Business

Exxon Overcomes Hefty Charge And Falling Crude Prices In Fourth Quarter To Top Profit Expectations

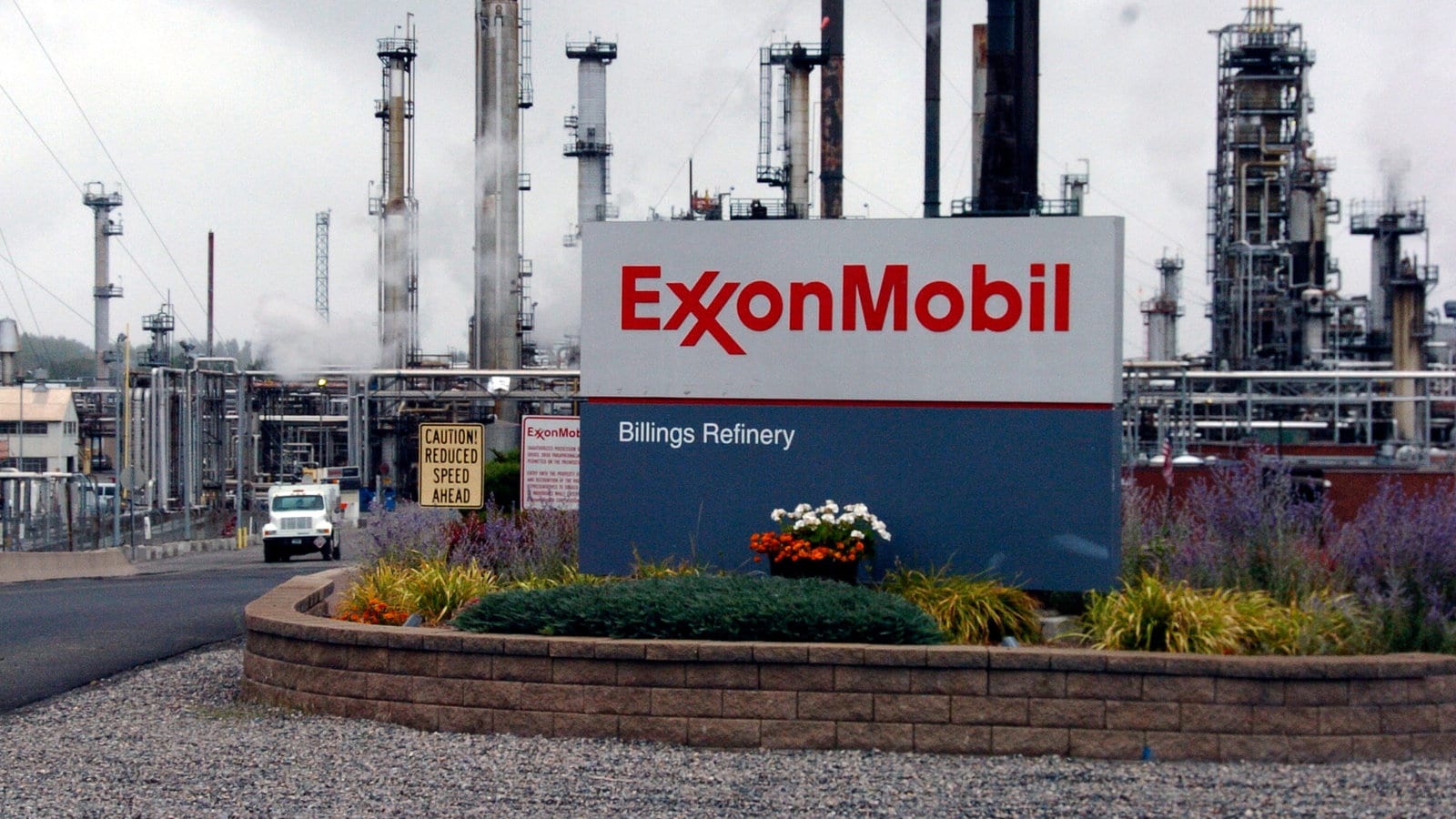

Exxon Mobil’s fourth-quarter sales and profits decreased in lockstep with the price of oil, and the energy giant suffered from a sizable impairment charge resulting from regulatory worries in California. Nonetheless, it reported a good adjusted profit, and the business increased its quarterly dividend.

Shares climbed 2% before the market started on Friday.

Revenue for the three months ending December 31 fell to $84.34 billion from $95.43 billion. Analysts polled by Zacks Investment Research projected $91.81 billion, which fell short.

During the quarter, Exxon earned $7.63 billion, or $1.91 per share. It made $12.75 billion a year ago, or $2.25 per share.

The current quarter contained a $2.3 billion impairment charge, with $2 billion due to regulatory barriers in California that have prohibited production and distribution assets from being brought back online.

Exxon Overcomes Hefty Charge And Falling Crude Prices In Fourth Quarter To Top Profit Expectations

Earnings per share, excluding the charge and other adjustments, were $2.48.

Analysts were forecasting earnings of $2.21 per share. Exxon does not change its stated results to reflect one-time occurrences such as asset sales.

The Spring, Texas-based corporation raised its quarterly dividend by 4% to 95 cents per share.

Exxon went on a buying spree last year when oil prices soared.

In July, the company announced it would pay $4.9 billion to acquire Denbury Resources, an oil and gas producer that has entered the carbon capture and storage market and looks to benefit from changes in US climate policy.

Exxon eclipsed that deal in October when it announced a $60 billion acquisition of shale company Pioneer Natural Resources. Two months later, the Federal Trade Commission, which administers federal antitrust laws, requested additional company information regarding the proposed merger. The request is a step the agency takes while determining whether a merger may be anticompetitive under US law. Pioneer disclosed the request in a filing on Tuesday.

Increased cash levels for all major producers fueled tremendous consolidation in the oil sector. Chevron said in October that it will buy Hess Corp. for $53 billion.

Exxon Overcomes Hefty Charge And Falling Crude Prices In Fourth Quarter To Top Profit Expectations

Chevron also published financial results on Friday, with a fourth-quarter adjusted profit of $3.45 per share on revenue of $47.18 billion. Wall Street projected a profit of $3.29 per share on $52.59 billion in revenue. Its stock rose marginally in the premarket.

The San Ramon, California-based corporation reported that annual production in the United States and worldwide had reached a new high. Chevron’s board of directors recommended raising the quarterly dividend to $1.63 per share, an 8% increase.

Exxon Overcomes Hefty Charge And Falling Crude Prices In Fourth Quarter To Top Profit Expectations

On Thursday, Shell plc announced an adjusted profit of $2.22 for the fourth quarter, with revenue of $80.13 billion. Analysts expected a profit of $1.94 per share. Shell’s stock rose marginally before the market opened.

Saudi Arabia and Russia’s oil production cuts are putting a strain on oil markets, and the war between Israel and Hamas still has the potential to spark a larger Middle Eastern conflict. While assaults on Israel do not impair global oil supply, according to a US Energy Information Administration report, “they raise the potential for oil supply disruptions and higher oil prices.”

SOURCE – (AP)