conservative Party in the United Kingdom is now polling poorly.

“There is unrest. “People see costs going up and up, but they don’t see their paychecks going up,” he said. “It’s going to be a very difficult thing for the federal government to deal with because so many of these factors are global in nature.”