Business

Tax Season Is Under Way. Here Are Some Tips To Navigate It.

NEW YORK — Tax season began Monday, and for many filing US tax returns — particularly those doing so for the first time — it may be a difficult chore that is sometimes pushed until the last minute. But, if you want to escape the stress of the approaching deadline, get organised as soon as possible.

Whether you do your taxes, go to a tax clinic, or hire a professional, navigating the tax system may take time and effort. Courtney Alev, Credit Karma’s consumer financial advocate, suggests you take it easy on yourself.

“Take a breath. Take some time, set out an hour, or work through it over the weekend. “You’ll hopefully realise that it’s much simpler than you think,” Alev added.

If you need more clarity on the process, there are numerous free tools available to assist you navigate it.

Here’s what you should know:

When is the deadline for filing taxes?

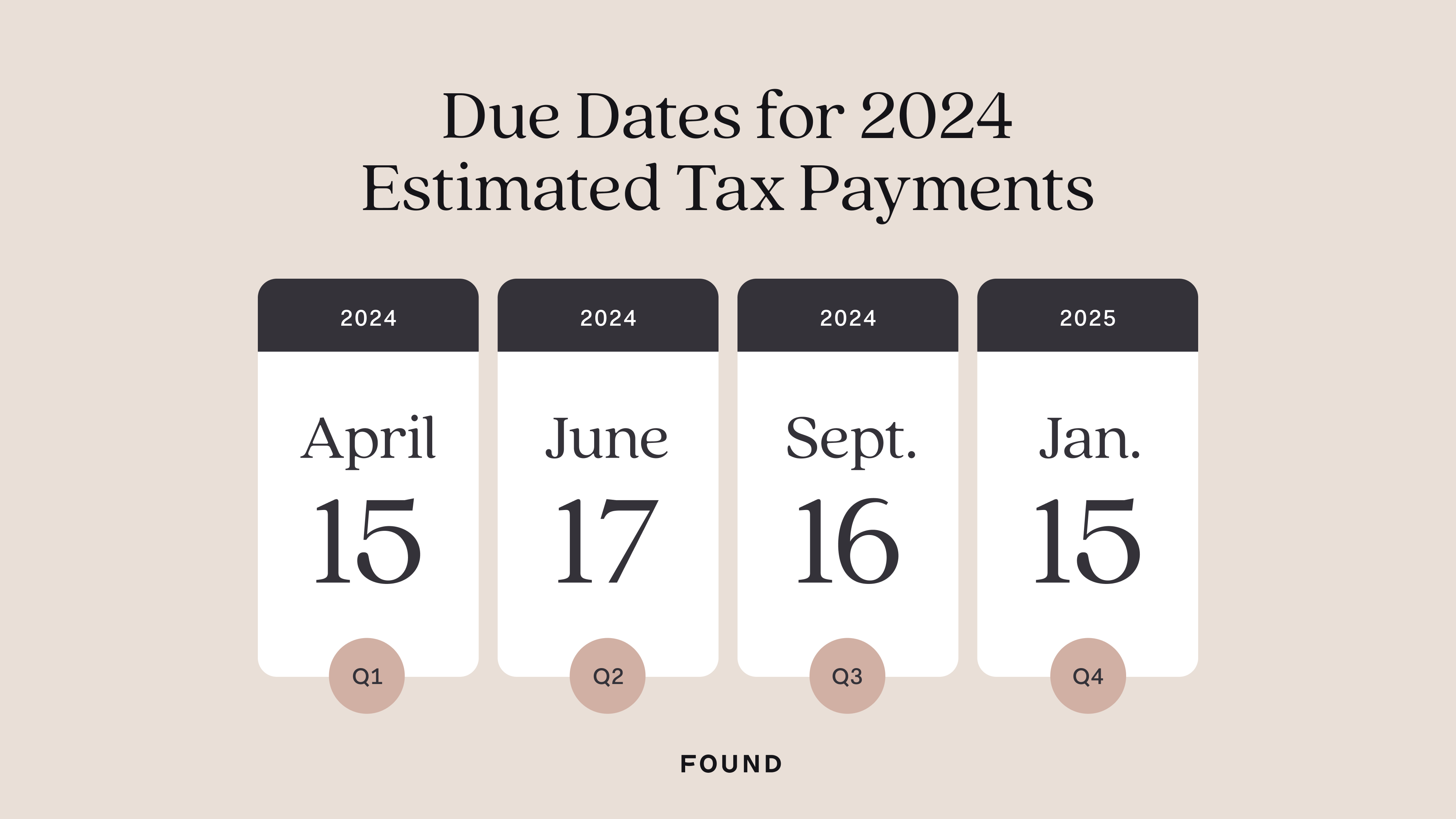

Taxpayers have until April 15 to file forms for 2023.

What do I need to do to file my tax return?

While the required documents may vary by situation, here is a broad outline of what everyone needs:

—Social Security Number

– W-2 documents, if you are employed.

– 1099-G if you are unemployed.

— 1099 paperwork if you are self-employed.

—Investment and savings records

—Any allowable deduction, such as educational costs, medical bills, charitable contributions, etc.

—Tax credits, such as the child tax credit and the retirement savings contribution credit.

