Business

‘BlackBerry’ Film The Must-Have Gadget That The iPhone Turned Into A Forgotten Relic

Almost everyone knows that Steve Jobs’ unique vision, unrelenting drive, and technological skill spawned the iPhone, a cultural revolution that continues to influence culture 16 years after the late Apple co-founder first showed the device to the world.

However, when Steve Jobs unveiled the first iPhone in 2007, another smartphone was a must-have accessory. It was the BlackBerry, a device so addictive that it was dubbed the “CrackBerry” by IT nerds and power brokers huddled over a tiny keyboard best used with both thumbs clickety-clacking.

The BlackBerry is now known as “that phone people had before they bought an iPhone,” a relic so obsolete that the Canadian firm that created it is now worth $3 billion, down from $85 billion at its peak in 2008, when it controlled nearly half of the smartphone industry.

But its legacy is worth remembering, and moviegoers will be able to learn more about it in the upcoming film “BlackBerry.” The film opens in theatres on Friday and is the latest film or television series to explore technology’s penchant for innovative innovation, blind ambition, ego clashes, and power battles that morph into morality plays.

That technique has already resulted in two Academy Award-nominated films scripted by Aaron Sorkin, 2010′s “The Social Network” on Facebook’s founding and 2015′s “Steve Jobs,” about the Silicon Valley legend. Then there was last year’s rush of TV series investigating the crises surrounding WeWork (“WeCrashed”), Uber (“Super Pumped”), and disgraced Theranos CEO Elizabeth Holmes (“The Dropout”), which won Amanda Seyfried an Emmy for her performance.

The BlackBerry is now known as “that phone people had before they bought an iPhone,”

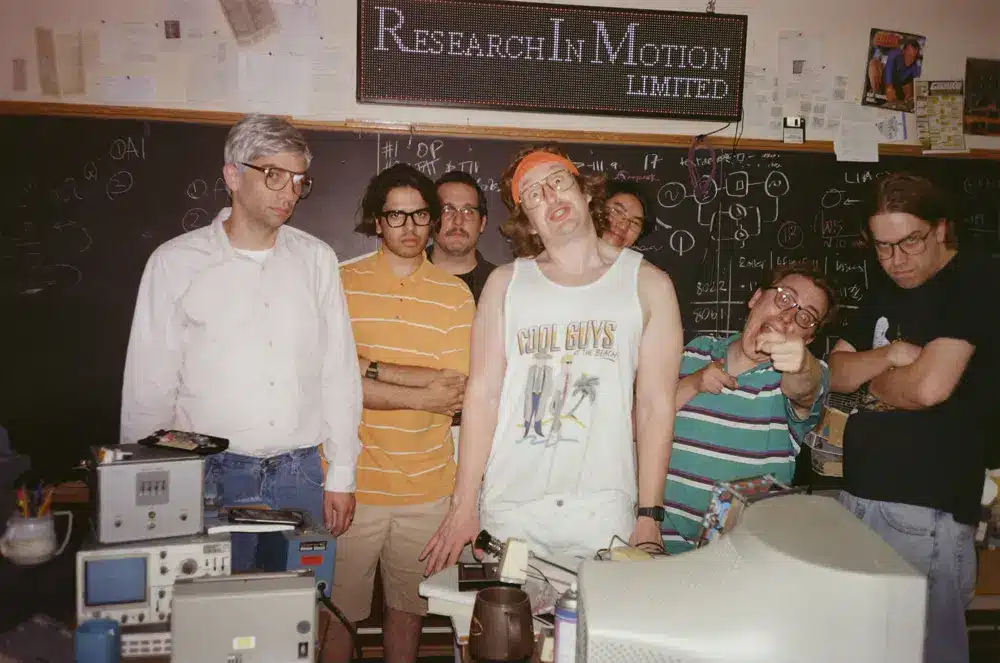

“BlackBerry” is told as a dark comedy centered on two friendly but clumsy geeks, Mike Lazaridis and Doug Fregin, who can’t seem to execute their idea to create a “computer in a phone” until they bring in a hard-nosed, foul-mouthed businessman, Jim Balsillie.

