On Wednesday, U.S. President Joe Biden announced a plan to sell off the remainder of his pre-release from the U.S. emergency oil reserve by the end of 2022 and begin replenishing the stockpile to reduce high gasoline prices ahead of the Nov. 8 midterm elections.

Biden’s goal is to increase supply sufficiently to prevent near-term oil price rises that would penalize Americans and reassure U.S. drillers that the U.S. government would enter the oil market as a buyer if prices fall too low.

He said 15 million barrels of oil would be offered from the emergency Oil Reserve as part of a record 180 million barrel release that began in May and that the U.S. is ready to tap supplies again early next year to keep prices under control.

“It’s what we’re calling a prepare and release plan,” Joe Biden said at a White House event. “This enables us to respond rapidly to world events and avert oil price rises.”

Joe Biden’s use of the federal government’s Oil reserves to manage oil price surges and attempts to enhance U.S. output demonstrate how the Ukraine crisis and inflation have altered the policies of a president who campaigned to reduce the country’s reliance on the fossil fuel industry.

The White House felt an increased sense of urgency after the Saudi-led Organization of Petroleum Exporting Countries irritated Biden, sided with Russia and agreed to a production cut, prompting Biden to remark that the US-Saudi relationship has to be revalued.

“With today’s statement, we’re going to continue to stabilize markets and lower prices at a time when other countries’ actions have produced such instability,” Biden said.

Biden blamed rising crude and gasoline costs on Russian President Vladimir Putin’s invasion of Ukraine, adding that prices had plummeted 30% from their peak earlier this year.

He also reminded U.S. energy corporations, gasoline merchants, and refiners to stop using record profits to buy back stock and instead invest in production.

Prices aren’t lowering fast enough, he claims.

“Families are hurting,” he says, and rising gasoline prices strain their finances.

Faced with criticism from Republicans who claim he is using the SPR for political reasons rather than an emergency, the president also stated that the nation’s stockpiles would be replenished in the coming years.

He stated that his goal is to replenish supplies when U.S. crude is about $70 per barrel, a price he believes will allow firms to profit while still being a good value for taxpayers. On Wednesday, the U.S. benchmark was around $85 per barrel.

According to Biden, the SPR, already at its lowest point since 1984, is more than half empty with more than 400 million barrels of oil.

The administration intended to stop selling the 180 million barrels in November. Purchases by businesses such as Marathon Petroleum Corp (MPC.N), Exxon Mobil Corp (XOM.N), and Valero Energy Corp (VLO.N) were, however, slower than expected over the summer, with approximately 15 million barrels remaining unsold.

Presidents in the United States have limited influence over fuel prices, but given the country’s vast gasoline consumption – the largest in the world – high costs at the pump can be political poison. Retail gasoline prices have decreased from a high in June, but they remain higher than historical averages and significantly contribute to inflation.

The disparity between wholesale and retail prices has also risen, prompting the White House to issue cautions against price gouging.

With the new SPR repurchase guarantee, Biden believes oil companies will be more confident in investing in production and stop pushing stock buybacks.

“So, to all businesses, I say, “You’re sitting on record profits, and we’re offering you more confidence.” So you may take action right now to improve oil production, “He stated.

Companies “You should not use your profits to repurchase stock or pay dividends. Not now, not while there is a war raging, “He asked them to lower the prices they charge at the pump.

In recent weeks, the oil sector has grown increasingly apprehensive that the administration may take the dramatic step of prohibiting or limiting gasoline or diesel exports to replenish dwindling U.S. supplies.

They have urged the government to withdraw the option, which officials are unwilling to do.

