Business

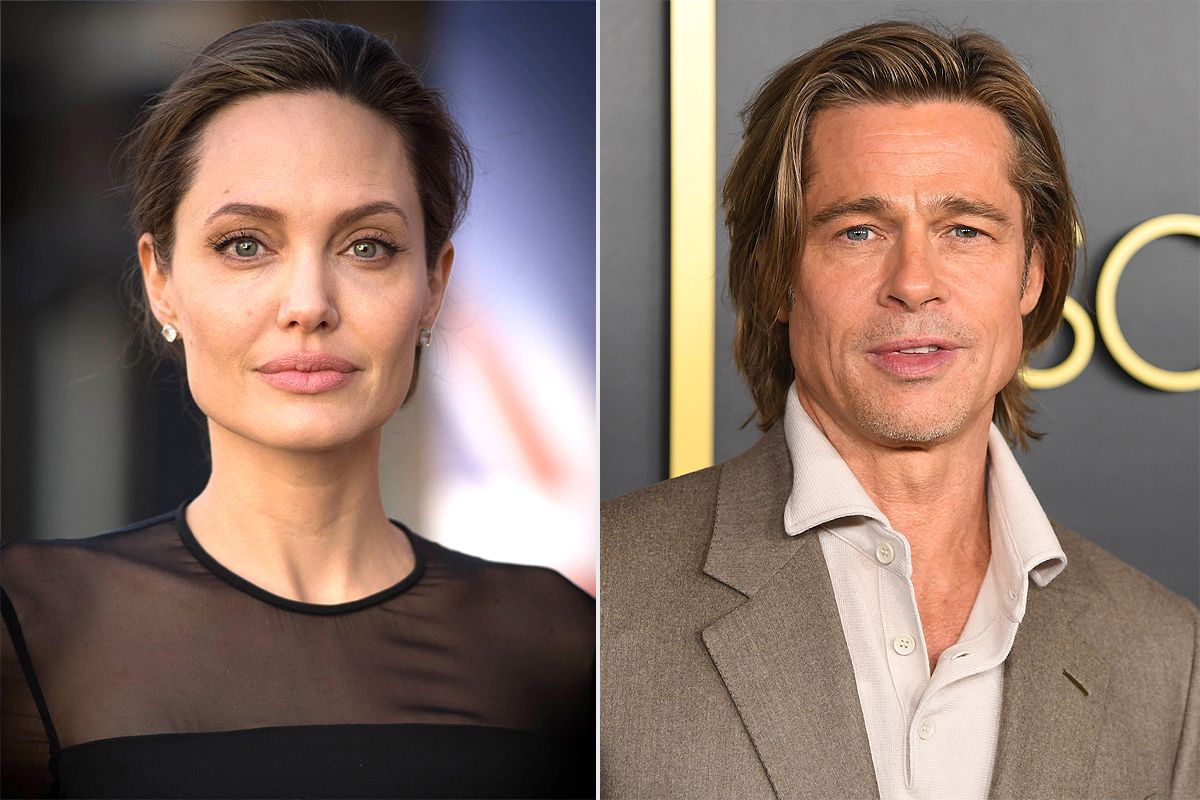

Brad Pitt And Angelina Jolie’s Winery Court Battle Heats Up

Brad Pitt and ex-Angelina Jolie are still embroiled in a contentious argument over a winery amid their custody case.

The Maleficent actress allegedly carried out a “vindictive and unlawful sale” of her part of their French estate and vineyard, Château Miraval, according to fresh records filed in Los Angeles on June 1 and obtained by E! News. The actor from Once Upon a Time…in Hollywood makes this claim.

Pitt, referring to his ex’s company, said in his amended complaint that “Jolie went forward with the vindictive putative sale in breach of her and Nouvel’s contractual obligations,” preferring to sell her stake in Miraval to a designated Russian oligarch and prevent Pitt from continuing to pursue his successful vision and strategy in developing the property and business that was intended to be their children’s legacy.

