Business

Inside McLaren: Chief Andrea Stella’s Vision For Sustained Momentum

McLaren enters 2024 optimistic that they have continued their good growth from last year but are concerned about Red Bull’s potential performance.

Lando Norris gained more points than any other driver last season, except Max Verstappen, after McLaren improved their chassis for the Austrian Grand Prix in July.

McLaren team principal Andrea Stella stated that his team has “not seen diminishing returns” in developing their new car.

However, he fears the same will apply to the dominant champion, Red Bull.

Inside McLaren: Chief Andrea Stella’s Vision For Sustained Momentum

“Red Bull should be extremely competitive and we will see where we are and what kind of challenge we will be able to set on track,” she said.

Last year, Red Bull and Verstappen had the most dominant season in Formula One.

The Dutchman won 19 of the 22 races, with Sergio Perez taking two of the remaining three.

McLaren began 2023 as one of the slowest cars in the field, but by the second half of the season, it had emerged as a prominent contender behind Red Bull, thanks to a highly effective development strategy.

And McLaren believes that, while their new vehicle looks good, Red Bull will make at least as much progress with their new design.

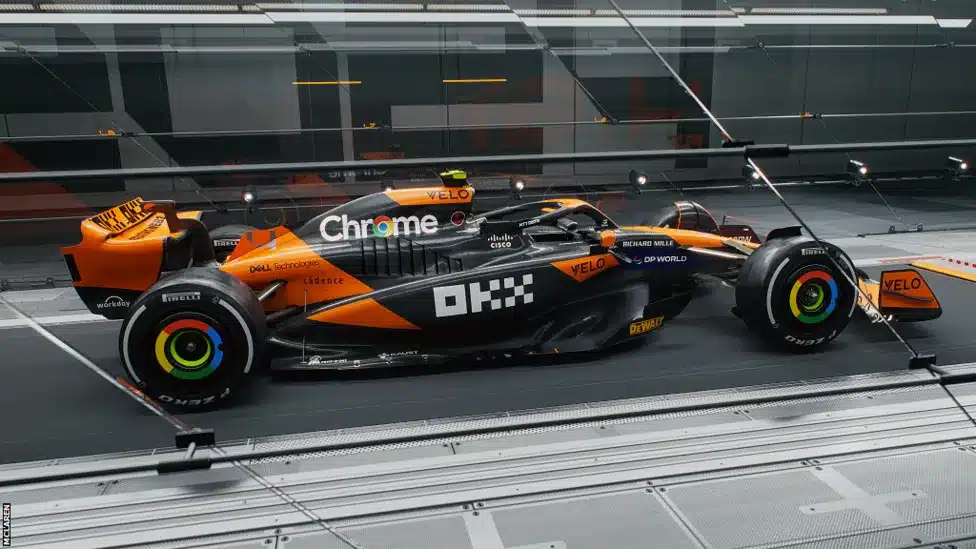

Speaking at an event to debut McLaren’s 2024 livery, Stella said the team was able to build on the significant progress made in Austria and a following big improvement in Singapore in September.

“The gradient we established last year that led to the Austria and Singapore development, it seems like we can maintain it,” she added.

“In the background, we are already working on other advancements that we plan to release very soon throughout the season, and they appear to be extremely fascinating.

“In terms of the regulations themselves and the development at McLaren, we seem like a linear gradient of development can be maintained.”

However, he pointed out that Red Bull stopped improving last year’s car unusually early in the season, which could be a bad sign for their 2024 performance.

“Competitiveness on track depends on what the opposition has done,” she remarked. “When we consider Red Bull, one factor raises concerns about what will happen in 2024: they have yet to significantly develop their automobile.

Inside McLaren: Chief Andrea Stella’s Vision For Sustained Momentum

“So, have they cashed in, gathered developments, and will they capitalise on the next year’s car? Here’s my theory.

“I can’t believe Red Bull was not in a position to create their car. They may have decided not to deliver improvements, but this could indicate that their [development] gradient has continued.”

