Business

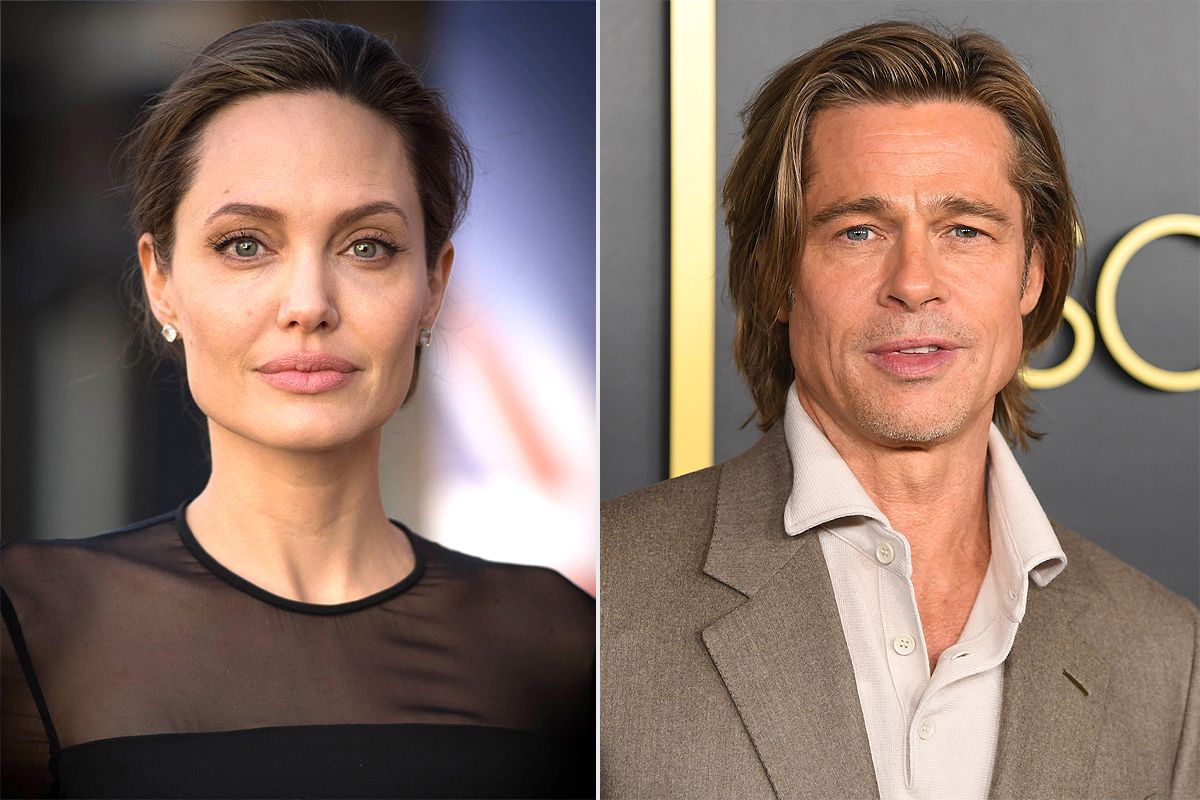

Brad Pitt And Angelina Jolie’s Winery Court Battle Heats Up

Brad Pitt and ex-Angelina Jolie are still embroiled in a contentious argument over a winery amid their custody case.

The Maleficent actress allegedly carried out a “vindictive and unlawful sale” of her part of their French estate and vineyard, Château Miraval, according to fresh records filed in Los Angeles on June 1 and obtained by E! News. The actor from Once Upon a Time…in Hollywood makes this claim.

Pitt, referring to his ex’s company, said in his amended complaint that “Jolie went forward with the vindictive putative sale in breach of her and Nouvel’s contractual obligations,” preferring to sell her stake in Miraval to a designated Russian oligarch and prevent Pitt from continuing to pursue his successful vision and strategy in developing the property and business that was intended to be their children’s legacy.

The purchase of 50% of Chateau Miraval and the Miraval trademark from Angelina Jolie was revealed in a press release by Tenute del Mondo, a division of the alcohol manufacturer Stoli Group, in October 2021. The statement continued, “We are thrilled to have a position alongside Brad Pitt as curators of their extraordinary vintages.”

