Politics

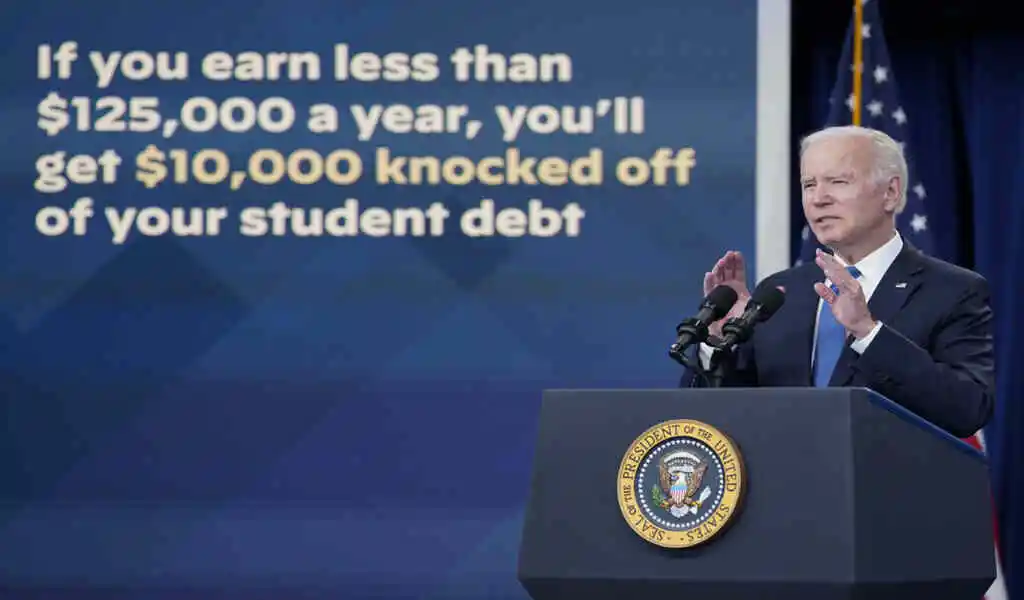

Biden’s Student Debt Relief Plan Blocked by Courts

(CTN News) – Legal challenges to President Joe Biden’s student debt reduction attempts have resurfaced, and recent verdicts are negative for his new repayment plan.

On Monday evening, district courts in Kansas and Missouri blocked sections of the new SAVE income-driven repayment plan, which was established last summer to provide borrowers with more reasonable payments and a shorter deadline for loan forgiveness.

The first lawsuit was filed in March in Kansas by 11 GOP state attorneys general, while the second was filed in April in Missouri by seven GOP state attorneys general. In both cases, the plaintiffs asked the courts to prohibit the SAVE plan and the loan forgiveness that comes with it, claiming that the relief exceeds the administration’s power.

The district court opinions issued on Monday were different, but both dealt a blow to the SAVE plan. Kansas Judge Daniel Crabtree ordered that new SAVE measures, such as decreased monthly payments, cannot be adopted while the legal process moves forward.

Impact on Student Debt Borrowers

Missouri Judge John Ross found that the plan’s provision to eliminate student debt for students with original sums of $12,000 or fewer, who qualified within 10 years, is now also barred.

Education Secretary Miguel Cardona decried the rulings on Monday, stating that “the Department of Justice will continue to vigorously defend the SAVE Plan.”

“Republican elected officials and special interests sued to block their own constituents from being able to benefit from this plan – even though the Department has relied on the authority under the Higher Education Act three times over the last 30 years to implement income-driven repayment plans,” Cardona wrote.

“While we continue to review these rulings, the SAVE plan still means lower monthly payments for millions of borrowers – including more than 4 million borrowers who owe no payments at all, and protections for borrowers facing runaway interest when they are making their monthly payments,” said the attorney general.

Here’s what borrowers need to know about the verdicts.

Borrowers with student loans who have previously enrolled in SAVE can continue paying the payments outlined in the plan. However, the additional measures slated to take effect on July 1 — such as halving undergraduate borrowers’ payments and providing forgiveness credit for periods of deferment and forbearance — have been blocked.

Here’s why. Kansas’ Crabtree decided in favor of the attorneys general, citing the SAVE plan’s monthly payment cap and shorter forgiving period as “overreaching any generosity Congress has authorized before.”

