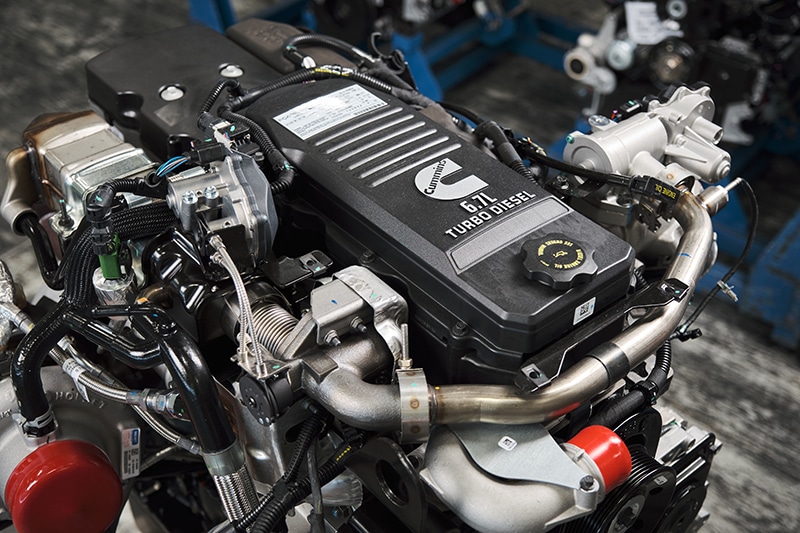

The Department of Justice has ordered the recall of 600,000 Ram trucks as part of a settlement requiring engine manufacturer Cummins Inc. to repair environmental harm caused by unlawfully installing emissions control software in several hundred thousand vehicles, avoiding emissions testing.

It revealed new facts about the December settlement on Wednesday.

Cummins is accused of avoiding emissions testing by employing equipment to bypass or defeat pollution controls. The engine manufacturer will pay a previously announced civil penalty of $1.675 billion to settle claims, the largest ever secured under the Clean Air Act, plus $325 million in remedies.

Cummins’ total penalty now exceeds $2 billion, which authorities from the US Justice Department, Environmental Protection Agency, California Air Resources Board, and California Attorney General described as a “landmark” in a conference call with reporters Wednesday.

“Let this settlement be a lesson: We won’t let greedy corporations cheat their way to success and run over the health and wellbeing of consumers and our environment along the way,” Robert Bonta, the attorney general of California, said.

Over a decade, hundreds of thousands of Ram 2500 and 3500 pickup trucks built by Stellantis were outfitted with Cummins diesel engines, including bypass engine control software. This includes 630,000 vehicles with unlawful defeat devices and 330,000 with unreported auxiliary emissions control equipment.

Engine Maker Cummins To Repair, Replace 600,000 Ram Trucks In $2 Billion Emissions Cheating Scandal

Officials could not say how many of those vehicles are still on the road, but Cummins, which has stated that it has done nothing illegal, must conduct a nationwide recall of more than 600,000 noncompliant Ram trucks.

Stellantis commented on the case to engine manufacturer Cummins, which said that Wednesday’s proceedings do not involve any more financial commitments beyond those revealed in December. “We are looking forward to obtaining certainty as we conclude this lengthy matter and continue to deliver on our mission of powering a more prosperous world,” the company said.

Cummins also stated that the engines not being recalled were within emissions standards.

Cummins will compensate for any smog-forming emissions caused by its activities as part of the settlement.

Preliminary assessments suggested that the emissions bypass resulted in “thousands of tons of excess nitrogen oxide emissions,” according to US Attorney General Merrick B. Garland’s prepared statement.

The Clean Air Act, a federal law implemented in 1963 to minimize and manage national air pollution, compels car and engine manufacturers to follow emission restrictions to safeguard the environment and human health.

The transportation industry accounts for roughly one-third of total US greenhouse gas emissions, with light-duty cars accounting for most of that. Limits strive to reduce emissions, particularly from gasoline and diesel fuel combustion, which include carbon dioxide and other harmful pollutants.

Engine Maker Cummins To Repair, Replace 600,000 Ram Trucks In $2 Billion Emissions Cheating Scandal

“We are increasingly discovering that the public health effects of car emissions are truly devastating, and they are also one of our largest sources of emissions contributing to climate change,” said Jacqueline Klopp, director of the Columbia Climate School’s Center for Sustainable Urban Development.

“To the extent that vehicle manufacturers are trying to evade our emission standards that are our biggest tool for protecting us from these public health impacts and climate change, these kinds of fines for evasion are hopefully a very important deterrent,” she said. “There are profound justice and equity issues around air pollution produced by transport emissions.”

Diesel exhaust is extremely toxic to human health and a strong carcinogen. Long-term exposure to ozone-producing nitrogen oxides can result in respiratory infections, lung illness, and asthma.

Officials acknowledged Wednesday that the Cummins settlement followed many other prominent emissions cheating instances involving the car sector in recent years.

Wednesday’s announcement comes seven years after German automaker Volkswagen agreed to plead guilty to five felony counts following investigations into its use of identical defeat devices, resulting in the major emissions scandal known as Dieselgate.

Engine Maker Cummins To Repair, Replace 600,000 Ram Trucks In $2 Billion Emissions Cheating Scandal

The business inserted software in some model year 2009-2015 diesel vehicles across its brands, bypassing emissions limits and spewing up to 40 times more pollutants than those standards permit. Volkswagen says 11 million vehicles worldwide were equipped with emission controls.

In 2017, the manufacturer agreed to pay a $2.8 billion criminal penalty and $1.5 billion in separate civil settlements.

Fiat Chrysler faced similar sanctions in 2019 for failing to disclose defeat devices used to cause vehicle pollution control systems to perform incorrectly during emission tests. Over 100,000 EcoDiesel Ram 1500 and Jeep Grand Cherokee models were sold in the United States with unapproved software.

To settle charges of cheating on emission tests in 2019, the manufacturer agreed to pay a $305 million civil penalty.

Daimler, Mercedes-Benz’s parent company, consented to a civil penalty of $857 million in 2020 due to disclosure errors and Clean Air Act violations.

“There’s a lot of sunk money into diesel engines and people making profits off of diesel engines,” Klopp, who hails from Columbia, added. “Unless you give them a really high fine and a really big deterrence, they’ll pay the fines to keep the profits. That is incredibly terrible because it prioritizes profits over the health of our communities.”

SOURCE – (AP)