The IRS website provides a more detailed document list.

Tom O’Saben, director of tax content and government relations at the National Association of Tax Professionals, recommends gathering all of your paperwork in one location before beginning your tax return and having your records from the previous year if your financial status has significantly altered.

To protect themselves from identity theft, O’Saben recommends taxpayers create an identity protection PIN with the IRS. Once you’ve created a number, the IRS will require it when you file your tax return.

How Do I File My Taxes?

You can file your taxes online or on paper. However, there is a significant time gap between the two methods. The IRS can process paper filings for up to six months, whereas electronic filings take only three weeks.

WHAT RESOURCES ARE THERE?

For those earning $79,000 or less yearly, the IRS provides free guided tax preparation that handles your arithmetic. If you have any issues while completing your tax forms, the IRS has an interactive tax aid tool that can provide answers depending on your information.

Aside from famous corporations like TurboTax and H&R Block, taxpayers can use licenced professionals such as certified public accountants. The IRS provides a directory of tax preparers around the United States.

The IRS also finances two programs providing free tax assistance: VITA and Tax Counselling for the Elderly (TCE). People who earn $64,000 or less per year, have disabilities, or speak little English are eligible for the VITA programme. People over the age of 60 are eligible for the TCE programme. The IRS has a website where you may find organisations that host VITA and TCE clinics.

If you have a tax problem, clinics nationwide can help you handle it. These tax clinics typically provide services in multiple languages, including Spanish, Chinese, and Vietnamese.

HOW CAN I AVOID MISTAKES ON MY TAX RETURN?

Many people are concerned about getting in trouble with the IRS if they make errors. Here’s how to avoid some of the more popular ones:

—Confirm your name on your Social Security card.

When working with customers, O’Saben always requests that they bring their Social Security cards to double-check their number and legal name, which can change when people marry.

“You may have changed your name, but you didn’t change it with Social Security,” he remarked. “If the Social Security number doesn’t match the first four letters of the last name, the return will be rejected, and that will delay processing.”

—Look for tax statements if you’ve opted out of paper mail.

Many people prefer to avoid receiving snail mail; however, doing so may result in your tax paperwork being included.

“If you didn’t get anything in the mail doesn’t mean that there isn’t an information document out there that you need to be aware of and report accordingly,” he said.

—Be sure to record all of your income.

If you worked more than one job in 2023, you’ll need the W-2 forms for each.

What about the Child Income Credit?

Last month, Congress announced a bipartisan deal to expand the child tax credit. The tax credit is $2,000 per kid, with just $1,600 refundable. The plan would gradually boost the maximum refundable child tax credit to $1,800 for 2023 tax returns, $1,900 the following year, and $2,000 for 2025 tax returns.

According to the Centre for Budget and Policy Priorities, if this deal is implemented, around 16 million low-income children will benefit from expanding the child tax credit. Lawmakers hope to move this bill as quickly as feasible.

What if I make a mistake?

Mistakes happen, and the IRS takes a different response in each case. In general, if you make a mistake or leave something out of your tax returns, the IRS will audit you, according to Alev. An audit indicates that the IRS will ask for additional documentation.

“Generally, they are quite understanding and willing to collaborate with others. “You won’t be arrested if you type in the wrong field,” Alev stated.

What if it has been years since I filed?

You can file taxes late; if you were expecting a refund, you may still receive it. If you last filed years ago and owe money to the IRS, you may face penalties, but the agency can work with you to set up payment plans.

How Can I Avoid Scams?

Tax season is a perfect time for tax scams, according to O’Saben. These frauds can be delivered via phone, text, email, or social media. The IRS does not use any of these methods to reach taxpayers.

Tax preparers can sometimes be fraud perpetrators, so ask many questions. According to O’Saben, this could be a warning sign if a tax preparer tells you you will receive a greater refund than in past years.

If you need help seeing what your tax preparer is doing, request a copy of the tax return and ask questions about each entry.

How long should I keep copies of my tax returns?

It’s usually a good idea to preserve a record of your tax returns in case the IRS audits you on something you reported years ago. O’Saben recommends retaining copies of your tax returns for up to seven years.

How Do I File a Tax Extension?

You can request an extension if you run out of time to file your tax return. However, remember that the extension only allows you to file your taxes, not pay them. Pay an estimated amount before the deadline to avoid penalties and interest if you owe taxes. If you expect a refund, you will still get it when you file your taxes.

Filing an extension gives you till October 15 to file your taxes. You can file for an extension using your preferred tax software or preparer, the IRS Free File tool, or by mail.

What happens if you file your taxes late?

You may face several fines if you miss the tax deadline and do not file for an extension. If you miss the deadline, you may face a failure-to-file penalty. According to the IRS, the penalty will be 5% of the unpaid taxes for each month the tax return is late.

You will face a failure-to-pay penalty if you owe taxes and fail by the deadline. Interest will be levied on both outstanding taxes and penalties. If you are eligible for a refund, you will not be penalised and will get your tax return payment. If you had unusual circumstances that prevented you from filing or paying your taxes on time, you may be entitled to waive or decrease your penalty.

You can apply for a payment plan if you owe too much in taxes. Payment options will allow you to repay over time

SOURCE – (AP)