However, Crabtree determined to keep SAVE components that had already gone into effect since the plaintiffs failed to demonstrate how they were harmed by parts of the plan that were already in existence.

For example, in June 2023, the Education Department disclosed its proposal to cap monthly payments and a shorter period for forgiveness, giving attorneys general time to fight the plan.

“All of this is to ask why: if these parts of the SAVE Plan promised an irreparable harm to plaintiffs, why didn’t they move to enjoin the SAVE Plan before they took effect?” Crabtree wrote.

However, with regard to the new SAVE measures slated to take effect on July 1, Crabtree decided that the plaintiffs succeeded in demonstrating injury because there was no delay in contesting the plan’s unimplemented elements, and any future remedies would be irreversible.

Rather than reversing or changing any SAVE provisions that have already been implemented, Crabtree chose to freeze any additional measures that have yet to be implemented until the court renders a final ruling.

While thousands of students have already received student loan forgiveness through the SAVE provision, which eliminates debt for borrowers with original sums of $12,000 or less, no new borrowers will be eligible for relief for the time being.

Missouri’s Ross issued a different ruling on SAVE. Missouri’s contention that the plan will hurt student-loan firm MOHELA due to reduced revenue has standing, considering the Supreme Court had rejected Biden’s first attempt at sweeping debt relief last summer.

Regarding the fate of SAVE, Ross concluded that while SAVE’s previously implemented components can continue, any future student loan forgiveness through the plan is prohibited.

He wrote that Congress did not account for the scope of loan forgiveness under SAVE, and as a result, the attorneys general have “a ‘fair chance’ of success on the merits on their claim that the Secretary has overstepped its authority by promulgating a loan forgiveness provision as part of the SAVE program.”

He also stated that even without student debt forgiveness, other elements such as lower payments and limited interest accrual will benefit borrowers. Because the attorneys general could not adequately show why the other clauses should be barred, Crabtree stated that he would only issue a preliminary injunction on debt cancellation.

Cardona announced on Tuesday that the Justice Department will appeal the rulings.

According to White House Press Secretary Karine Jean-Pierre, the Education Department will continue to enroll more Americans in SAVE. The plan offers benefits such as $0 payments for those earning $16 per hour or less, lower monthly payments for millions more borrowers, and protection from runaway interest for those making monthly payments.

SEE ALSO: Presidential Debate Preview: Biden vs Trump Face Off in Atlanta

Politics

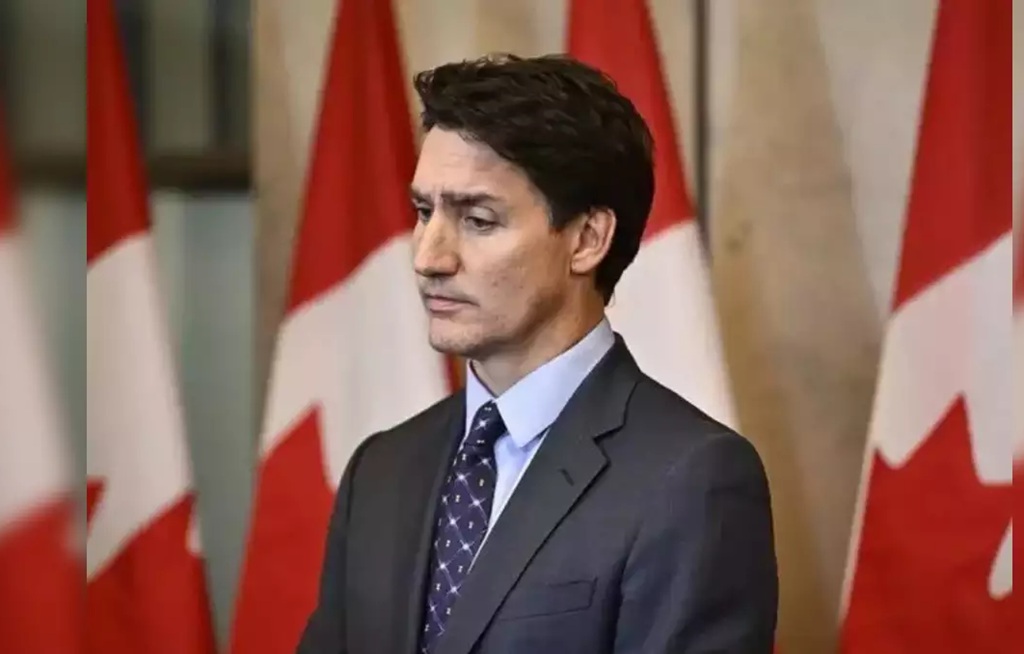

NDP Leader Jagmeet Singh Vows to Topple Trudeau Government

Canada’s opposition leader said his caucus plans to vote against Justin Trudeau’s government. If the prime minister does not seek a temporary suspension of parliament, the country will be plunged into an election early next year.

