News

Canada’s Housing Bubble Could Spell Disaster for Trudeau

According to experienced strategists, Canada’s housing market is in danger of collapsing since it has one of the greatest housing bubbles in history. The degree of debt that Canadians have taken on in contrast to their earnings has left many in a perilous situation if mortgage rates continue to climb, which is likely, according to Phillip Colmar, partner at MRB Partners, in an interview on Tuesday.

“Canada is probably sitting on the largest housing bubble of all time,” he said.

Colmar suggested that inflated housing prices in Canada are a result of the Bank of Canada’s monetary policy providing easy money for two decades for a variety of reasons. Currently, he sees risk in mortgage rates rising as Canadian bond yields rise, especially at a time when debt-to-income ratios are sky high.

“The worst part for a housing bubble is when you have [a] credit bubble underneath it,” Colmar cautioned. The amount of Canadian indebtedness in the system against income is tremendous — and debt servicing has increased dramatically.”

While Canadian banks are doing their lot to keep the property market from collapsing, Colmar predicts it will.

There is clearly a risk that if mortgage rates rise, unemployment rises, or we enter the next recession, this thing will wind up in a deleveraging cycle, he added.

Trudeau Hasn’t Helped in Canada’s Soaring Housing Cost

The rising cost of housing in Canada has become a key electoral issue for Prime Minister Justin Trudeau, as his main opponent focuses on generational frustrations over affordability.

This summer, Trudeau has played defence on the problem, naming a new housing minister and diverting some of the burden to other levels of government. However, with Trudeau’s party already slipping in recent surveys, housing has become a serious vulnerability for him.

“Failure to appear to be doing enough on housing could be politically disastrous for the Liberals,” David Coletto, CEO of polling firm Abacus Data told Bloomberg.

The issue is especially crucial for Canadians under 40, a critical group that Trudeau’s party could not have won the last two elections without, according to Coletto. His firm’s most recent survey showed Pierre Poilievre’s Conservatives leading the Liberals by ten points.

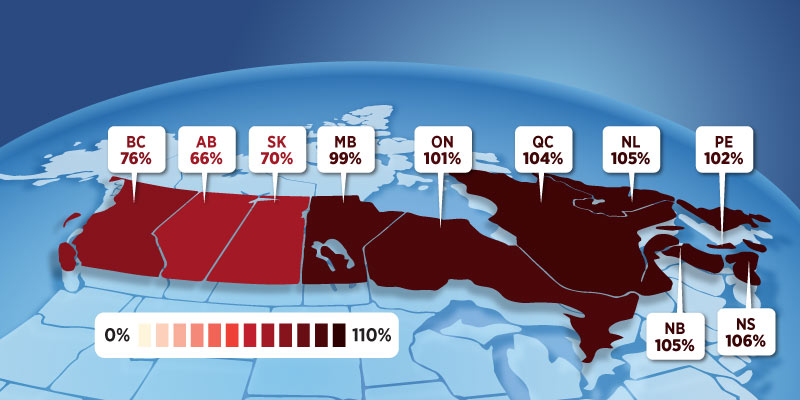

The average price of a home in Canada has more than quadrupled in the last decade, reaching $760,600 (US$572,470) in June. Trudeau’s government, which took office in 2015, has also steadily increased yearly immigration targets, with more than one million people coming last year, putting a strain on an already scarce housing supply.

Poilievre has pounded Trudeau on the issue, concentrating on young people’s rage. He told reporters outside the Parliament building in Ottawa on Tuesday that Canada’s home affordability is among the worst in the world.

“Rent has more than doubled,” he remarked. “Mortgage payments have doubled.” Down payments were required and doubled. All of this comes after eight years of Justin Trudeau.”

To be fair, rising housing costs have many causes outside of Trudeau’s control. Provinces and cities, which are in charge of land-use planning, zoning, and permitting, are to fault, as are real estate investors, overseas buyers, years of low loan rates, and other issues.