Biden is to Blame for High Gas Prices

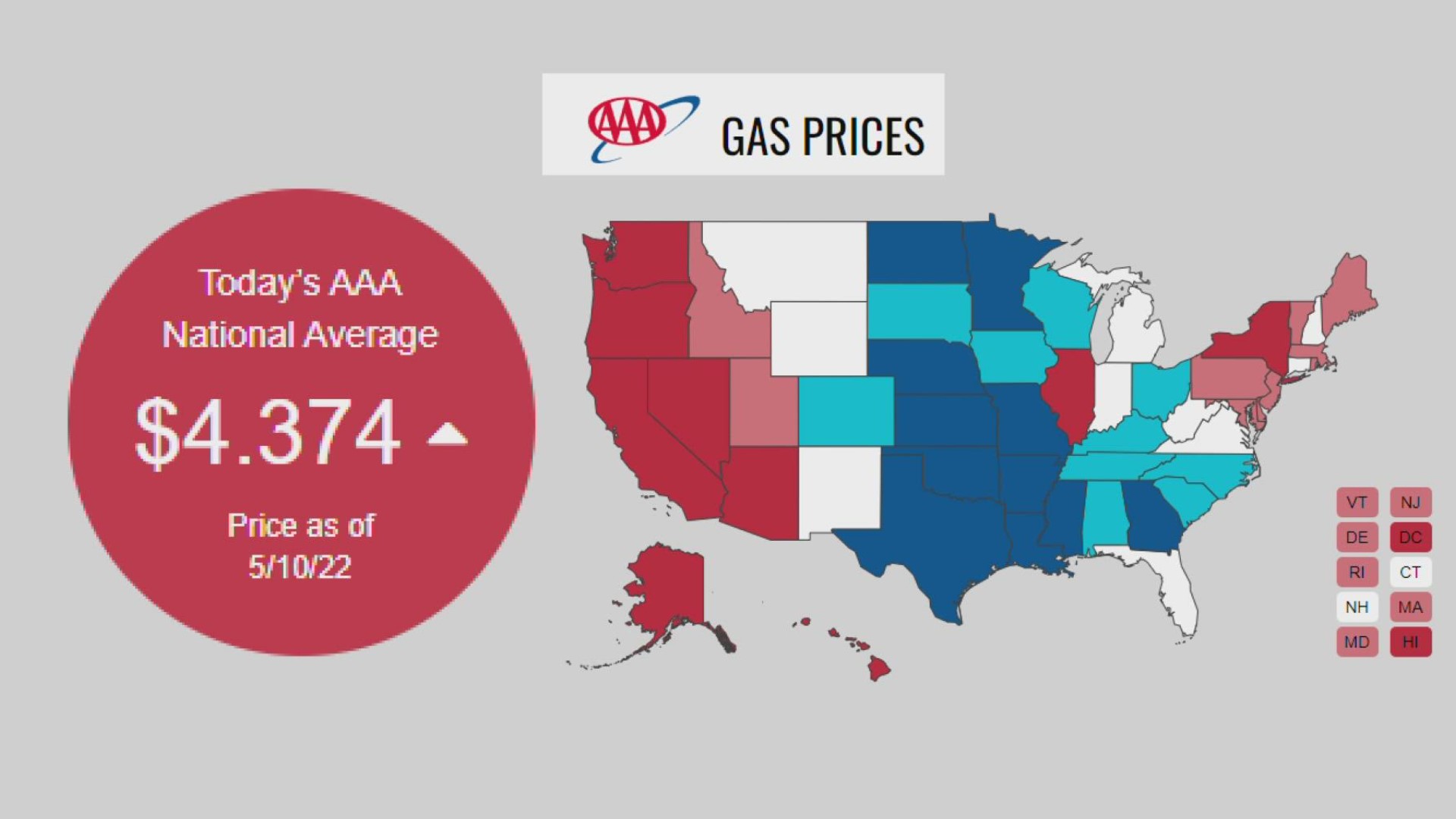

When President Biden began office, a gallon of normal gas cost an average of $2.38. It now costs $3.92.

Mr. Biden has attempted to blame Russian President Vladimir Putin and his invasion of Ukraine for the rising cost, referring to it as “Putin’s price hike, and now he’s blaming Saudi Arabia.

” However, gasoline had already reached $3.53 per gallon when the red megalomaniac invaded. As a result, Mr. Putin was not to blame.

The president has taken numerous attempts to reduce the price but to no avail. He released millions of barrels from the Strategic Petroleum Reserve (SPR), but practically every analyst believes this is only a temporary solution.

By the end of March, a gallon of gas cost $4.23, so he drew on the vast emergency reserve, allowing the discharge of 125 million barrels of oil. However, the United States consumes approximately 20 million barrels of oil daily, so Mr. Biden’s release was brief.

Prices levelled off for roughly five weeks, hovering just above $4. Then it all started over: $4.62 at the end of May and even $5.00 by mid-June.

However, economists argue that the SPR release is not the cause of declining prices. Prices had risen so far that many had just stopped buying.

Prices began to rise again after 99 days of decline. Reporters questioned White House press secretary Karine Jean-Pierre about it all last Tuesday.

“You stated that the president was to blame for the drop in gas prices. “Is the president to blame for rising petrol prices?” a reporter inquired.

“It’s far more sophisticated than that,” Ms. Jean-Pierre explained. “You are aware of this. There have been global challenges to which we have all responded. When I say ‘all,’ I mean that other countries have had to deal with it since the pandemic.

There was the pandemic, and then there was Putin’s war. In addition, Putin’s war has raised petrol costs at the pump. “We’ve seen that over the last few months,” she remarked.

As prices began to climb again, Mr. Biden began to blame oil firms, despite taking credit for reducing costs.

According to the letter acquired by The Wall Street Journal from Energy Secretary Jennifer Granholm to seven major refiners, the Biden administration has gone so far as to advise them to limit fuel exports.

“Given the historic level of U.S. refined product exports,” Ms. Granholm said in an August letter to seven U.S. refiners, “I again advise you to focus in the near term on growing inventories in the United States rather than selling down present stockpiles and boosting exports.”

However, the refiners retaliated. “Banning or restricting the export of refined products would certainly lower inventory levels, reduce domestic refining capacity, raise consumer fuel costs, and alienate U.S. friends during a time of conflict,” business leaders said in response to Ms. Granholm.

Mr. Biden also halted much of the oil production growth in the United States.

“Recall that the United States imported 10.1 million barrels per day (BPD) of crude oil in 2005, with OPEC accounting for 4.8 million BPD (48%) of that total. The SPR held 685 million barrels. With the United States buying 10.1 million BPD of crude oil at the time, there was enough oil to last 68 days,” Forbes noted.

Mr. Biden even went to Saudi Arabia to ask for more oil (remember the fist bump with Crown Prince Mohammed bin Salman?). He almost went empty-handed, save for a vague agreement in which Saudi Arabia stated that it would “help global oil market balancing for continued economic growth” but never specified how much petroleum would be delivered.

Mr. Biden stated that he was not there for oil but that he and the prince “privately agreed that oil-producing states would agree to increase output at an Aug. 3 summit,” according to The New York Times.

While the Organization of Petroleum Exporting Countries (OPEC) declared an increase in output in August — 100,000 barrels per day — it didn’t last long. OPEC stated this month that it would cut oil production by two million barrels a day due to a glut in the global crude oil market.

In the end, Mr. Biden deserves none of the credit — and all of the blame — for rising gas costs.

Source: VOR News, Reuters