Although “BlackBerry” is based on the painstakingly researched book “The Lost Signal,” director and co-star Matt Johnson admitted in an interview with The Associated Press that he took more liberties in the film. Among other adjustments, Johnson mentioned altering some timelines, molding the company culture through his 1990s perspective, and infusing the important characters with “our own personalities and ideas.”

“But our lawyers wouldn’t let us put anything in the film that was an outright fabrication,” Johnson explained.

Johnson had to make a lot of assumptions on his part as the enigmatic Fregin, who sold all of his shares in BlackBerry’s holding company — then known as Research In Motion, RIM — about the same time Apple unveiled the first iPhone and has remained low-key ever since.

“Doug is a true cypher, he has never done a taped interview,” Johnson added, describing Fregin as a “kind of mascot figure who is tying the culture of the office together.”

Ironically, Johnson got much of his inspiration for Fregin from one of RIM’s early workers, Matthias Wandel, who released a YouTube video criticizing mistakes in the “BlackBerry” teaser. Previously, Wandel briefed Johnson on RIM’s history and even shared journals he kept during the development of the BlackBerry.

The BlackBerry is now known as “that phone people had before they bought an iPhone,”.

“I think he’ll be quite charmed when he sees the film because so many of his original notes are in it,” Johnson said of Wandel. “It’s so funny that he released that video (because) he inspired so much of my character.” I stole everything from him. I owe him a lot.”

Balsillie, RIM’s co-CEO with Lazaridis, emerges as the most intriguing guy in the film. Balsillie is portrayed by actor Glenn Howerton (best known for his role in the TV series “It’s Always Sunny in Philadelphia”) in a way that casts him as both the story’s main antagonist and protagonist, dropping f-bombs in tyrannical temper tantrums while making savvy moves that turned the BlackBerry into a cultural sensation.

“It always felt like this was a guy who weirdly felt a little outside of what people would consider to be sort of a titan of technology or business,” Howerton said of Basillie in an AP interview. “I played him almost always as someone who had something to prove, that he could play with the big boys.”

Balsillie eventually became embroiled in legal issues stemming from unlawful modifications to the pricing of stock options, a practice known as “backdating” that also implicated Apple’s former general counsel and former chief financial officer in 2007 for handling pay packages issued to Jobs. Balsillie and Lazaridis both left RIM in 2012.

Balsillie appears to be enjoying the renewed attention from the new film now that BlackBerry has receded from public consciousness, although quibbling with some aspects of his character in a recent interview with The Canadian Press.

Unlike Lazaridis and Fregin, Balsillie attended a recent screening of the film in Toronto and even walked the red carpet alongside Johnson and Howerton.

“In many ways, (Jim) was the hero, the character who changed for the better (in the film),” Johnson explained. “The audience was completely focused on him. It was almost a hallucinogenic sensation to be in the theatre with Jim, who was the one who was laughing the hardest.”

Balsillie, who is teased in one scene for not having watched “Star Wars,” told Howerton that he enjoyed seeing “BlackBerry” so much that it was the first movie he had ever seen twice in his life.

SOURCE – (AP)

Business

Sonic the Hedgehog Dominates Christmas Wish Lists

Sonic the Hedgehog is dominating Christmas wish lists this year. The lovable blue hedgehog is back in the spotlight, from sonic the hedgehog toys and games to sonic the hedgehog coloring pages and movie hype.

Sonic-themed holiday merchandise is on fire, from quirky sweaters to action figures flying off shelves. Sonic the Hedgehog Christmas outfits for kids are selling out fast, making them a go-to gift option for festive fun.

Retailers have been quick to recognize Sonic’s holiday appeal. Special promotions and exclusive items, like the Sonic holiday t-shirts, are everywhere.

Everyone’s stocking up on Sonic merchandise, from big-box stores to boutique retailers.

