Investment

Banker Says Trump’s Financial Statements Were Key To Loan Approvals, But There Were ‘Sanity Checks’

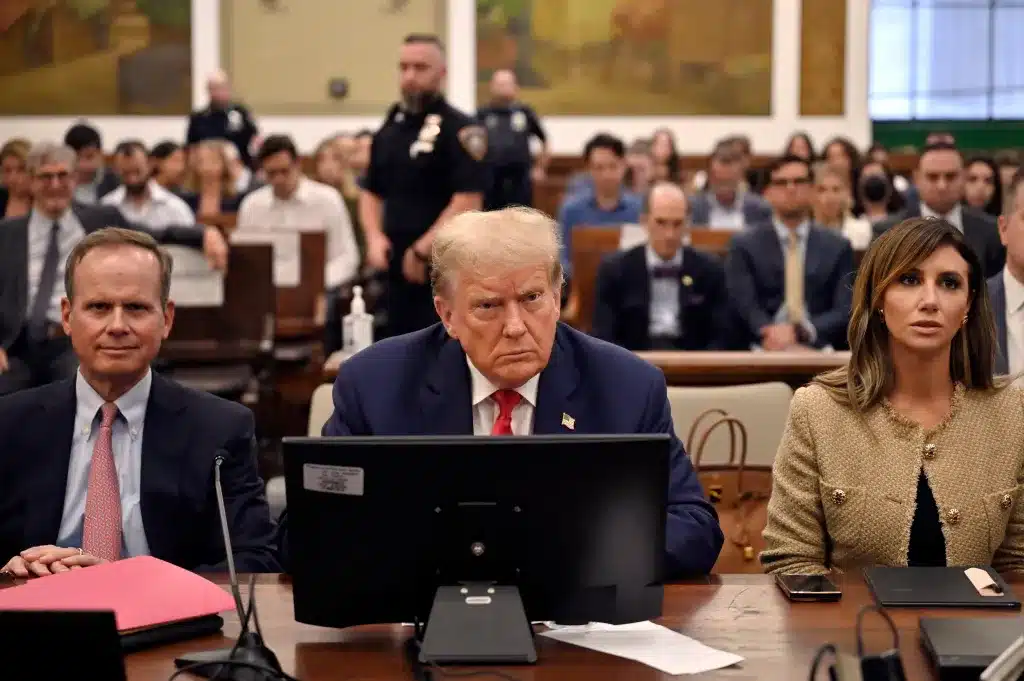

NEW YORK — Unsuspected by the court, Donald Trump obtained hundreds of millions of dollars in loans based on financial statements, a retired bank official testified at the former president’s New York civil fraud trial on Wednesday.

Former Deutsche Bank risk management officer Nicholas Haigh testified that Trump’s “statements of financial condition” were crucial in securing his approval for a $125 million loan in 2011 for his golf resort in Doral, Florida, and a $107 million loan in 2012 for his Chicago hotel and condo skyscraper.

Haigh stated that although the bank did not conduct comprehensive appraisals of Trump’s properties, it occasionally “haircuts” the values he set on Trump Tower and his golf courses significantly.

“I believe the phrase we used to describe the numbers could have been’sanity checks’,” he said.

Trump secured larger loans at lower interest rates due to those figures, according to Haigh, who oversaw the risk group for the bank’s private wealth management division from 2008 to 2018.

A judge ruled last month that the former president and his organization, the Trump Organisation, engaged in years of fraudulent activity by providing financial statements to banks, insurers, and others that inflated the value of Trump’s assets and net worth to secure loans and make business deals.

Tuesday, in testimony, Allen Weisselberg, the former chief financial officer of Donald Trump, admitted that the financial statements occasionally contained inaccurate information.

Banker Says Trump’s Financial Statements Were Key To Loan Approvals, But There Were ‘Sanity Checks’.

Emphasizing the disclaimers on the documents that, in his opinion, cautioned lenders to conduct their research, Trump refutes any misconduct. The disclaimers state, among other things, that without additional information, others “might reach different conclusions” regarding Trump’s financial position and that the financial statements have not been audited.

Last week, he described it to reporters in the courthouse hallway as “similar to a ‘buyer beware’ clause.” Trump has asserted that the institutions he conducted business with were not negatively affected, that he generated substantial profits from his transactions, and that they “have no complaints to this day.”

Haigh is providing testimony in the fraud lawsuit that New York Attorney General Letitia James filed against Donald Trump, his organization, and its senior executives. This marks the inaugural testimony of a bank official in a court of law regarding the influence that Trump’s financial statements exerted on his loan applications.

By the regulations of Deutsche Bank, Trump was obligated to serve as a guarantor for the Doral and Chicago loans, in addition to placing the Wabash Avenue skyscraper and resort in the Miami area as collateral.

The private wealth management division of Deutsche Bank, which oversaw the loans, Haigh stated, “Would not have approved them without a “powerful financial guarantee” from Trump.”

Haigh stated that he examined Trump’s financial statements before approving the loans and had no reason to dispute their veracity at the time.