McLaren enters 2024 with one of the strongest driver lineups on the field, featuring Australian Oscar Piastri alongside Norris.

In an outstanding maiden season, Piastri won the sprint race at the Qatar Grand Prix, becoming the first F1 driver before Norris, and signed a contract extension with McLaren until the end of 2026.

Norris’ contract ends a year before that, and McLaren is determined to extend it with the British driver.

McLaren Racing CEO Zak Brown stated, “My primary role is to put the right people in place and provide him with the necessary resources and support.” That’s Andrea and the entire squad.

“When you want to win the World Championship again, you need management, technology, infrastructure, and two grand prix drivers. We have all of these in place.

“We have Lando under contract for another few years. Of course, we have a continuous dialogue with him.

“He is starting to think through [his future], as we are – 2026 is not far away and we recognise that being able to retain Lando and Oscar is a key element and something that is a high priority for us.”

Brown returned to an issue he has discussed several times recently, voicing worries over Red Bull’s connection with their young team.

The season-long rebranding of Alpha Tauri, who will reveal their new identity in the upcoming weeks, is leading them to a situation in which they are taking as many parts for their vehicle as is legal.

Inside McLaren: Chief Andrea Stella’s Vision For Sustained Momentum

While this is comparable to Haas’ arrangement with Ferrari in 2016, Brown is concerned that their second team may gain an unforeseen edge given Red Bull’s dominance and the budget limitation that limits every team’s investment.

“I’m concerned over the Alpha Tauri-Red Bull alliance,” he remarked. “Alpha Tauri is, from what I gather, heading to the United Kingdom, which will assist both teams. This A/B squad and co-ownership raises serious concerns about the sport’s health and fairness.

“When these rules were implemented, the sport was in a different place. There was a significant divide between folks like us, who had large budgets, and the smaller teams. And now everyone is almost near the cap, if not already there.

“So everyone is playing with the same size bat, to use a baseball analogy, and hence [sharing parts] is unnecessary. However, it may provide someone with an unfair edge, and as a sport, we must address this issue as soon as possible.

“I would like to see us focus on that as an industry before it gets to where F1 once was, which is very out of balance because people are playing by the rules but a different set of rules.”

SOURCE – (BBC)

Business

Forced Sale Google Chrome Could Fetch $20 Billion

Antitrust officials in the US could force the sale of Google’s Chrome browser for up to $20 billion, demonstrating the tremendous worth of the world’s most popular web browser.

Bloomberg Intelligence attributes Chrome’s projected worth to its more than 3 billion monthly active users. The US Department of Justice is preparing to request a federal judge order the browser’s separation from Google’s parent company, Alphabet.

Chrome’s worth comes from its overwhelming 61% market share and its crucial role in Google’s advertising ecosystem. User data enables businesses to better target adverts, and the browser also acts as an important distribution mechanism for Google’s AI technologies.

Industry analysts think it may be difficult to find a suitable buyer. While tech behemoths like Amazon could finance the purchase, they would likely face regulatory scrutiny.

AI businesses, such as OpenAI, may emerge as more viable contenders. They could potentially leverage Chrome to broaden their reach and develop an advertising business.

“It’s not directly monetizable,” one analyst told Bloomberg. “It functions as a gateway to other things. It’s unclear how you would assess that in terms of pure revenue generation.”

Google opposes prospective sales, claiming that they will hamper innovation. The firm does not break out Chrome’s revenue individually in its financial filings, even though the browser’s user data plays an important part in the company’s principal revenue stream, advertising.

The DOJ’s suggestion follows Judge Amit Mehta’s August decision that Google had illegally monopolized the search industry. The judge will consider the recommended remedies at a two-week hearing in April 2024, with a final judgment due in August 2025.

Related News:

Appeals Court Delays Order For Google To Open Its App Store In Antitrust Case

Appeals Court Delays Order For Google To Open Its App Store In Antitrust Case

Business

Bitcoin Has Set a New Record And Is Approaching $100,000.

(VOR News) – Bitcoin broke beyond the $98,000 mark for the first time on Thursday as investors awaited Donald Trump’s second term as president. All of this happened during the day. As such, cryptocurrency has reached a significant turning point.