Online shopping platforms are seeing a surge in searches for Sonic items. Whether it’s Sonic Christmas-themed tops or Sonic the Hedgehog coloring pages, Sonic the Hedgehog toys or Sonic and the Hedgehog 3, the demand is skyrocketing.

Retailers who tap into this trend are sure to see strong holiday sales.

Sonic has been around since the early 90s, but his popularity never wanes. With the release of Sonic 3, fans are more excited than ever.

Sonic the Hedgehog 4

Meanwhile, Paramount Pictures is preparing “Sonic the Hedgehog 4,” with the newest addition in the family-friendly genre set for a spring 2027 release.

The announcement comes as “Sonic 3” opens in theatres on Friday, estimated to gross $55 million to $60 million from 3,800 North American locations.

The sequel is shaping up to be a good holiday season blockbuster for Paramount, which explains the desire in future “Sonic” adventures. On the international front, the film will be released on Christmas Day in 52 markets.

On Rotten Tomatoes, critics gave “Sonic 3” an outstanding 87% fresh score.

The first two films grossed a total of $725.2 million at the global box office and generated over $180 million in global consumer expenditure through home entertainment rentals and digital purchases.

They also inspired a spinoff Paramount+ series, “Knuckles,” which premiered earlier this year.

Related News:

Man Creates Candy Cane Car to Spread Christmas Cheer

Business

Amazon Strike Called By Teamsters Union 10,000 Walkout

An Amazon strike has hit facilities in the United States in an effort by the Teamsters union to pressure the corporation for a labour agreement during a peak shopping season.

The Teamsters union told the Associated Press that Amazon delivery drivers at seven facilities in the United States walked off the job on Thursday after the firm failed to discuss a labour contract.

According to the union, Amazon employees in Teamsters union jackets were protesting at “hundreds” of additional Amazon facilities, which the union billed as the “largest strike” in US history involving the company.

The corporation, which employs over 800,000 people in its US delivery network, stated that its services will be unaffected.

It was unclear how many people, including members of Germany’s United Services Union, participated in Thursday’s demonstration. The Teamsters union reported that thousands of Amazon employees were implicated in the United States.

Amazon Strike at 10 Locations

Overall, the group claims to represent “nearly 10,000” Amazon strikers, having signed up thousands of people at roughly ten locations across the country, many of whom have joined in recent months.

The organization has claimed recognition from Amazon going on strike, claiming the firm illegally neglected its obligation to bargain collectively over salary and working conditions.

The Teamsters is a long-standing US union with nearly one million members. It is well-known for securing lucrative contracts for its members at companies like delivery behemoth UPS.

Most of the Teamsters’ Amazon campaigns have concerned drivers working for third-party delivery companies that partner with the tech behemoth.

Amazon denies that it is liable as an employer in those circumstances, which is a point of legal contention. In at least one case, labour officials have taken a preliminary stance in favour of the union.

Stalled Contract Negotiations

Amazon employees at a major warehouse on Staten Island in New York have also chosen to join the Teamsters. Their warehouse is the only Amazon facility in the United States where labour officials have formally recognized a union win.

However, the Amazon strike is because contract negotiations have not progressed since the 2022 vote. It was not one of the areas scheduled to go on strike on Thursday.

Amazon, one of the largest employers in the United States, has long received criticism for its working conditions and has been the target of activists seeking to gain traction among its employees.

Related News:

Amazon Releases Nova, a Fresh Set of Multimodal AI Models.

Business

Amazon Encounters Numerous Strikes As Unions Aim At The Holiday Shopping Surge.

(VOR News) – Thousands of Amazon employees at various sites across the country were scheduled to go on strike on Thursday in an effort by the Teamsters union to pressure the retail behemoth to acknowledge its unionised workers in the United States.

The walkout is expected to concentrate on seven Amazon locations across the country during the holiday purchasing surge and may be the most significant union action against Amazon in the nation’s history.

The business announced on Thursday morning that there had been no effect on operations. It also stated that it is “continuing to concentrate on fulfilling customers’ holiday orders.”