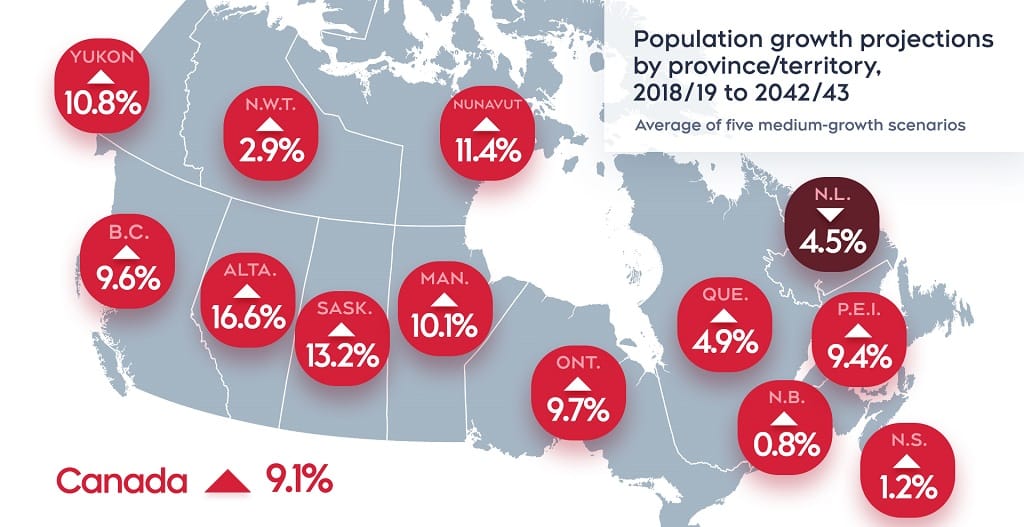

Nonetheless, Canada’s aggressive immigration ambitions have outpaced housing construction, exacerbating the demand-supply imbalance. In the year to March, 4 to 5 international migrants landed in Canada for every new unit of housing construction that began. That is the highest ratio of new Canadians to new residences in statistics dating back to 1977.

Poilievre, on the other hand, dodged reporters’ inquiries on whether he will lower immigration targets on Tuesday.

Former Liberal member Adam Vaughan, who assisted in the development of Trudeau’s $82 billion national housing policy, said that the country is better off now than it would have been without his party’s policies. He claims that if the government had done nothing, federal spending on social housing would have been merely $1 billion this year.

More needs to be done, he says, and time would be better spent concentrating on solutions across levels of government rather than laying blame. Trudeau’s remark on Monday that housing is not a fundamental federal priority was “problematic,” according to Vaughan.

“It is a responsibility of the federal government, if not literally, then politically, and I would argue that it is morally,” said Vaughan, who now works at public relations firm Navigator.

According to Mike Moffatt, senior policy and innovation director at the Smart Prosperity Institute, the federal government has a number of instruments at its disposal to address the housing shortfall without increasing its debt.

These approaches include focusing immigration policy on construction workers, electricians, and others who could help increase housing supply, as well as postponing international student visa approvals until provinces order universities to provide additional accommodation for them.

If the government does act, “they had better act quickly because time isn’t on their side, and there’s a chance that one of the opposition parties could really start to own this issue,” Moffatt said.

Former Trudeau policy director Marci Surkes believes the government is working on a housing strategy as a core component of its fall budget update.

“This is ground that the Liberal Party should be occupying and owning,” said Surkes, who currently works as an adviser for the Compass Rose Group. “At this point, they should have been making more tangible progress.” And yet, given the economic circumstances, whatever progress has been made to date does not feel sufficient.”

The New Democratic Party’s Jagmeet Singh, whose party has agreed to support the Liberal minority government in Parliament, said on Tuesday that Trudeau’s “finger-pointing” will not fix the housing crisis, despite the fact that all levels of government bear some responsibility.

“We can’t ignore the significant levers that the federal government has,” he remarked. “The levers are so significant that I would say the federal government has incredible powers to actually solve this problem if they choose to do so.”