According to Coin Metrics, the top cryptocurrency was trading at $97,541.61 during the most recent trading session. Merchants provided this information. This suggests a price gain of more than three percent during the previous trading session.

When the period began, Bitcoin peaked at $98,367.00.

During the premarket trading session, MicroStrategy, a platform that facilitates cryptocurrency foreign exchange trading and serves as a bitcoin proxy, saw a 13% gain. Coinbase, on the other hand, had a 2% rise during that period. Furthermore, all of these increases occurred simultaneously.

The market value of Mara Holdings increased by 9%, which helped raise the valuation of mining companies overall. This was among the factors that led to the total rise.

Because of the widespread belief that President Trump will usher in a new era of prosperity for cryptocurrencies, one marked by more favorable laws and the possible creation of a national strategic bitcoin reserve, the price of Bitcoin has been rising steadily this month.

The most recent change brought about by the increase was the consequence of higher financing rates and more open interest in the futures market during Asian trading hours. The rise was the catalyst for this change. This action was prompted by the ensuing rush.

Throughout its lifespan, this legislation was the catalyst for this change for a variety of reasons. At the same time, spot market premiums decreased, according to CryptoQuant statistics. All of this happened at the same time.

Furthermore, a number of short liquidations have been sparked by the recent spikes in Bitcoin’s price, which has caused the price to rise overnight. As a result, the price has gone up much more. As a result, the total number of short liquidations has increased.

According to CoinGlass, these liquidations have effectively produced more than $88 million in capital during the last 24 hours.

Rob Ginsberg, an analyst at Wolfe Research, noted in a study released on Wednesday that “historically, following previous movements of this magnitude, Bitcoin has either entered a consolidation phase or disregarded the overbought condition as investors accumulate.” This phrase relates to the fact that this particular move has happened before.

Ginsberg stated this in reference to the evolution of Bitcoin over time.

Ginsberg’s answer makes reference to Bitcoin’s propensity to go through a period of consolidation. The comment also made reference to this.

He said, “Considering we are emerging from an extended consolidation phase and the price has reached a new high, it suggests that the pursuit is underway.”

The crucial psychological milestone of $100,000 is expected to be reached in the upcoming weeks, and this breakthrough could happen as early as Thursday. It seems likely that this level will be reached. There is a chance that this new development will take place.

This task will be carried out against the backdrop of this historical era. In addition, if Trump were to win a second term, federal budget deficits would increase, inflation would likely increase, and the dollar’s position in international affairs would change.

The administration that Trump would run during his presidency would be responsible for these consequences. All of these characteristics would positively impact the value of Bitcoin as a currency if they were taken into account in the order that they are presented.

The price of bitcoin had risen by more than 130% by the beginning of 2024.

SOUREC: CNBC

SEE ALSO:

PayPal’s Technical Challenges Are Affecting Thousands Of Customers Globally.

NVIDIA’s Earnings: The Leader In AI Chips Demonstrates Relentless Growth.

Business

Target Struggles in the Third Quarter: Offers Tempered Holiday Outlook and Price Cuts

(VOR News) – Target experienced a modest rise in sales during the third quarter; nevertheless, profitability declined due to reduced customer spending attributed to inflation and adverse effects from the ongoing costs associated with the October dockworker strike.

Despite ongoing consumer expenditure in the United States, but with more prudence, the Minneapolis retailer did not meet Wall Street’s forecasts for the quarter and similarly disappointed industry analysts with its projections for the final quarter of the year.

Target’s reduction in prices for Christmas products, including a Thanksgiving promotion that lowered the cost of the holiday feast relative to last year’s total, raises concerns about disappointing quarterly results.

Target’s latest quarter sharply contrasts with competitor Walmart, which reported another quarter of exceptional revenues on Tuesday and provided positive forecasts for the forthcoming holiday season. Amazon disclosed last month that its quarterly profits had risen. Amazon surpassed projections with an 11% rise in quarterly revenue.