If the NDP gains support from other major opposition parties, Trudeau’s government would be forced to step down, sparking an election shortly after Donald Trump’s expected return to the White House in Washington DC.

Trudeau’s Liberals currently lack a majority in the House of Commons and have relied on NDP backing to pass laws and remain in power. Singh and Trudeau previously agreed on a cooperation deal, but the NDP leader ended that arrangement in September.

Singh’s declaration came just before Trudeau unveiled changes to his cabinet, a move aimed at steadying his government following Chrystia Freeland’s surprising resignation as finance minister earlier in the week. Polls show the Liberals are unpopular, and Trudeau is under internal pressure to resign after Freeland’s departure.

“The Liberals don’t deserve another chance,” Singh said. “That’s why the NDP will vote to end this government and let Canadians choose new leadership.”

Trudeau is expected to consider his political future over the holidays, and parliament will reconvene on January 27.

One option for Trudeau is asking the governor-general to prorogue parliament, which would end the current session. This move could delay Singh’s non-confidence vote by postponing lawmakers’ return to Ottawa.

The new cabinet begins its term amid economic uncertainty, worsened by Trump’s threat to impose 25 percent tariffs on Canadian goods.

Dominic LeBlanc — who joined the prime minister at a dinner meeting with Trump at Mar-a-Lago in November — was sworn in as finance minister on Monday after Freeland quit.

Today, Prime Minister Justin Trudeau announced changes to his Cabinet. He said the new cabinet will prioritize Canadians’ most important objectives: enhancing the economy and reducing the cost of living.

The team will continue to advance in housing, child care, and school food while striving to return more money to Canadians’ wallets, building on the investments made since 2015.

The changes to the cabinet are as follows:

- Anita Anand becomes Minister of Transport and Internal Trade

- Gary Anandasangaree becomes Minister of Crown-Indigenous Relations and Northern Affairs and Minister responsible for the Canadian Northern Economic Development Agency

- Steven MacKinnon becomes Minister of Employment, Workforce Development and Labour

- Ginette Petitpas Taylor becomes President of the Treasury Board

The Prime Minister also welcomed the following new members of his Cabinet:

- Rachel Bendayan becomes Minister of Official Languages and Associate Minister of Public Safety

- Élisabeth Brière becomes Minister of National Revenue

- Terry Duguid becomes Minister of Sport and Minister responsible for Prairies Economic Development Canada

- Nate Erskine-Smith becomes Minister of Housing, Infrastructure and Communities

- Darren Fisher becomes Minister of Veterans Affairs and Associate Minister of National Defence

- David J. McGuinty becomes Minister of Public Safety

- Ruby Sahota becomes Minister of Democratic Institutions and Minister responsible for the Federal Economic Development Agency for Southern Ontario.

- Joanne Thompson becomes Minister of Seniors.

These new ministers will work with all members of the Cabinet to deliver real, positive change for Canadians. They join the following ministers remaining in their portfolio:

- Terry Beech, Minister of Citizens’ Services

- Bill Blair, Minister of National Defence

- François-Philippe Champagne, Minister of Innovation, Science and Industry

- Jean-Yves Duclos, Minister of Public Services and Procurement and Quebec Lieutenant

- Karina Gould, Leader of the Government in the House of Commons

- Steven Guilbeault, Minister of Environment and Climate Change

- Patty Hajdu, Minister of Indigenous Services and Minister responsible for the Federal Economic Development Agency for Northern Ontario

- Mark Holland, Minister of Health

- Ahmed Hussen, Minister of International Development

- Gudie Hutchings, Minister of Rural Economic Development and Minister responsible for the Atlantic Canada Opportunities Agency

- Marci Ien, Minister for Women and Gender Equality and Youth

- Mélanie Joly, Minister of Foreign Affairs

- Kamal Khera, Minister of Diversity, Inclusion and Persons with Disabilities

- Dominic LeBlanc, Minister of Finance and Intergovernmental Affairs

- Diane Lebouthillier, Minister of Fisheries, Oceans and the Canadian Coast Guard