Brad Pitt and ex-Angelina Jolie are still embroiled in a contentious argument over a winery amid their custody case.

And in his most recent filing, the actor claims that he learned about “Jolie’s putative sale” to Stoli from the press release and that she “collaborated in secret” with the company’s founder, Russian-born billionaire Yuri Shefler, and his associates to “pursue and then consummate the purported sale, ensuring that Pitt would be kept in the dark.” Pitt also mentioned that he rejected Shefler’s offer to purchase Miraval.

According to CNN, the billionaire was exiled from Russia in 2000 due to his opposition to President Vladimir Putin. The Oscar winner also claimed in his paperwork that the U.S. Treasury Department had branded Shefler as an “oligarch in the Russian Federation.”

In addition, the actor claims that Jolie changed her mind about giving him her interest after a temporary custody decision went in his favor. About four months before the announcement, in late May 2021, Pitt was given joint custody of the former couple’s children by a retired judge who had been retained to resolve the dispute.

The actress for Eternals, who has seven children with her ex—Maddox, now 21; Pax, 19, Zahara, 18, Shiloh, 17, and twins Knox and Vivienne, 14—later filed a lawsuit, and a California appeals court agreed with her that the judge who issued the decision should be removed from the case because he failed to adequately disclose his professional relationships with Pitt’s attorneys. The custody dispute is still pending.

Despite her contractual duties and years of pledges to Pitt, the actor claims in his amended complaint that “in the wake of the adverse custody ruling, she no longer wanted to sell to Pitt.”

Jolie had stated in court records from 2022 that she was not required to sell her stake to her ex, but she has yet to react to Pitt’s most recent filing. Her lawyer was contacted by E! News for comment, but no response was received.

The conflict between the ex-couple and the winery began in 2022. Pitt filed a lawsuit against Jolie in February of that year for allegedly selling her shares in Chateau Miraval without his permission. In 2008, the two invested together to purchase the winery. In front of their six children, they married in 2014 on the vineyard’s property.

Brad Pitt and ex-Angelina Jolie are still embroiled in a contentious argument over a winery amid their custody case.

After that, in September 2022, Jolie’s business filed a $250 million countersuit against Pitt, claiming that he had organized an effort to “seize control” of Chateau Miraval “in retaliation for the divorce and custody proceedings.” Although a judge pronounced the couple legally separated in 2019, the divorce between the Girl, Interrupted actress and the actor has not yet been finalized. The actress filed paperwork to break her marriage to the actor in 2016.

According to Jolie’s petition, the Babylon star allegedly “ignored” a “final offer to sell her interest in the winery,” thus, Jolie sold Nouvel to a global beverage corporation in 2021.

Jolie offered to sell Pitt her investment despite not being required to do so and engaged in months-long negotiations with him, according to her declaration. “Pitt’s hubris got the better of him, and as a deal was about to be struck, he made an eleventh-hour demand for onerous and irrelevant conditions, including a clause designed to prevent Jolie from publicly speaking about the circumstances that had caused their marriage to end.”

Pitt responded to Jolie’s countersuit on June 1 by stating that he vigorously refutes all of the charges and requests that the court dismiss Jolie’s cross-complaint with prejudice.

Pitt is suing Jolie for punitive and exemplary damages and a statement that her alleged sale of Nouvel was invalid. Pitt is also demanding a jury trial.

SOURCE – (AP)

Business

Trudeau Accelerates Bond Selloff Over Mass Spending Fears

Prime Minister Justin Trudeau has accelerated bond selloffs, citing fears of a larger deficit over his GST giveaway. Investors were concerned he was returning to his free-spending strategy as an election loom.

On Thursday, Trudeau unveiled a C$6.3 billion ($4.5 billion) tax relief and rebate program. It includes a two-month moratorium on federal sales tax on various commodities such as Christmas trees, wine, toys, and books and a C$250 check for almost 19 million Canadians, or over half of the population.

