Business

Trudeau Loses His Mind Over Bell Canada Cutting 4,800 Media Jobs

Bell Canada Enterprises has announced plans to reduce 9% of its staff, or 4,800 positions, in a historic and unprecedented mass layoff.

In addition to the layoffs, Bell announced that it will sell 45 radio stations, close over 100 The Source stores, and discontinue most of its midday and weekend newscasts.

The current round of layoffs comes after Bell eliminated 1,300 positions just eight months ago in June 2023, but it has continued an annual cycle of cuts from within the telecom behemoth, citing declining ad income and losses at CTV News and BNN Bloomberg.

Bell CEO Mirko Bibic stated that the company’s news activities are losing approximately $40 million per year, and ad revenues have plummeted by $140 million in 2023 compared to the previous year.

Bell’s layoffs follow CBC and Radio-Canada’s decision to lay off 600 employees and cancel some programmes in December to help cover a $125-million budget shortfall.

Shortly after the announcement, Canadian Liberal Prime Minister Justin Trudeau stated that he was “furious” with Bell’s plan to reduce jobs and programmes in its media sector.

Trudeau expressed deep frustration with the cuts as his administration attempts to dominate the media narrative by restricting conservative media under a proposed Online Harms Act.

“This is a garbage decision by Bell Canada, a corporation that should have known better,” Trudeau told reporters.

“Over the past years, corporate Canada — and there are many culprits on this — have abdicated their responsibility towards the communities that they have always made very good profits off of.”

Bell Canada didn’t immediately reply to Trudeau’s comments.

When announcing the changes on Thursday, Bell Canada blamed the Trudeau administration. The business said it was cutting back on capital spending and slowing down the construction of its fibre-optic network, citing Trudeau’s policies, such as a regulatory decision last year that would force it to open up its broadband networks to smaller rivals at set prices.

Bell CEO Mirko Bibic stated that we must take additional measures in response to the Trudeau government’s increasingly unsupportive regulatory policies, legacy business reductions, and a macroeconomic climate characterised by higher interest rates and ongoing inflation.

Bell Canada plans to save up to C$200 million (US$149 million) this year through workforce reductions.

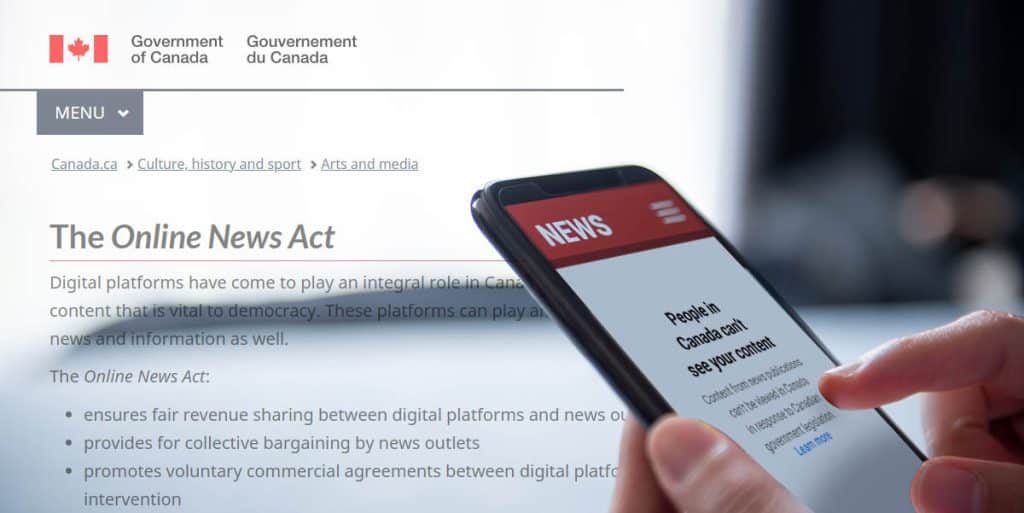

Trudeau’s government has attempted to provide funding to Canadian mainstream news sites through laws such as the Online News Act, which attempted to force Google and Facebook to pay for content.

Facebook’s parent company, Meta, declined, instead barring users in Canada from sharing links to news articles. Google negotiated payments in the order of C$100 million.

Trudeau’s Online News Act Bill C-18

In June 2023, the Trudeau government passed Bill C-18, often known as the Online News Act, which forced Big Tech behemoths Google and Meta to reimburse Canadian news organisations for information appearing on their platforms.

Trudeau claimed that Google and Meta controlled 80% of Canada’s $14 billion online advertising market and were responsible for the decline of mainstream media.

Despite Trudeau’s administration supporting the Canadian Broadcasting Corporation (CBC) with around $1.3 billion in the fiscal year 2022-2023.

Trudeau’s law requires tech titans to negotiate compensation agreements with journalistic organisations. Otherwise, the Canadian Radio-television and Telecommunications Commission (CRTC) steps in.

The Marxist Trudeau government intends to extract $329 million per year by taxing Facebook and Google income at a rate of 4%. No other country in the world imposes such a high tax.

According to Conservatives, the Liberal administration under Justin Trudeau intends to control how Canadians live, think, and speak.

Earlier this year, they pushed through Bill C-11 to tax Netflix and YouTube, raking in millions given to Canadian creators to develop shows no one watches.

Justin Trudeau’s popularity is at an all-time low; most Canadians want him to quit, and even his caucus turns against him. Trudeau’s trademark manoeuvre throughout his political career has been to seek out a political conflict that will energise his followers while diverting attention away from the country’s major concerns.

Taking on big corporations helps him to seem like David versus Goliath and to be a hero in the press.

Trudeau likes linking the health of the media to the state of democracy, although a media business under the heel of big government is considerably worse than no media.