- Lawrence MacAulay, Minister of Agriculture and Agri-Food

- Soraya Martinez Ferrada, Minister of Tourism and Minister responsible for the Economic Development Agency of Canada for the Regions of Quebec

- Marc Miller, Minister of Immigration, Refugees and Citizenship

- Mary Ng, Minister of Export Promotion, International Trade and Economic Development

- Harjit S. Sajjan, President of the King’s Privy Council for Canada and Minister of Emergency Preparedness and Minister responsible for the Pacific Economic Development Agency of Canada

- Ya’ara Saks, Minister of Mental Health and Addictions and Associate Minister of Health

- Pascale St-Onge, Minister of Canadian Heritage

- Jenna Sudds, Minister of Families, Children and Social Development

- Rechie Valdez, Minister of Small Business

- Arif Virani, Minister of Justice and Attorney General of Canada

- Jonathan Wilkinson, Minister of Energy and Natural Resources

Politics

Trudeau Accused of “Phony Feminism” After Freeland’s Departure

Prime Minister Justin Trudeau is facing a backlash for claiming to be a feminist after firing Chrystia Freeland as Finance Minister and replacing her with Dominic Leblanc on Tuesday.

Justin Trudeau has positioned himself as a feminist leader, a central element of his political identity. In 2015, Canada made history by appointing its first gender-equal cabinet, a significant step in the ongoing effort to champion women’s rights policies.

Trudeau aimed to solidify his reputation as a pioneer in the fight for gender equality. Recent accusations of “phoney feminism” have sparked a heated debate regarding the consistency between his statements and his actions.

Chrystia Freeland’s resignation from the cabinet has sparked criticism directed at Prime Minister Trudeau, raising questions about his approach to women in leadership roles.

Chrystia Freeland, previously regarded as one of Prime Minister Trudeau’s closest allies, has officially resigned from her position as Finance Minister. In her resignation letter, she notably omitted any reference to gender issues.

Freeland’s departure mirrors Trudeau’s removal of several high-profile women;

- Jody Wilson-Raybould, former Attorney General, was removed in 2019 after the SNC-Lavalin controversy.

- Jane Philpott, then President of the Treasury Board, was also ousted following her support for Wilson-Raybould.

- Celina Caesar-Chavannes, a Liberal MP, left politics after claiming Trudeau didn’t handle internal disagreements well.

These firings have fuelled debates about his handling of women in leadership positions and made a mockery of his claims of being a feminist.

Conservative Leader Pierre Poilievre criticized Trudeau for the optics of replacing Freeland with a male cabinet member, calling it evidence of Trudeau’s “fake feminism.”

“Just blame Chrystia Freeland and make her wear it all. Some feminist,” Poilievre said at a news conference on Tuesday.

The same week as Trudeau was insulting Americans for not electing a woman president, he was busy throwing his own woman deputy prime minister under the bus to replace her with a man, Poilievre commented.

Prominent Conservative MP Michelle Rempel Garner asked how any woman in that caucus could “defend that man instead of calling for an election now,” while Alberta Premier Danielle Smith said Trudeau needed to start proving himself if he was going to keep declaring himself “to be such a supporter of women.”

MP Melissa Lantsman referred to an “old boys’ club” being in charge.

“It’s time for credible leadership in the seriousness of this moment, not the fake feminism of this phoney prime minister,” said Lantsman, who represents the Conservatives in the Thornhill riding.

Former Liberal MP Celina Caesar-Chavannes said she believes there is a pattern of female cabinet ministers who were “thrown under the bus” after “challenging someone whose name is Trudeau.”

Trudeau Defended

However, while Freeland’s resignation has sparked accusations of sexism, political experts suggest that focusing solely on gender may oversimplify the issue.

Freeland, an accomplished politician and the country’s first female Finance Minister left primarily due to policy disagreements. Her decision was less about being a powerful woman and more about divergent views on leadership and economic strategy.

Political scientist Dr. Melanee Thomas remarked that qualified women in politics often face frustrations when their expertise is dismissed.

She cautioned against reducing complex political dynamics to gender alone. By framing Freeland’s resignation solely as evidence of sexism, the broader challenges faced by all leaders in Trudeau’s cabinets—men and women alike—are overlooked.