The declaration looked to mark the end of a brief period of fiscal restraint, as Finance Minister Chrystia Freeland committed to contain budget deficits to prevent stoking inflationary pressures.

Now that inflation has returned to the Bank of Canada’s 2% target, policymakers have reduced the benchmark interest rate by 125 basis points since June.

Trudeau’s Liberal government sees an opportunity to dig deeper into the public purse, but some analysts believe investors are keeping a careful eye on the country’s debt.

Bonds continued to fall on Thursday following the announcement, as the 10-year benchmark yield rose 7 basis points to 3.457%. After retail data showed a rise in consumer spending on Friday, it increased by up to 3.488%.

As the Trudeau government considers additional fiscal spending, concerns about Canada’s financial situation persist.

Budget Shortfall

Freeland has yet to publish final spending and income figures for the fiscal year that ended in October. Parliamentary Budget Officer Yves Giroux predicts a deficit of C$46.8 billion, much exceeding Freeland’s self-imposed aim of a C$40 billion shortfall.

Despite promises to reduce deficits, the Trudeau government continues to increase expenditure. This year’s budget includes a new capital gains tax inclusion rate to balance the cost of new housing and social initiatives.

This sparked anger from investors and entrepreneurs but allowed Freeland to present a consistent deficit despite significant spending.

The recent declaration indicates that Trudeau’s government no longer feels restrained in its capacity to use economic stimulus to restore favor.

Pierre Poilievre’s Conservatives have led most surveys by roughly 20 points for over a year. They have pounded the prime minister on affordability and promised to reduce taxes, especially income taxes. An election is expected in late October 2025.

The sales tax break will run from December 14 to February 15. The left-wing New Democratic Party intends to support it but has stated that it will continue to advocate for its permanent implementation and expansion to include additional items.

Let the Bankers Worry

Following Trudeau’s announcement, traders in overnight swap markets reduced their bets that the Bank of Canada will drop interest rates by 50 basis points for the second time in December, lowering the odds to fewer than 25% by the end of Thursday. As of late Friday morning, the odds were less than 17%.

The announcement also encouraged several experts to improve their short-term projections for Canada’s GDP. Analysts at the Bank of Montreal predict that the country’s GDP will increase at a 2.5% annualized rate in the first three months of 2025, up from 1.7%.

Speaking to reporters on Friday, Trudeau praised his government’s approach to program expenditure, claiming it fosters optimism and possibilities for families and the middle class.

“We’re focusing on Canadians. “Let the bankers worry about the economy,” Trudeau stated.

Related:

Canada’s Budgetary Watchdog Warns Over Trudeau’s Spending

Business

Forced Sale Google Chrome Could Fetch $20 Billion

Antitrust officials in the US could force the sale of Google’s Chrome browser for up to $20 billion, demonstrating the tremendous worth of the world’s most popular web browser.

Bloomberg Intelligence attributes Chrome’s projected worth to its more than 3 billion monthly active users. The US Department of Justice is preparing to request a federal judge order the browser’s separation from Google’s parent company, Alphabet.

Chrome’s worth comes from its overwhelming 61% market share and its crucial role in Google’s advertising ecosystem. User data enables businesses to better target adverts, and the browser also acts as an important distribution mechanism for Google’s AI technologies.

Industry analysts think it may be difficult to find a suitable buyer. While tech behemoths like Amazon could finance the purchase, they would likely face regulatory scrutiny.

AI businesses, such as OpenAI, may emerge as more viable contenders. They could potentially leverage Chrome to broaden their reach and develop an advertising business.

“It’s not directly monetizable,” one analyst told Bloomberg. “It functions as a gateway to other things. It’s unclear how you would assess that in terms of pure revenue generation.”

Google opposes prospective sales, claiming that they will hamper innovation. The firm does not break out Chrome’s revenue individually in its financial filings, even though the browser’s user data plays an important part in the company’s principal revenue stream, advertising.

The DOJ’s suggestion follows Judge Amit Mehta’s August decision that Google had illegally monopolized the search industry. The judge will consider the recommended remedies at a two-week hearing in April 2024, with a final judgment due in August 2025.

