Business

Banks in Canada Warn Over Trudeau Inflation and Unsustainable Debt

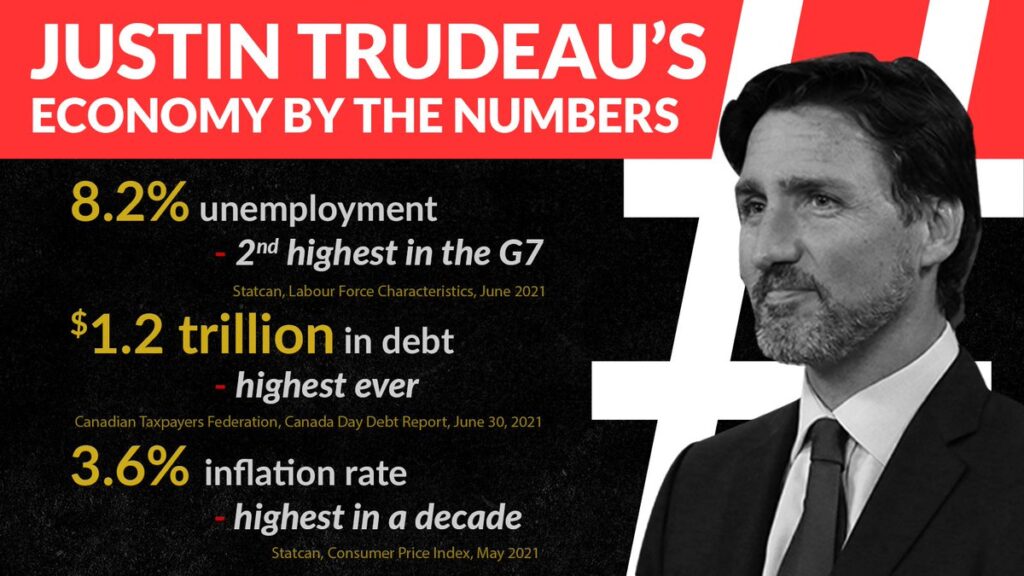

Banks and economists in Canada warn that Prime Minister Justin Trudeau’s plan to increase annual spending by billions of dollars will lead to unsustainable debt, especially if economic growth is weaker than expected.

To compete with the US Inflation Reduction Act, Finance Minister Chrystia Freeland’s latest budget added C$43 billion ($32 billion) in net new costs over six years, primarily by increasing healthcare spending and clean-technology subsidies. According to Derek Holt, an economist at the Bank of Nova Scotia, overall program spending is set to balloon to 51% above pre-pandemic levels by 2028, contradicting her description of the budget as prudent.

“Big spending, big deficits, big debt, high taxes, high inflation, and bond market challenges are not the path to prosperity,” Holt wrote in an investor report released Wednesday, describing the country’s federal and provincial governments as “addicted to high spending.”

The increase in spending comes despite the government projecting C$34 billion less revenue over the next six years than in November. Higher interest rates are expected to harm economic growth.

“Canada has moved beyond its post-1990s and pre-pandemic voter apprehension of big spending promises and has entered a new era driven by massive spenders at the federal and provincial levels of government,” Holt said. “The risk is that the deficit will grow even larger if GDP performs worse than expected versus the budget’s use of stale forecasts from February — before the recent turmoil — that project no contraction.”

Furthermore, the green subsidies announced in Freeland’s budget become more generous over time. While the budget estimates that the net cost of the various green tax credits will be around C$20 billion over the next five years, the finance department estimates that the cost will exceed C$80 billion by 2034.

When asked about Holt’s report, Trudeau and Freeland defended their spending as necessary, arguing that Canada is in a better fiscal position than its Group of Seven counterparts.

Freeland also stated that the green incentives would help growth in the long run, citing former Bank of Canada Governor Stephen Poloz’s budget assessment. “If you make investments that increase the country’s economic capacity, that is fiscally responsible,” she told reporters in Ottawa.

The fiscal projections in the budget are fraught with risk, according to John Manley, finance minister under former Liberal Prime Minister Jean Chretien, in 2002 and 2003.

He said that if deficits worsen, future governments may be forced to make difficult decisions about program cuts. In the 1990s, Chretien’s government had to take drastic measures to bring Canada’s debt under control, and Manley claimed that his budget as Industry Minister was severely cut.

“If Liberals don’t want to face that kind of calamity, it’s far better to carefully manage the growth of your expenditures and revenue,” Manley said on BNN Bloomberg Television. “Because otherwise, there will be a reckoning, and someone will have to face it.”

People in Canada are struggling to keep up with rising costs.

People in Canada are struggling to keep up with rising costs.

Rising prices have impacted nearly everyone in Canada, and many believe they have reached a tipping point. According to Global News, new data shows that more than half of Canadians struggle to keep up with inflation.

Rising prices have impacted nearly everyone in the country; some believe they have reached a tipping point. According to new data, more than half of Canadians are struggling with inflation.

According to a recent Ipsos poll, 32% of people are struggling to meet the rising costs of everyday necessities.

This is just one of several statistics highlighting the country’s current financial difficulties.

“22% of Canadians, or more than one in every five, say they are completely out of money.” “They’re saying they can’t afford any more household expenses,” said Sanyam Sethi, vice president of Ipsos Public Affairs.

“Things aren’t going well. The concerns are nowhere near being addressed.”

According to a poll, one-fifth of Canadians are ‘completely out of money’ as inflation bites, over half of Canadians struggle to make ends meet, and women are the most concerned about their finances.

“Women are nearly twice as likely as men to say there is no way they can pay more for household expenses or necessities because they are completely tapped out,” Sethi explained.

Women are concerned that they will not be able to feed their families, and women’s shelters in Kelowna say their resources are in high demand because people require assistance.

“Whether it’s this year, five years ago, or, sadly, five years from now, we’ll always be full.” “With or without an economic crisis, that’s just our reality,” said Allison Mclauchlan, executive director of the Kelowna Women’s Shelter.

Borrowing costs rise as the Bank of Canada raises its benchmark interest rate.

According to Mclauchlan, it can also be difficult for women who have escaped an abusive situation to regain financial stability.

“Think about a woman who has been financially abused for ten years and has no bank account, no savings, no earnings and how difficult that is,” McLauchlan explained.

Residents in Kelowna told Global News that rising living costs had forced them to change their spending habits.

With gas prices rising again, more than 55% of Canadians were concerned they couldn’t afford it.

People in Canada are struggling to keep up with rising costs.

People in Canada are struggling to keep up with rising costs.