Business

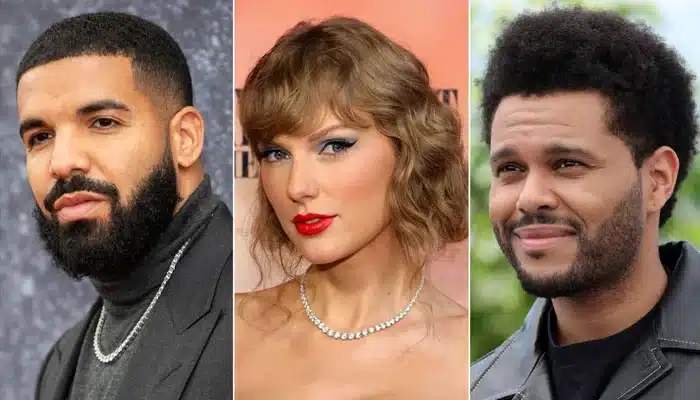

Songs By Taylor Swift, Drake And More Are Starting To Disappear From TikTok. Here’s Why

NEW YORK — TikTok may appear (or sound) slightly different as you continue to scroll through the app.

Universal Music Group, representing big-name artists such as Taylor Swift, Bad Bunny, and Drake, announced earlier this week that it would no longer allow its music to be played on the app after a licencing agreement between the two firms expired on Wednesday.

Owned by ByteDance, has verified to The Associated Press that the removal of UMG-related music has begun. As of early Thursday, many popular songs have disappeared from the social media platform’s catalogue.

Songs By Taylor Swift, Drake And More Are Starting To Disappear From TikTok. Here’s Why

Removing UMG-licensed music will likely take a few days, but hardcore TikTokers are already witnessing the results. Here’s an overview of where things stand.

What music is being removed from TikTok?

The songs being withdrawn from TikTok are those licenced by UMG, which has a massive reach across the music industry and, as a result, our current digital diet.

“Universal Music Group is literally the largest record label… in the history of the music industry,” stated Andrew Mall, an associate professor of music at Northeastern University. He stated that an “uncountable number of tracks and sounds” would impact TikTok, severely reducing creator possibilities.

TikTok users who signed up on Thursday will see that they can no longer search for many popular songs, including those by Ariana Grande, Justin Bieber, Billie Eilish, and others, under the “sounds” button.

Users will no longer be able to add these songs to the next dance craze or other trending material, and previous videos using UMG-licensed music will be removed. According to a UMG spokeswoman, TikTok will determine whether these existing films are muted or removed outright.

Songs By Taylor Swift, Drake And More Are Starting To Disappear From TikTok. Here’s Why

Artists can also not share the audio of their UMG-licensed songs on TikTok. If UMG licences the music, it should be muted, according to the representative, who added that the business will safeguard its copyrights.

According to a person familiar with the situation, UMG’s representation of an artist’s tracks may also have an impact on their tour videos. This becomes more problematic if there are numerous songwriters, as it may affect recordings from other labels, according to the person.

Again, total eradication is likely to be a process. TikTok users may still be able to access some UMG music on Thursday, for example, and existing videos may take several days to be muted or removed.

How did we get here?

The licensing deal between UMG and TikTok expired after the two businesses could not reach a new agreement, prompting heated confrontations.

In a statement to artists and songwriters on Tuesday, UMG stated that it has pressed TikTok on three issues: “appropriate compensation for our artists and songwriters, protecting human artists from the harmful effects of AI, and online safety for TikTok’s users.”

Songs By Taylor Swift, Drake And More Are Starting To Disappear From TikTok. Here’s Why

UMG stated that TikTok suggested paying its artists and songwriters at a fraction of the rate other major social platforms paid and that TikTok accounts for just approximately 1% of its total revenue. The music giant also criticised TikTok’s promotion of AI song creation, which UMG claims endangers human musicians, as well as the platform’s history of hate speech, intolerance, bullying, and harassment.

TikTok responded to UMG’s concerns, stating that it has negotiated “artist-first” agreements with every label and publisher.

“It is sad and disappointing that Universal Music Group has put their own greed above the interests of their artists and songwriters,” the founder of TikTok remarked.

WILL IT LAST?

Despite the expiration of the licencing agreement, observers note that UMG and TikTok are still in the midst of negotiations, which are unlikely to last forever.

“We have watched this movie before. “It’s a wonderful, theatrical standoff between two major corporations… who want to assert their authority on the landscape,” said Ted Cockle, former head of UMG’s Virgin EMI Records and current music advisory firm Mussel Music Management.

Users will most certainly find methods to cope in the meantime, according to Cockle, but he and others doubt that such a standoff would last long, pointing out that cooperation between UMG and TikTok benefits both parties greatly. According to Mall, gaps in other licencing agreements in the twenty-first century’s digital era have often lasted only a day to a few months.

There will likely be additional pressure from TikTok producers, artists, and fans.

“This is a platform that’s really important for artists,” said Alexandra J. Roberts, a Northeastern University law and media professor. “It may not have a significant impact on established musicians, but others will lose cash streams. And I believe we will see frustrated fans, correct? Users who don’t understand or are enraged by the fact that they can’t utilise, access, or interact with some artists’ work.”

Representatives for numerous UMG-licensed artists, including Taylor Swift, Bad Bunny, SZA, Drake, Ariana Grande, and Billie Eilish, did not immediately respond to The Associated Press’s requests for comment.

Mall emphasised the repercussions of removing music from social media platforms such as TikTok, especially for emerging musicians. In this case, UMG and its established major musicians will probably perform “just fine,” he claimed, but “smaller labels, smaller artists (couldn’t) afford to do something like this.”

Content writers and marketing gurus are already planning to pivot as needed. Jessica Henig, founder and CEO of music marketing business Unlocked Branding, which works on campaigns with UMG-licensed music, said it could be better, but her team has become accustomed to dealing with delays in the social media scene.

Still, Henig, who previously led influencer marketing at Virgin EMI, believes time will tell.

“If this is going to be a longevity thing, then we might have a different conversation,” she told me.

SOURCE – (AP)