Tariffs are posing a growing threat to Canada’s economy, increasing the likelihood that the Bank of Canada will continue lowering interest rates. Experts say the uncertainty around tariffs—such as their timing, scale, and impact—combined with domestic economic trends, could force multiple rate cuts this year to help the central bank handle these challenges.

Since June, the Bank of Canada has cut its overnight interest rate six times, bringing it down from 5% to 3%. While recent signs of economic recovery raised the possibility of a pause in cuts, ongoing trade tensions, particularly with the United States, have made that less likely.

Mackenzie Investments strategist Dustin Reid told Morning Star he believes more cuts are on the way. “The Bank is likely to lower rates to its neutral range of 2.25% this year,” he says. If tariffs escalate significantly, the rate could drop as low as 1.5%, he adds.

How Much Will the Bank of Canada Cut Rates

In January, the Bank of Canada hinted at a potential pause in rate cuts. However, recent developments on tariffs suggest that pausing anytime soon may not be realistic, according to Jimmy Jean, Desjardins Group’s chief economist.

Earlier this year, US President Donald Trump announced new tariffs on Canadian goods, only to postpone some of them shortly after. He later imposed a 25% tax on Canadian steel and aluminum, effective March 12.

Jean predicts widespread duties could be introduced this spring, though he doubts such high tariffs would last long. “If the US opts for smaller, short-term tariffs, the Bank might cut rates to around 2% by mid-year,” he says. But if harsher measures are in place longer, Jean warns deeper cuts may follow.

The Bank of Canada ended 2024 with two consecutive 50-basis-point cuts, followed by a smaller 25-point cut in January. Ratehub mortgage expert Penelope Graham expects at least two more moderate cuts this summer, even if Canada avoids heavy tariffs.

“Without additional tariffs, the data supports one more cut after March 12, assuming inflation stays near 2% and job growth holds steady,” she explains.

Canadian policymakers are also keeping an eye on US economic trends, as the Federal Reserve appears less likely to lower its rates this year. “The Bank of Canada will try to avoid creating a much wider gap with the Fed’s rates,” Graham says, though she acknowledges that trade negotiations could quickly change the situation.

A Mixed Forecast for Canada’s Economy in 2025

As Canada’s largest trade partner, the US has a significant influence on the country’s economic outlook. Ongoing trade disputes with Washington have created uncertainty, and Jean points to the unpredictable nature of US trade policy as a major risk.

Canada’s economic growth will largely depend on how trade policies evolve. “With trade and fiscal policies likely shifting throughout the year, the Bank’s growth forecast leans slightly negative,” says Reid.

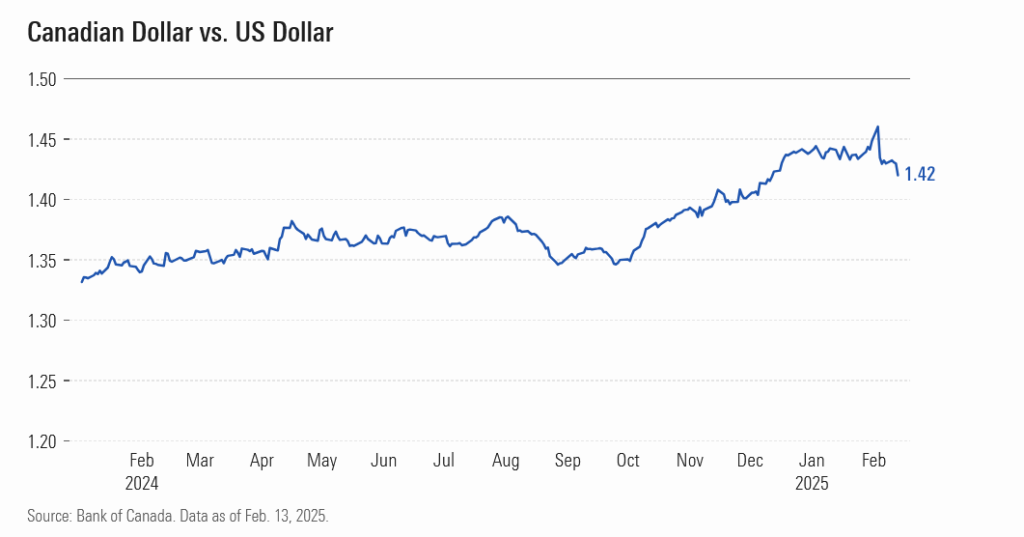

A weaker Canadian dollar is adding to the challenges. “We’re likely to see more downward pressure on the loonie due to tariff concerns and differing rate policies between Canada and the US,” Graham explains.

Graham also highlights other factors affecting growth, including slower immigration and low productivity, which she says will remain key issues this year, even without the added strain of tariffs and rising inflation.

Factors Driving Rate Cut Decisions

Beyond trade issues, the Bank will consider a range of economic factors, such as inflation, employment, consumer spending, and the housing market. The Bank’s latest projections estimate an average economic growth rate of 1.8% this year and next.

“They’re watching how the economy responds to past rate cuts,” Graham says. “Labour market strength, currency trends, and overall growth will all play a role in their decisions.”

The real estate market is also a factor. “The Bank is monitoring housing closely,” says Jean. “While Toronto is still struggling, other markets are heating up due to lower rates.”

Any effects from US tariffs, retaliatory measures by Canada, and their impact on inflation and employment will also shape the Bank’s policy.

What This Means for Consumers and Investors

For Canadians, lower rates mean cheaper borrowing costs, but the benefits could be overshadowed by job losses or financial strain. “Rates will likely drop further this year, with or without tariffs,” says Graham. However, she warns this won’t help much if people start losing jobs and can’t manage their debt.

Experts advise caution when taking on new debt. “Borrowers need to think carefully about their risk tolerance, especially when choosing between fixed and variable mortgages,” Graham explains.

With no clear outcome on tariffs or potential policy changes, analysts recommend preparing for the worst while staying hopeful.

The Bank of Canada can’t prevent economic challenges but can help ease the adjustment process. “Whether it’s the uncertainty now or a trade shock later, the Bank’s role is to support the economy,” Jean says. If a 25% tariff becomes reality, a recession is possible. However, Jean believes it wouldn’t be as severe as the one caused by the COVID-19 pandemic.

The bigger risk lies in long-term structural damage. “Some businesses would struggle to survive unless they find new markets,” Jean warns. “Adjusting to such changes would take time and be difficult, but Canada’s strengths in energy and critical minerals give it some competitive edge in global markets.”