The International Brotherhood of Teamsters maintains that it represents more than 10,000 Amazon employees and contractors in aviation centres, warehouses, and delivery centres.

Amazon has refused to acknowledge the union for many years.

The retail giant, which employs approximately 1.5 million individuals, excludes contractors and part-timers. A strike has been initiated by delivery couriers and warehouse employees at seven distinct locations in order to exert pressure on the company to negotiate a collective bargaining agreement that would encompass modifications to compensation, amenities, and working conditions.

Picketing was intended for New York, Atlanta, Los Angeles, San Francisco, and Skokie, Illinois.

Also, the Teamsters assert that they are establishing picket lines at “hundreds” of additional warehouses and delivery centres by encouraging non-unionized workers to picket under U.S. labour law, which protects workers’ ability to take collective action to further their interests.

“Amazon workers are exercising their power,” Randy Korgan stated to NPR.

“They now realise there is a pathway to take on a corporate giant like this – and that they hold the power.” Amazon responds by accusing the Teamsters of fabricating information regarding the strikes, asserting that the participants are “entirely” outsiders rather than employees or subcontractors of the corporation.

Amazon spokesperson Kelly Nantel stated that “the reality is that they were unable to secure sufficient support from our employees and partners and have invited external parties to harass and intimidate our team.” For more than a year, the Teamsters have been intentionally misleading the public by claiming to represent “thousands of employees and drivers.” They do not.

The Teamsters did not provide a specific duration for the strike; however, they informed NPR that it would extend beyond one day. Workers would receive $1,000 per week in strike money, as per the union.

Teamsters President Sean O’Brien issued a statement in which he stated, “If your package is delayed during the holidays, you can attribute it to Amazon’s insatiable greed.” We established a firm deadline for Amazon to attend the meeting and treat our members equitably. They disregarded it.

The Teamsters granted until December 15 to convene with its unionised employees and develop a collective bargaining agreement.

Amazon has opposed all unionisation efforts in court, asserting that unions were not advantageous to its employees and emphasising the compensation and benefits that the organisation currently provides.

Amazon has been accused of discriminatory labour practices on numerous occasions, including the termination of labour organisers. Furthermore, it has disputed its official status as a contract employer.

Teamsters organize Amazon delivery couriers and other employees.

In June, Amazon established its first unionised warehouse in Staten Island, New York, two years after making history by voting to join the fledgling Amazon Labour Union, which is also affiliated with the Teamsters.

The union is one of the most influential in the United States and Canada, with 1.3 million members. On Thursday, the German United Services Union declared that Amazon employees in Germany would participate in a strike in conjunction with their American counterparts.

In the past, Amazon has experienced demonstrations in Germany and Spain that were related to the holiday season in order to advocate for improved wages and working conditions.

“The holiday season has arrived.” Delivery is anticipated. Patricia Campos-Medina, the executive director of Cornell University’s Worker Institute, asserts that “this is the moment in which workers have control over the supply chain.”

The Teamsters have reported that Amazon’s profits have increased both during and after the pandemic. The corporation is currently valued at over $2.3 trillion, with net income of $15 billion in the most recent quarter alone. It is the second-largest private employer in the United States, following Walmart.

SOURCE: NPR

SEE ALSO:

SoftBank Is Courting Trump With a Proposal To Invest $100 Billion in AI.

TVA News Montreal Becomes Most-Watched News Source in Quebec

-

Politics4 weeks ago

Miller Expects 4.9 Million Foreigners to Leave Canada Voluntarily

-

News3 weeks ago

Nolinor Boeing 737 Crash Lands in Montreal

-

News3 weeks ago

“Shocking Video” Vancouver Police Shoot Armed Suspect 10 Times

-

Tech4 weeks ago

Increasing its Stake in OpenAI by $1.5 Billion is a Possibility for SoftBank.

-

News4 weeks ago

Facebook Securities Fraud Case Dropped

-

Health4 weeks ago

A Canadian Teenager’s Bird Flu Virus Has Mutations