Banker Says Trump’s Financial Statements Were Key To Loan Approvals, But There Were ‘Sanity Checks’.

Haigh stated that the documents depicted Trump as an affluent businessman who was substantially indebted and had substantial investments in real estate, golf courses, and other ventures. He added that representatives of Deutsche Bank met with executives of the Trump Organisation to review the information and examined bank account and brokerage statements to verify his cash holdings.

Concerning Trump’s financial statements, Haigh stated, “I assumed that the representations of assets and liabilities were generally trustworthy.”

While Trump’s 2011 financial statement estimated his net worth to be $4.3 billion, an internal credit report from Deutsche Bank estimated it to be approximately $2.4 billion when he applied for the Doral loan. The bank reduced the value of planned developments by 75%, citing “the uncertainty in valuing undeveloped land,” among other reasons, in an internal document. The financiers expressed a disagreement of $94 million regarding the appropriate method of accounting for golf membership deposits among his liquid assets and reduced the value of his courses by half.

“Does this suggest that the bank possessed the capability to inspect and make adjustments to the cash holdings?” Attorney for Trump Jesus M. Suarez questioned Haigh.

The former banker expressed uncertainty regarding the precise observations of his colleagues regarding the membership deposits, but “it appears that the lending officers relied, at least in part, on information supplied by the client’s representatives.”

Banker Says Trump’s Financial Statements Were Key To Loan Approvals, But There Were ‘Sanity Checks’.

A loan condition imposed by the bank stipulates that as a guarantor, Trump must uphold a minimum net worth of $2.5 billion, exclusive of any value attributed to his notoriety.

Haigh stated, “As the final arbiter, I had to be satisfied with the loan’s terms, including the covenants that safeguarded the bank.” He stated that the $2.5 billion benchmark was intended to protect the bank if the market declined.

The Republican presidential frontrunner for the upcoming year, Trump, witnessed the initial three days of the trial last week. His testimony is anticipated later in the trial.

In a pretrial ruling last month, Judge Arthur Engoron found that Trump, Weisselberg, and other defendants had engaged in years of fraudulent activity by inflating the value of Trump’s assets and net worth through the fabrication of financial statements.

Engoron demanded that a court-appointed receiver take control of some Trump enterprises as retaliation, raising doubts about the management of Trump Tower and other well-known properties in the future. On Friday, an appeals court temporarily halted the implementation of that particular provision of Engoron’s ruling.

Allegations of conspiracy, insurance fraud, and falsification of business documents are the subject of the civil trial. James, a Democrat, is pursuing a prohibition on Trump conducting business in New York and $250 million in penalties.

SOURCE – (AP)

Investment

Amazon Crosses $2 Trillion In Stock Market Value For The First Time

NEW YORK — Amazon.com Inc.’s market value topped $2 trillion for the first time in afternoon trade on Wednesday.

The increase in Amazon’s stock market valuation comes just over a week after Nvidia reached $3 trillion and briefly became the most valuable firm on Wall Street.

Amazon | AP News Image

Amazon Crosses $2 Trillion In Stock Market Value For The First Time

Nvidia’s chips power numerous AI applications, so the company’s price has skyrocketed.

Amazon has also made significant investments in AI as the technology’s popularity has increased worldwide.

Amazon | Forbes Image

Amazon Crosses $2 Trillion In Stock Market Value For The First Time

The majority of the company’s attention has been on business-oriented products, such as AI models and a chatbot named Q, which Amazon makes available to businesses that use its cloud computing unit AWS.

In April, Amazon CEO Andy Jassy stated that AI capabilities have reaccelerated AWS’s growth and that it was on track to generate $100 billion in annual revenue.

Amazon | Forbes

Amazon Crosses $2 Trillion In Stock Market Value For The First Time

Last year, the unit’s growth slowed as companies trimmed expenditures due to high inflation.

The digital behemoth has also invested $4 billion in Anthropic, a San Francisco-based AI business, to develop foundation models for generative AI systems. Amazon also creates and designs its own AI processors.

SOURCE – (AP)

Investment

Nvidia: The Strange Exception Where A Lower Stock Price Can Be Better For Investors

Ahead of Monday’s market opening, GameStop shares are rising on speculation that the man at the center of the pandemic meme stock frenzy owns a sizable number of shares in the video game retailer, potentially worth millions.

GameStock’s stock rose more than 87% in premarket trading.

Keith Gill, also known as “Roaring Kitty” on social media platforms YouTube and X, goes by the handle Deep F- – – – – Value on Reddit. Late Sunday, a Reddit user posted a screenshot in the r/SuperStonk thread, which some believe is an image of Gill’s GameStop shares and call options. The graphic suggested that Gill may own 5 million GameStop shares worth $115.7 million as of Friday’s closing price. The picture also revealed 120,000 call options at GameStop with a strike price of $20 that expires on June 21. The call options were purchased at approximately $5.68 per piece.