The purchase of 50% of Chateau Miraval and the Miraval trademark from Angelina Jolie was revealed in a press release by Tenute del Mondo, a division of the alcohol manufacturer Stoli Group, in October 2021. The statement continued, “We are thrilled to have a position alongside Brad Pitt as curators of their extraordinary vintages.”

Brad Pitt and ex-Angelina Jolie are still embroiled in a contentious argument over a winery amid their custody case.

And in his most recent filing, the actor claims that he learned about “Jolie’s putative sale” to Stoli from the press release and that she “collaborated in secret” with the company’s founder, Russian-born billionaire Yuri Shefler, and his associates to “pursue and then consummate the purported sale, ensuring that Pitt would be kept in the dark.” Pitt also mentioned that he rejected Shefler’s offer to purchase Miraval.

According to CNN, the billionaire was exiled from Russia in 2000 due to his opposition to President Vladimir Putin. The Oscar winner also claimed in his paperwork that the U.S. Treasury Department had branded Shefler as an “oligarch in the Russian Federation.”

In addition, the actor claims that Jolie changed her mind about giving him her interest after a temporary custody decision went in his favor. About four months before the announcement, in late May 2021, Pitt was given joint custody of the former couple’s children by a retired judge who had been retained to resolve the dispute.

The actress for Eternals, who has seven children with her ex—Maddox, now 21; Pax, 19, Zahara, 18, Shiloh, 17, and twins Knox and Vivienne, 14—later filed a lawsuit, and a California appeals court agreed with her that the judge who issued the decision should be removed from the case because he failed to adequately disclose his professional relationships with Pitt’s attorneys. The custody dispute is still pending.

Despite her contractual duties and years of pledges to Pitt, the actor claims in his amended complaint that “in the wake of the adverse custody ruling, she no longer wanted to sell to Pitt.”

Jolie had stated in court records from 2022 that she was not required to sell her stake to her ex, but she has yet to react to Pitt’s most recent filing. Her lawyer was contacted by E! News for comment, but no response was received.

The conflict between the ex-couple and the winery began in 2022. Pitt filed a lawsuit against Jolie in February of that year for allegedly selling her shares in Chateau Miraval without his permission. In 2008, the two invested together to purchase the winery. In front of their six children, they married in 2014 on the vineyard’s property.

Brad Pitt and ex-Angelina Jolie are still embroiled in a contentious argument over a winery amid their custody case.

After that, in September 2022, Jolie’s business filed a $250 million countersuit against Pitt, claiming that he had organized an effort to “seize control” of Chateau Miraval “in retaliation for the divorce and custody proceedings.” Although a judge pronounced the couple legally separated in 2019, the divorce between the Girl, Interrupted actress and the actor has not yet been finalized. The actress filed paperwork to break her marriage to the actor in 2016.

According to Jolie’s petition, the Babylon star allegedly “ignored” a “final offer to sell her interest in the winery,” thus, Jolie sold Nouvel to a global beverage corporation in 2021.

Jolie offered to sell Pitt her investment despite not being required to do so and engaged in months-long negotiations with him, according to her declaration. “Pitt’s hubris got the better of him, and as a deal was about to be struck, he made an eleventh-hour demand for onerous and irrelevant conditions, including a clause designed to prevent Jolie from publicly speaking about the circumstances that had caused their marriage to end.”

Pitt responded to Jolie’s countersuit on June 1 by stating that he vigorously refutes all of the charges and requests that the court dismiss Jolie’s cross-complaint with prejudice.

Pitt is suing Jolie for punitive and exemplary damages and a statement that her alleged sale of Nouvel was invalid. Pitt is also demanding a jury trial.

SOURCE – (AP)

:max_bytes(150000):strip_icc():focal(587x223:589x225)/angelina-jolie-1-2b124302a8644440a370dfb00176c94b.jpg)