Target fell over 21% on Wednesday morning.

Chairman and CEO Brian Cornell stated, “We encountered distinct challenges and financial constraints that impacted our overall performance.”

FactSet reports that Target’s net income for the quarter ended November 2 was $854 million, or $1.85 per share, markedly below the anticipated $2.30 and a decline from $971 million, or $2.10 per share, in the same quarter of the previous year.

Despite an increase in sales to $25.67 billion from $25.4 billion the previous year, they fell short of Wall Street’s projections.

Target announced that for the fiscal fourth quarter, it anticipates earnings per share to fall between $1.85 to $2.45. This amount is below the $2.65 per share forecast by analysts surveyed by FactSet.

The retailer announced that in the third quarter, its comparable sales, derived from stores and digital platforms operational for a minimum of one year, increased by 0.3%.

This is inferior to the second quarter’s 2% growth. Several months of decreases, comprising a 3.7% reduction in the first quarter and a 4.4% reduction in the company’s final quarter of 2023, were counterbalanced by the rise in the April–June period.

Cosmetics sales rose by almost 6%, whilst food, beverages, and necessities such as shampoo experienced gains in the low single digits relative to the previous year.

The positive attributes were negligible. Target’s quarterly customer traffic rose by 2.4%. Target officials report that this represents an increase of 10 million sales transactions compared to the previous year. Digital comparable sales rose by 10.8% due to a 20% enhancement in same-day delivery facilitated by the Target Circle loyalty program and double-digit growth in its drive-up service.

Target encountered several challenges.

Target’s food and beverage sales constitute under 25% of overall sales, indicating a greater dependence on luxury items such as apparel and accessories.

Target management acknowledged that the company, similar to other retailers, had to redirect specific items due to the strike of 45,000 dockworkers, the first occurrence since 1977.

The accumulation of commodities in warehouses escalated operational expenses and diminished corporate earnings.

The commitment by President-elect Donald Trump to impose elevated import tariffs is resulting in difficulties for Target and other enterprises. Trump advocates for a 60% tariff on Chinese imports and a 20% levy on all other products. Cornell stated that, despite monitoring trends meticulously, the corporation has prioritized diversifying its supplier network.

“Currently, there exists considerable uncertainty regarding future developments, and we will exercise our flexibility to adapt as necessary,” he stated on the call.

Buyers remain apprehensive due to ongoing uncertainty, as prices, albeit decreasing, remain elevated compared to a few years prior.

“They are exhibiting significant patience, pursuing promotions and outstanding value on essential pantry items,” Cornell stated during a conference call with reporters. “Over the year, they have consistently focused on discretionary categories and are practicing prudent shopping behaviors.”

Target officials indicated a decline in television purchases, although they expressed interest in incorporating candles, frames, and flowers into their home décor.

Target has been reducing prices to boost sales. Last spring, it reduced costs for numerous essentials, including milk and diapers. Almost fifty percent of the numerous goods offered this Christmas are priced below $20. Target is offering a Thanksgiving dinner bundle for four people at $20, which is $5 less than its 2023 Thanksgiving meal package.

SOURCE: USN

SEE ALSO:

Comcast Is Expected To Announce Its Cable Network Separation On Wednesday.

Canada’s Budgetary Watchdog Warns Over Trudeau’s Spending

-

Tech4 weeks ago

Apple Unveiled A Fresh Glimpse Of Their AI Featuring ChatGPT Integration.

-

Business4 weeks ago

Costco Is Offering The Peloton Bike+ At 300 Locations This Holiday Season.

-

News4 weeks ago

Boeing Reports $6 Billion Quarterly Loss As Striking Workers Vote Whether To Accept Contract Offer

-

News4 weeks ago

The FBI Looks At Claimed Leaks Of Sensitive Israel Attack Records.

-

News4 weeks ago

‘Malcolm In The Middle’ Star Frankie Muniz Lands Full-Time NASCAR Ride In 2025

-

Business4 weeks ago

The Volkswagen China CMO Faced Expulsion From China Due To Drug Use.