Nvidia | AP News Image

Nvidia: The Strange Exception Where A Lower Stock Price Can Be Better For Investors

Gill’s account on X also tweeted an image of a reverse card from the popular game Uno on Sunday night. There was no associated text for the image.

This latest behavior comes just three weeks after Gill emerged online for the first time in three years, causing GameStop’s stock price to rise. In May, the “Roaring Kitty” account shared an image on X of a man sitting forward in his chair, a meme commonly utilized by gamers when things become serious.

Following the post on X, there was a video from years ago on YouTube in which Gill defended the troubled company GameStop and concluded by saying, “That’s it for now because I’m out of breath.” FYI, here’s a fast 4-minute video I made to summarize the $GME bull argument.

Nvidia | PC Gamer Image

Nvidia: The Strange Exception Where A Lower Stock Price Can Be Better For Investors

In 2021, GameStop was a video game retailer battling to survive as consumers shifted fast from discs to digital downloads. Big Wall Street hedge funds and major investors were betting against or shorting its stock with the expectation that its shares would continue to fall precipitously.

Gill and many who agreed with him reversed the course of a firm that appeared to be on the verge of collapse by purchasing thousands of GameStop shares despite practically all acknowledged indicators indicating that the company was in serious trouble.

That triggered what is known as a “short squeeze,” in which large investors who had bet on GameStop were obliged to buy its swiftly increasing stock to offset significant losses.

Nvidia | Nvidia Image

The Strange Exception Where A Lower Stock Price Can Be Better For Investors

Others that joined the viral rush on Monday include movie theater company AMC Entertainment Holdings, which is up more than 26% in premarket trading. Koss Corp., a headphone producer, increased by more than 14%, while BlackBerry, the once-dominant smartphone maker, increased by more than 4%.

SOURCE – (AP)

Investment

GameStop Leaps In Premarket As Roaring Kitty May Hold Large Position

Shares of GameStop are jumping ahead of Monday’s market start, fueled by suspicion that the man at the core of the pandemic meme stock frenzy owns a big number of shares in the video game store, potentially worth millions.

GameStock’s stock rose more than 87% in premarket trading.

Keith Gill, also known as “Roaring Kitty” on social media platforms YouTube and X, goes by the handle Deep F- – – – – Value on Reddit. Late Sunday, a Reddit user posted a screenshot in the r/SuperStonk thread, which some believe is an image of Gill’s GameStop shares and call options. The graphic suggested that Gill may own 5 million GameStop shares worth $115.7 million as of Friday’s closing price. The picture also revealed 120,000 call options at GameStop with a strike price of $20 that expire on June 21. The call options were purchased at approximately $5.68 per piece.

Gamestop | CNBC Image

GameStop Leaps In Premarket As Roaring Kitty May Hold Large Position

Gill’s account on X also tweeted an image of a reverse card from the popular game Uno on Sunday night. There was no associated text for the image.

This latest behavior comes just three weeks after Gill emerged online for the first time in three years, causing GameStop’s stock price to rise. In May, the “Roaring Kitty” account shared an image on X of a man sitting forward in his chair, a meme commonly utilized by gamers when things become serious.

The post on X was followed by a YouTube video from years ago in which Gill defended the troubled corporation GameStop, saying, “That’s it for now because I’m out of breath. FYI, here’s a fast 4-minute video I made to summarize the $GME bull argument.

Gamestop | CFA Image

GameStop Leaps In Premarket As Roaring Kitty May Hold Large Position

In 2021, GameStop was a video game retailer battling to survive as consumers shifted fast from discs to digital downloads. Big Wall Street hedge funds and major investors were betting against it or shorting its stock with the expectation that its shares would continue to fall precipitously.

Gill and many who agreed with him reversed the course of a firm that appeared to be on the verge of collapse by purchasing thousands of GameStop shares despite practically all acknowledged indicators indicating that the company was in serious trouble.

That triggered what is known as a “short squeeze,” in which large investors who had bet on GameStop were obliged to buy its swiftly increasing stock to offset significant losses.

:max_bytes(150000):strip_icc()/game-stop-2000-9164fb7b71664bf1be53fc883c902eb1.jpg)

Gamestop | EW Image

GameStop Leaps In Premarket As Roaring Kitty May Hold Large Position

Others that joined the viral rush on Monday include movie theater company AMC Entertainment Holdings, which is up more than 26% in premarket trading. Koss Corp., a headphone producer, increased by more than 14%, while BlackBerry, the once-dominant smartphone maker, increased by more than 4%.

SOURCE – (AP)

-

Politics4 weeks ago

Miller Expects 4.9 Million Foreigners to Leave Canada Voluntarily

-

News3 weeks ago

Nolinor Boeing 737 Crash Lands in Montreal

-

News2 weeks ago

“Shocking Video” Vancouver Police Shoot Armed Suspect 10 Times

-

Tech3 weeks ago

Increasing its Stake in OpenAI by $1.5 Billion is a Possibility for SoftBank.

-

News4 weeks ago

Facebook Securities Fraud Case Dropped

-

Health4 weeks ago

A Canadian Teenager’s Bird Flu Virus Has Mutations