Trudeau has remained relatively quiet, stating that Freeland’s departure was not an “easy day” for him.

Unlike previous controversies, he has not publicly defended his feminist credentials since Freeland’s resignation, leaving a vacuum for critics to dominate the narrative.

Over the years, Trudeau has said that “adding women changes politics,” presenting himself as an ally for feminist causes. His silence now begs the question: does he believe his track record speaks for itself, or is he struggling to respond to the growing skepticism?

Politics

Liberal MPs Call on Trudeau to Resign

Prime Minister Justin Trudeau is facing extreme political pressure, with Liberal MPs publicly urging him to step down for the sake of the Liberal Party of Canada.

Yesterday, Trudeau faced a triple setback: the resignations of Finance Minister Chrystia Freeland and Housing Minister Sean Fraser and a crushing byelection loss in British Columbia.

Trudeau is facing an uphill battle to maintain his grip on leadership as dissatisfaction among Liberal MPs is mounting. The recent events have added fuel to the fire.

Freeland, formerly one of Trudeau’s most prominent cabinet members, resigned in protest after allegedly being informed she’d be shuffled out of her role as finance minister. Many MPs believe this was poorly handled and symbolic of deeper issues within Trudeau’s leadership.

Adding insult to injury, the Liberals lost a B.C. byelection by 50 percentage points to the Conservatives—a seat they had held in the last general election. This loss has amplified concerns that Trudeau can no longer resonate with voters.

For the Good of the Party

Some Liberal MPs said Tuesday that Prime Minister Justin Trudeau cannot continue as party leader and needs to resign for the party’s good.

Liberal MPs like Wayne Long and Ken Hardie are now outspoken critics, claiming that Trudeau’s leadership is a huge liability for the party. Long described the Prime Minister as “living in a false reality,” warning that staying the course could lead the Liberals to electoral disaster.

Ontario MP Francis Drouin, a longstanding defender of Trudeau, has joined the chorus of dissent. He doubted the party’s ability to move forward under Trudeau, saying, “I’ve been a great defender, but I just don’t see how we recover.”

Other MPs, including Alexandra Mendès and Sean Casey, have echoed similar sentiments. Mendès stated she was deeply affected by Freeland’s treatment, while Casey suggested that Trudeau no longer enjoys the confidence of the caucus.

The Liberal caucus appears more divided than ever, with roughly a third of MPs reportedly favouring Trudeau’s immediate resignation. According to Long, between 40 and 50 MPs actively push for his resignation, while around 50 remain loyal to him. The rest are seemingly undecided or staying silent.

Trudeau’s Unwillingness to relinquish power

This lack of unity is becoming a significant issue. MP Chad Collins admitted, “I can say we’re united.” He suggested a secret ballot within the caucus would reveal overwhelming opposition to Trudeau’s continued leadership.

At a Liberal caucus meeting today, Trudeau acknowledged the growing discontent; however, he hasn’t shown any signs of stepping down. He assured MPs he understood their concerns, but many doubted his willingness to relinquish power.

The Liberals are at a crossroads. Liberal MPs worry they could lose the next general election if Trudeau remains in office, with polls showing Trudeau’s public support hovering around 20 percent.

MPs have called for a change before it’s too late, calling Trudeau’s leadership a “drag” on the party’s prospects.

The internal division might deepen if Trudeau doesn’t resign. According to some political analysts, more backbenchers will switch sides against Trudeau, especially if they are left out of the next cabinet move.

One thing is certain: the Liberal Party must decide soon. The longer the ambiguity persists, the more difficult it will be to regain voters’ confidence. For now, Canadians are left wondering whether Trudeau’s tenure as prime minister is ending—or if he will beat the odds once more.

Related News:

Dominic LeBlanc Sworn in as Canada’s New Finance Minister

-

Politics4 weeks ago

Miller Expects 4.9 Million Foreigners to Leave Canada Voluntarily

-

News3 weeks ago

Nolinor Boeing 737 Crash Lands in Montreal

-

News3 weeks ago

“Shocking Video” Vancouver Police Shoot Armed Suspect 10 Times

-

Tech4 weeks ago

Increasing its Stake in OpenAI by $1.5 Billion is a Possibility for SoftBank.

-

News4 weeks ago

Facebook Securities Fraud Case Dropped

-

Health4 weeks ago

A Canadian Teenager’s Bird Flu Virus Has Mutations