Related News:

Appeals Court Delays Order For Google To Open Its App Store In Antitrust Case

Appeals Court Delays Order For Google To Open Its App Store In Antitrust Case

Business

Bitcoin Has Set a New Record And Is Approaching $100,000.

(VOR News) – Bitcoin broke beyond the $98,000 mark for the first time on Thursday as investors awaited Donald Trump’s second term as president. All of this happened during the day. As such, cryptocurrency has reached a significant turning point.

According to Coin Metrics, the top cryptocurrency was trading at $97,541.61 during the most recent trading session. Merchants provided this information. This suggests a price gain of more than three percent during the previous trading session.

When the period began, Bitcoin peaked at $98,367.00.

During the premarket trading session, MicroStrategy, a platform that facilitates cryptocurrency foreign exchange trading and serves as a bitcoin proxy, saw a 13% gain. Coinbase, on the other hand, had a 2% rise during that period. Furthermore, all of these increases occurred simultaneously.

The market value of Mara Holdings increased by 9%, which helped raise the valuation of mining companies overall. This was among the factors that led to the total rise.

Because of the widespread belief that President Trump will usher in a new era of prosperity for cryptocurrencies, one marked by more favorable laws and the possible creation of a national strategic bitcoin reserve, the price of Bitcoin has been rising steadily this month.

The most recent change brought about by the increase was the consequence of higher financing rates and more open interest in the futures market during Asian trading hours. The rise was the catalyst for this change. This action was prompted by the ensuing rush.

Throughout its lifespan, this legislation was the catalyst for this change for a variety of reasons. At the same time, spot market premiums decreased, according to CryptoQuant statistics. All of this happened at the same time.

Furthermore, a number of short liquidations have been sparked by the recent spikes in Bitcoin’s price, which has caused the price to rise overnight. As a result, the price has gone up much more. As a result, the total number of short liquidations has increased.

According to CoinGlass, these liquidations have effectively produced more than $88 million in capital during the last 24 hours.

Rob Ginsberg, an analyst at Wolfe Research, noted in a study released on Wednesday that “historically, following previous movements of this magnitude, Bitcoin has either entered a consolidation phase or disregarded the overbought condition as investors accumulate.” This phrase relates to the fact that this particular move has happened before.

Ginsberg stated this in reference to the evolution of Bitcoin over time.

Ginsberg’s answer makes reference to Bitcoin’s propensity to go through a period of consolidation. The comment also made reference to this.

He said, “Considering we are emerging from an extended consolidation phase and the price has reached a new high, it suggests that the pursuit is underway.”

The crucial psychological milestone of $100,000 is expected to be reached in the upcoming weeks, and this breakthrough could happen as early as Thursday. It seems likely that this level will be reached. There is a chance that this new development will take place.

This task will be carried out against the backdrop of this historical era. In addition, if Trump were to win a second term, federal budget deficits would increase, inflation would likely increase, and the dollar’s position in international affairs would change.

The administration that Trump would run during his presidency would be responsible for these consequences. All of these characteristics would positively impact the value of Bitcoin as a currency if they were taken into account in the order that they are presented.

The price of bitcoin had risen by more than 130% by the beginning of 2024.

SOUREC: CNBC

SEE ALSO:

PayPal’s Technical Challenges Are Affecting Thousands Of Customers Globally.

NVIDIA’s Earnings: The Leader In AI Chips Demonstrates Relentless Growth.

-

Politics2 weeks ago

Trudeau Orders Facebook to Block Australian Presser Video

-

Business4 weeks ago

Canada CBC News CEO Catherine Tait Recalled to Parliamentary Committee

-

Celebrity4 weeks ago

Shaun White’s Proposal To Nina Dobrev Was Romantic Gold

-

Tech4 weeks ago

Apple Launches The IPhone Into The AI Era With Free Software Update

-

News3 weeks ago

Pro-Khalistanis Sikhs Attack Hindu Temple in Brampton

-

Food4 weeks ago

Starbucks Is Making A Popular Add-On Free Of Charge

:max_bytes(150000):strip_icc():focal(587x223:589x225)/angelina-jolie-1-2b124302a8644440a370dfb00176c94b.jpg)